Today our guest blog posting will cover something that's been on our minds for the past few months...a Bear market! I'm often asked, "what can I do?" There isn't enough time in the day to help someone who asks me questions like that to be honest. If you don't have a place to start, or a strategy in place you're already behind and destine for failure. So read the article below from WallStreetSurvivor and set up your plan.

==================================================================

Making money in a down market may seem impossible, but there are proven strategies that allow you to profit and seize opportunities that are available in almost any Down, or Bear, market.

When there is turbulence in the stock market, and there appears to be widespread pessimism about stocks, should you simply throw in the towel, sell all your holdings and wait for the market to turn bullish again? The answer is NO! The key is to turn these bumps into plateaus of opportunities. There are several proven strategies to turn market losses into your gains.

Here are three:

* Shorting Stocks

* Buying Bear Market ETF's

* Buying Defensive Stocks

Shorting Stocks

So... Shorting is a way to make a profit from a stock falling in price when the market is bearish.

In 'short', it's a bet that a certain stock will fall.

If a stock looks like it will start losing value, then you can bet against it and make money as its price drops. When you short, you are actually borrowing the shares from your broker with the intention of selling them in the future. So basically, it's a loan of the shares. But the price you sell them at is all profit.

Let's look at an example. If stock ABC is trading at $30 and you expect it to go down, you would 'short' sell it. This means if your broker has loaned you money to buy ABC at $30/share and it falls to $25/share, you make a profit $5/share. That is, you sold the stock for $30/share, and you only paid $25/share for it, even though you sold it before you paid for it. Shorting stocks allows you to make money on a stock when it falls in value.

Let's dive into a few more facts about shorting and risks associated with shorting. To start with, borrowing shares means margin and while you short-sold a stock, if the company announces a dividend, you would have to reimburse the owner for the dividend. Meanwhile, your downside risk is equivalent to how high the stock may rise after you short-sold which is potentially unlimited downside risk.

Another way to look at a bear market if you're not a big fan of shorting is...

Bear Market ETFs

An alternative to shorting stocks or indexes is to buy Bear Market Exchange Traded Funds (ETFs)

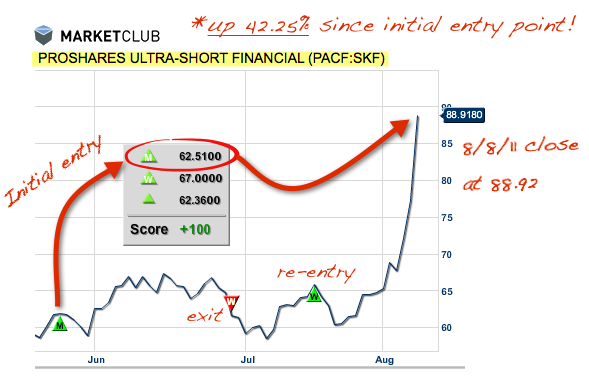

Bear Market ETFs are designed in a way that when major indexes go down, these ETFs gain value that matches the drop in the index. Moreover, a type of ETF called Ultra Short ETFs allow you to multiply your gains (or losses) by investing in leveraged ETFs. What that means is for a 2:1 leveraged Ultra Short ETF, if the underlying index goes down by 4%, your ETF would go up by 8%. For example, the Ultra Short ETF - Short Ultra Financials (AMEX: SKF) has a 2:1 leveraged relation with the underlying Dow Jones U.S. Financials index (INDEX: DJUSFN). Beginning in November 2007, if you would have bought SKF, with a 10% loss in the index value; you would have gained 20%. Not bad, huh?

In summary, with Bear Market ETFs, you could still reap the benefits of shorting in a down market, without worrying about margin or the unlimited risk associated with shorting a stock. Additionally, Ultra Short ETFs provide an interesting alternative to multiply your gains or to hedge a downturn by investing in leveraged securities.

More Bear Market ETFs:

* UltraShort Consumer Goods (AMEX: SZK)

* UltraShort Health Care (AMEX: RXD)

* UltraShort Oil & Gas (AMEX: DUG)

* UltraShort Real Estate (AMEX: SRS)

* UltraShort Semiconductors (AMEX: SSG)

* UltraShort Utilities (AMEX: SDP)

Bear Market Index ETF's:

* UltraShort Nasdaq (AMEX: QID) is designed to profit when the Nasdaq index of technology stocks goes down.

* UltraShort S&P 500 ProShares (AMEX: SDS) is designed to profit when the S&P 500 index goes down.

* UltraShort Dow30 ProShares (AMEX: DXD) is designed to profit when the Dow Jones Industrial Index goes down.

Defensive Stock Picks

Seema Garg, Program Manager at Wall Street Survivor

Looking for more ways to profit in a Down market? Here are six industries to BUY in a Bear market that could make you money while others may be selling:

Wall Street Survivor

http://www.wallstreetsurvivor.com/Public/Learn/DefensiveStockPicks.aspx

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.

It would almost seem like MarketClub's Trade Triangles could see into the future, but you won't find any mumbo-jumbo or "black box" technique hiding behind our symbols, just market-conquering technical analysis.