Gold (FOREX:XAUUSDO) has been so much out of favor over the last couple of years that it seems like no one is really looking or talking about this market anymore.

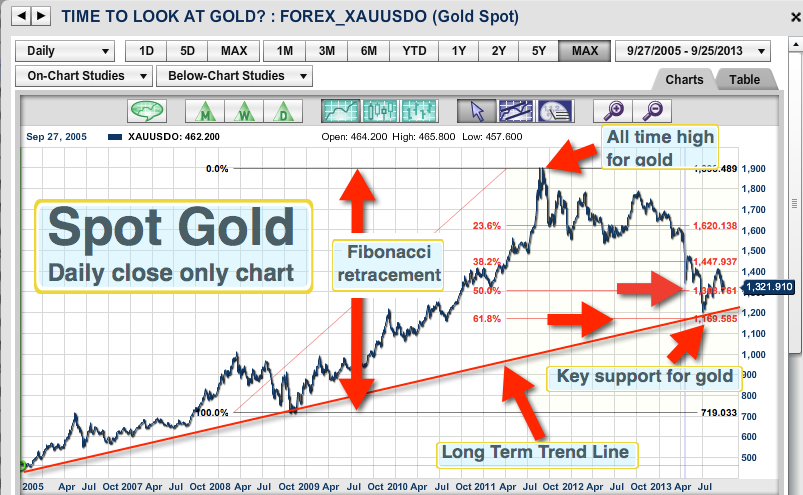

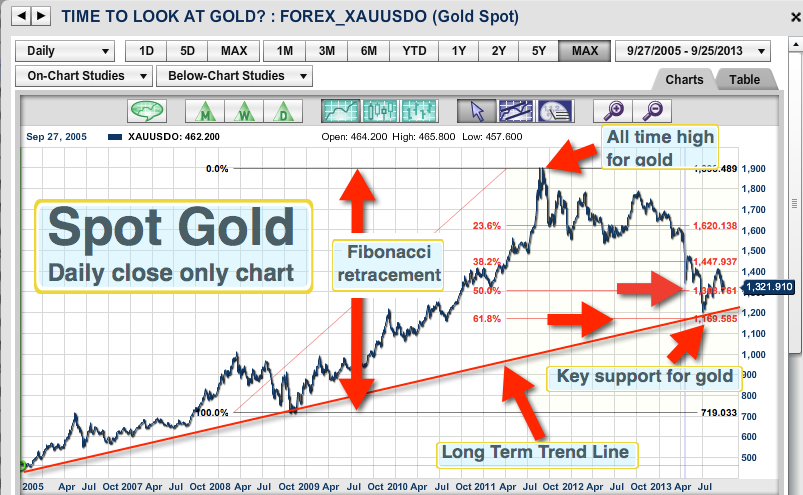

I was looking through a bunch of charts last night and I found some interesting technical aspects to gold that I would like to share with you today. Looking at the chart below, we can easily see the Fibonacci correction in gold. The gold market retraced back to an area of natural Fibonacci support, which is between the $1,170 and $1,308 levels. This represents major 61.8% and 50% Fibonacci retracements on the chart.

The gold market also found support in a long-term trend line, which started in 2005. This is extremely important in my view as the trend line is in an upward trajectory. We would need to see gold move into some sort of consolidation pattern before we would see a reversal to the upside in this market.

At the moment, all of our Trade Triangles are negative and I do not recommend going against these indicators. As you can see by the trading results, just by following the Weekly Trade Triangles, you do so at your own peril.

One of the hardest things for most investors and traders to do is to buy something that's been going down for a long time, investors are just not mentally prepared to do that. The purpose of today's posting is to mentally prepare you to start thinking about gold and putting gold on your radar screen for a future move. When it begins, I believe we could see a significant upside rally in this metal.

So let's wrap up with the positives and negatives for gold. Starting with the potential positives, the Fibonacci numbers and the long-term trend line from 2005 all support the long-term upward trend in gold. On the negative side, all of our Trade Triangles are red, indicating that the trend is still down.

Ideally what I would like to see in gold is a combination of the market moving out of its support area and our long and intermediate term Trade Triangles turning green and positive.

Have a great trading day.

Adam Hewison

President, INO.com

Co-Creator, MarketClub