Today's guest is Chuck Young from Rebel Traders. Chuck is going to give us his insight into what it takes to become a successful and disciplined trader. I have to say that I think he nailed it...what do you think? Check it out then leave a comment, let Chuck know what you think makes a successful trader. Enjoy!

===================================================================

Ask anyone who has been holding stocks for many years what the previous two years has done to their portfolios; I’m sure you will get some nasty comments. For many years everyone from professional financial advisors to our parents told us that the “buy and hold” strategy was the only real way to make money in the long term. Well I’m sure those who have been doing just that are not very happy now that nearly 50% of their portfolio has evaporated.

In the span of 9 years the U.S. markets have gone through two very ugly bear markets, and the current bear market is not yet over. So the ‘buy and hold’ people have taking a real beating in the past decade.

If you told someone 10 years ago that you were a ‘stock trader’ you might have received a strange look or perhaps a lecture about how dangerous trading stocks would be. “Listen young man… the only way to save for your retirement is to put your money into stocks and ignore it… you will have a lot of money when you retire”. How many times have we heard something like that during our lifetime?

Today if you told someone that you traded stocks you might get an evil look because the media has painted traders as a group of people who have contributed to the massive stock market declines experienced during the current bear market. There are numerous types of traders; currency traders, hedge fund traders, and commodities traders (recall last summer the media blamed traders for the rapid rise in oil prices) just to name a few.

But actually individual traders who trade from their own homes are nothing at all like those portrayed by the mainstream media. We are market participants who look to capitalize on short term price movements, take our gains, and then move on to another trade when one presents itself.

The ‘buy and hold’ strategy has been proven to be flawed for guaranteeing that you will have enough money to retire with. The nature of the markets now requires an active involvement on your part if you are to preserve and grow your capital. And how do you actively manage your holdings? You become a stock trader.

As a stock trader you are simply managing your holdings actively. It does not mean you are buying and selling every day (that is for highly experienced day traders). It means that you use various charting tools, your understanding of chart reading, and by keeping track of trends to know what and when to buy. And by keeping a close watch on your holdings you know when the time comes to sell them and take your profits.

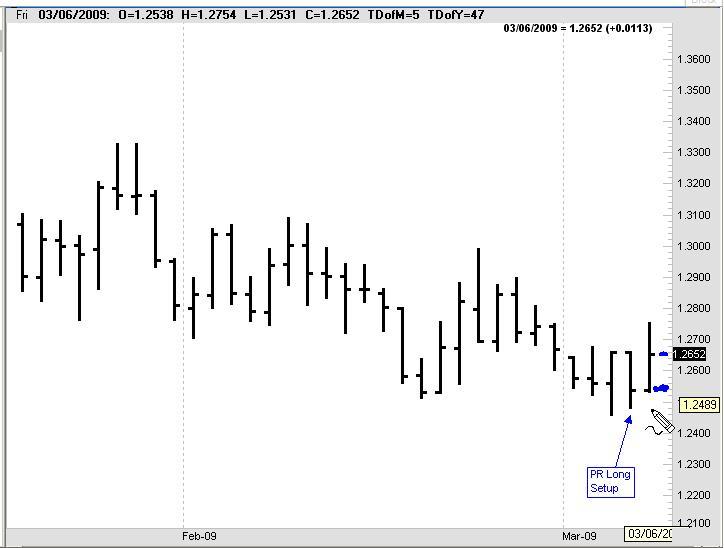

This is referred to as “swing trading”, or sometimes referred to as “position trading”. It means you initiate a position in a certain stock based on your analysis of the charts using healthy risk management, and then when the charts communicate that the time to sell is upon you then you exit the position. That is ‘swing trading’.

Swing trading can mean you hold a stock for a few days or a few months, regardless of the time frame the goal is the same; to capitalize on short term price movements and then get out before there is a significant change in the trend of the stock. This is an active involvement in your portfolio that helps you prevent the types of losses experienced by those who ‘buy and hold’ and walk away hoping their money will be there when they need it. And ‘hope’ is not an investment strategy; if a person relies on hope then they are prone to fail.

