The Merriam-Webster dictionary defines sentiment as, “an attitude, thought, or judgment prompted by feeling: predilection.: a specific view or notion: opinion.: emotion.: refined feeling: delicate sensibility especially as expressed in a work of art.: emotional idealism.”

As it pertains to the financial markets, market sentiment is the view or attitude that creates our opinion as to whether an asset class is overvalued or undervalued. It shapes and changes the value of a stock or commodity’s price.

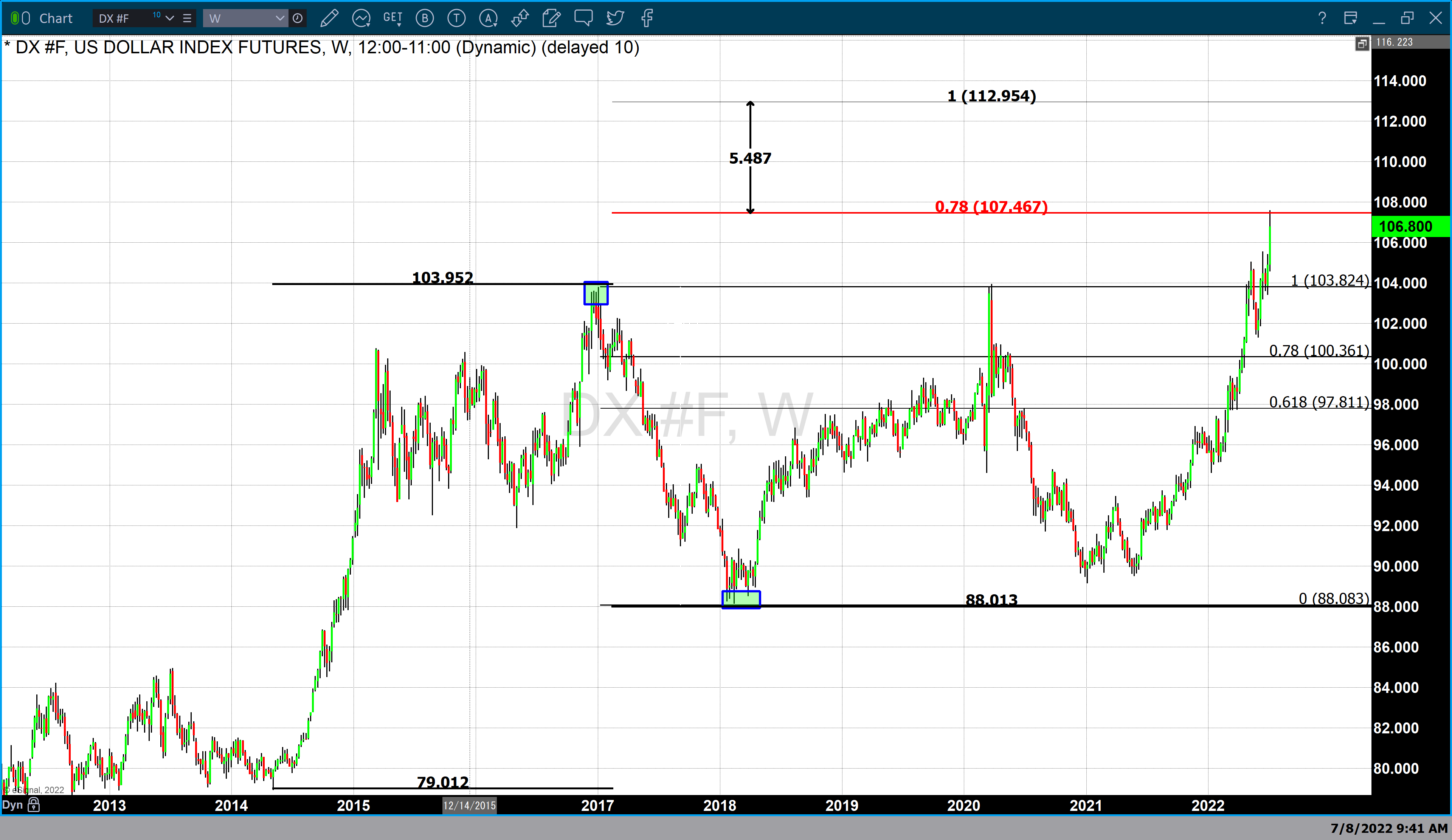

Market sentiment is overly sensitive to statements and comments made by Federal Reserve officials because those individuals have the power and influence to change monetary policy.

There is a dramatic difference between the perception of upcoming Federal Reserve monetary policy changes and the actions of Federal Reserve officials.

The Federal Reserve raised rates at every FOMC meeting this year except in January, from March through November, a total of six rate hikes. Over the last four FOMC meetings (June, July, September, and November) they raised rates by 75 basis points.

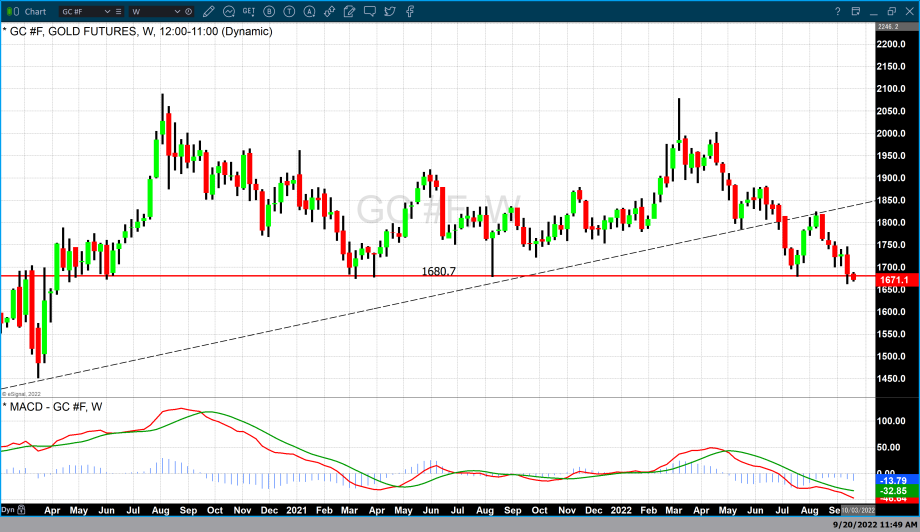

The aggressive nature of the Federal Reserve’s monetary policy moved gold dramatically lower from March up until the beginning of November. Gold traded to its highest value this year of $2078 in March. By the beginning of November, gold prices had dropped to approximately $1621, resulting in a price decline of 21.99%.

During the first week of November, market sentiment shifted because inflation rates had declined fractionally, and investors viewed this fractional drop as a signal that the Federal Reserve would begin to loosen its aggressive monetary policy. This caused gold to rise dramatically from $1621 to an intraday high of $1792 by Tuesday, November 15. Continue reading "Gold Market Sentiment Adjusts To Recent Fed Comments"