The past few weeks have been challenging for logistics giant United Parcel Service, Inc. (UPS) as it faced the prospect of a crippling labor strike if the company did not agree to a new contract containing the demands put forward by the International Brotherhood of Teamsters, the labor union representing the nearly 330,000 workers of UPS.

The Teamsters have been demanding better pay, especially for part-time employees, and improved working conditions. The workers were scheduled to go on strike from August 1, 2023, without an agreement. However, UPS and Teamsters reached an agreement on July 25, 2023, potentially avoiding the strike, which could have crippled U.S. supply chains and impacted the economy.

Earlier in June, UPS announced its agreement with Teamsters on new heat safety measures, which build upon the company's important actions in February. The company has agreed to equip newly purchased U.S. small package delivery vehicles with air conditioning starting January 1, 2024. After equipping over 95,000 package cars with a cooling fan, UPS will install a second fan in vehicles without air conditioning by June 1, 2024.

It also agreed that exhaust heat shields will be included in the production of new package cars and will be retrofitted into existing package cars within 18 months of contract ratification. Despite these agreements, UPS and Teamsters remained at odds over pay and benefits for part-time workers that comprise a significant part of UPS’ workforce.

The deadlock was finally broken a few days before the potential strike as UPS and Teamsters reached a preliminary labor deal that included raises for full- and part-time workers. Under the tentative agreement, all UPS union employees would receive a $2.75-an-hour raise this year and a $7.50-an-hour pay increase over the next five years. Its part-time workers’ pay would start at $21 an hour, up from the $16.20 per hour currently.

Teamsters General President Sean O’Brien said the agreement was worth $30 billion. In a statement, O'Brien said, “We’ve changed the game, battling it out day and night to ensure our members won an agreement that pays strong wages, rewards their labor, and doesn’t require a single concession. This contract sets a new standard in the labor movement and raises the bar for all workers.”

UPS CEO Carol Tomé said, “Together, we reached a win-win-win agreement on the issues that are important to Teamsters leadership, our employees, and to UPS and our customers. This agreement continues to reward UPS’s full- and part-time employees with industry-leading pay and benefits while retaining the flexibility we need to stay competitive, serve our customers and keep our business strong.”

The five-year agreement is subject to union members' voting and ratification from August 3 till August 22. UPS released its second-quarter earnings with its EPS coming 4 cents above the consensus estimate, while its revenue missed the Street estimates by $1.06 billion.

After its second-quarter earnings report, UPS lowered its revenue estimate by $4 billion. It now expects its fiscal 2023 revenue to be $93 billion, and the company also lowered its adjusted operating margin to 11.8%, down from the previous estimate of 12.8%. It expects a capital expenditure of $5.3 billion.

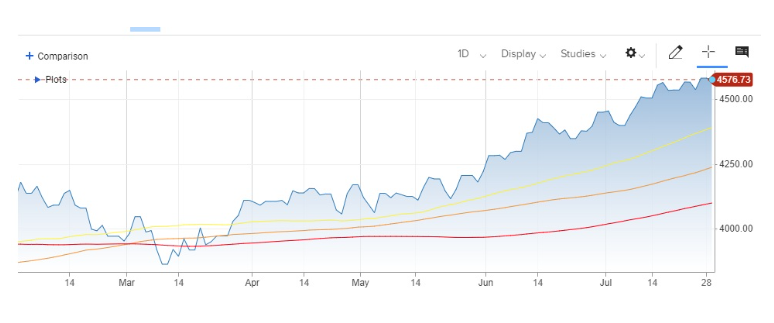

UPS’ stock has gained 4.8% in price year-to-date. However, it has declined by 7.4% over the past year.

Here’s what could influence UPS’ performance in the upcoming months:

Disappointing Financials

UPS’ total revenue for the second quarter ended June 30, 2023, declined 10.9% year-over-year to $22.06 billion. Its adjusted operating profit decreased 18.4% over the prior-year quarter to $2.92 billion. The company’s adjusted operating margin came in at 13.2%, compared to 14.4% in the prior-year quarter.

Its adjusted net income declined 24.1% year-over-year to $2.19 billion. In addition, its adjusted EPS came in at $2.54, representing a decline of 22.8% year-over-year.

Mixed Analyst Estimates

Analysts expect UPS’ EPS and revenue for fiscal 2023 to decline 17.9% and 3.7% year-over-year to $10.63 and $96.59 billion, respectively. Its EPS and revenue for fiscal 2024 are expected to increase 9.9% and 4.3% year-over-year to $11.68 and $100.77 billion, respectively.

Mixed Valuation

In terms of forward non-GAAP P/E, UPS’ 17.14x is 4.3% lower than the 17.90x industry average. Its 11.20x forward EV/EBITDA is 0.4% lower than the 11.25x industry average. Likewise, its 14.33x forward EV/EBIT is 8.5% lower than the 15.66x industry average.

On the other hand, in terms of forward Price/Book, UPS’ 7.19x is 175.6% higher than the 2.61x industry average.

High Profitability

In terms of the trailing-12-month net income margin, UPS’ 10.90% is 74.9% higher than the 6.23% industry average. Likewise, its 16.23% trailing-12-month EBITDA margin is 20% higher than the industry average of 13.53%. Furthermore, the stock’s 4.88% trailing-12-month Capex/Sales is 67% higher than the industry average of 2.93%.

Solid Historical Growth

UPS’ revenue grew at a CAGR of 9.7% over the past three years. Its EBITDA grew at a CAGR of 16.7% over the past three years. Moreover, its EPS grew at a CAGR of 35.8% over the past three years.

Bottom Line

The agreement UPS reached with Teamsters will cost it $30 billion in additional spending over the five-year contract period, increasing its costs significantly.

Additionally, the threat of the strike still lingers as many union members could vote against the ratification as they were not pleased with the $21 per hour pay for part-time workers. They were expecting a wage of around $25 per hour.

Furthermore, UPS faces stiff competition from FedEx Corporation (FDX). Given the mixed analyst estimates and valuation, waiting for a better entry point in UPS shares could be wise.