So now your interest is peaked, and you want to get started right away at becoming an active manager of your stock holdings, a trader. Your next step is to learn how to read charts, understanding the fundamentals of technical analysis, and get setup with the electronic broker of your choice. Now you think you have everything ready and you take your first plunge into trading. You have studied the charts, you keep an eye on the broad market trends, and then you identify the best risk to reward entry price and you ‘hit the button’, now you’re in! So you begin to watch your trade by keeping a close watch on the performance of your trade, you know where your exit price is based on your understanding of the chart, and you have a ‘stop loss’ set to protect your capital in case the stock goes against your analysis.

Things are humming along great and you spot another chart that is providing you with a great entry price and you want to take a position in that stock now. But now you have to decide if you should sell your first trade in order to move your money into the new one... STOP.

If you ever find yourself needing to sell your stock in order to buy another then you have to stop right away. A smart trader never puts all of his or her capital into one trade at once. Placing all of your trading capital into one trade puts you on a direct course to failure.

As a trader you have to manage your trading capital by dividing it up into pieces. And only one piece can be allocated to any one trade. In this manner you reduce the risk to your overall capital. But wait you say, how can I make any decent money if I don’t go ‘all in’. You do it slowly, that’s how. If you want to be a successful trader with growing funds that enables you to trade another day, then you must absolutely practice good trading capital management.

For example, let’s say you have $20,000 set aside to begin your trading career with. You put all $20,000 into one trade and unfortunately the trade does not work as you expected and you end up taking a 4% loss on the trade. Now you are left with an $800 hole in your account. But, had you divided up your trading capital into 10 pieces now that same trade would result in a loss of only $80 because you only had $2,000 on the trade.

But you say this will take forever for me to make any money. You say that I want it faster. If you become impatient then you will fall into the trap of letting greed dictate your trading system, and once you cross the line to greed then your trading plan will be prone to fail. Patience and self discipline are very important in trading; you must keep reminding yourself of that.

Getting back to your statement that ‘it will take forever’ to make any money this way. It may appear to be slow at first but following healthy capital management techniques ensures you are able to stay in the game. Remember, your gains may be small at first but for every profitable trade you add that money back into your capital pool of funds. So your next trade instead of being $2,000 now you might be able to put $2,500 into each trade. It is only a matter of time before your portfolio begins to increase rapidly, so long as you always stick to your trading rules, your capital management techniques, and your discipline.

As you expand your trading capital over time you can increase the number of slices you make in your trading capital pie. But, I never recommend anyone just starting out to try and keep track of more than 10 trades at any one time. For me I have made good money over the years using the 10% rule, occasionally I will go upwards to 20 trades at one time, but I always come back to my average of 10.

Also keep in mind that you do not have to have all 10 slices of your trading capital in the market all the time. If you only have 3 or 4 trades that is fine, remember that the smart trader waits for the best trades to come to him or her, never go chasing trades for the sake of just being ‘in the market’.

Trading can be a very rewarding endeavor, it can be fun, and it can also be dangerous if you don’t practice proper trading disciplines. And one of the most important disciplines is to manage your trading capital properly.

There are two very important rules that traders must follow:

1. Practice capital preservation

2. Make money

You cannot perform rule #2 if you don’t learn how to do rule #1!

Best of luck,

Charles Young

Rebel Traders

===================================================================

For more on Chuck and Rebel Traders be sure to check out RebelTraders.net

It takes a big man to admit a mistake, especially when the mistake almost crippled an industry giant. Rick Wagoner, former GM CEO, came clean this week admitting his mistakes. Now, no one likes to see anyone lose a job, but this mistake placed General Motors (NYSE_GM) in jeopardy years ago.

It takes a big man to admit a mistake, especially when the mistake almost crippled an industry giant. Rick Wagoner, former GM CEO, came clean this week admitting his mistakes. Now, no one likes to see anyone lose a job, but this mistake placed General Motors (NYSE_GM) in jeopardy years ago.