If you are a trader, you don’t care how the market stacks up to past fundamentals.

But, if you are a long-term investor, knowing how the market appears today from a fundamental standpoint, compared to other times, is something you want to keep an eye on.

Knowing when the market is becoming expensive or even overpriced is essential because that tells you it may be time to start taking your foot off the gas. Or the other side of that coin is that the market appears cheap or underpriced.

These times are when the words of Warren Buffett, “Be greedy when others are fearful and fearful when others are greedy,” stand out the most to me.

Buffett is trying to tell investors that when others are buying, despite stocks and the market as a whole being very expensive, you should be concerned. He also says that you should be greedy when others are afraid, likely because of market turmoil and stocks are selling off. Buffett gives you a straightforward, back-of-the-napkin blueprint of when to sell and buy.

With that all said, I don’t believe there are hard-pressed rules on this is when to sell, or this is when to buy.

However, I think now is a time that you should start considering when you will sell or, at the very least, start planning your next moves based on how the market reacts to the coming weeks or months.

One reason I believe we may be hitting a peak is because of general market sentiment. Towards the end of the summer, most market participants, the talking heads on news outlets, and even Wall Street (i.e., the big banks) were saying a recession was very likely in 2023.

However, the market was rallying during that time, then we peaked in August and finally sold off in September. During the fall, the markets were mostly flat, and then things spiked in January. Now the thinking is we may not hit a recession, and inflation may be behind us. Is the market feeling like it could be getting greedy?

But what about the complex data showing us the markets may be overvalued right now? Continue reading "The Market Is Looking Expensive"

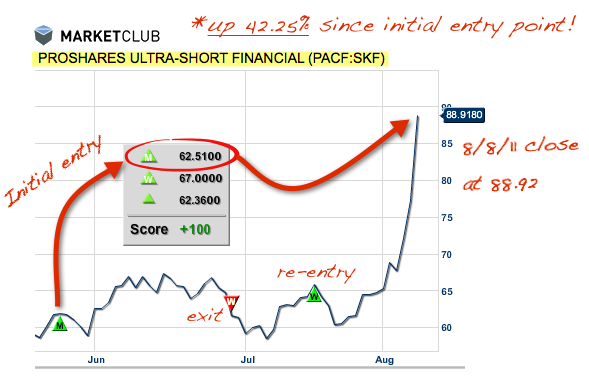

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.