While the U.S. economy grew at a 2.6% annual rate in the third quarter, high inflation, weak third-quarter corporate earnings, and fears of another aggressive rate hike by the Fed are raising the possibility of a recession in the next 12 months.

With investors anticipating a broad slowdown, this year could be the worst year for the stock market since the 2008 financial crisis.

However, a corresponding slowdown in the energy demand can be safely ruled out due to supply-side constraints caused by the conflict between Russia and Ukraine and OPEC+’s decision to cut oil production by 2 million barrels/day.

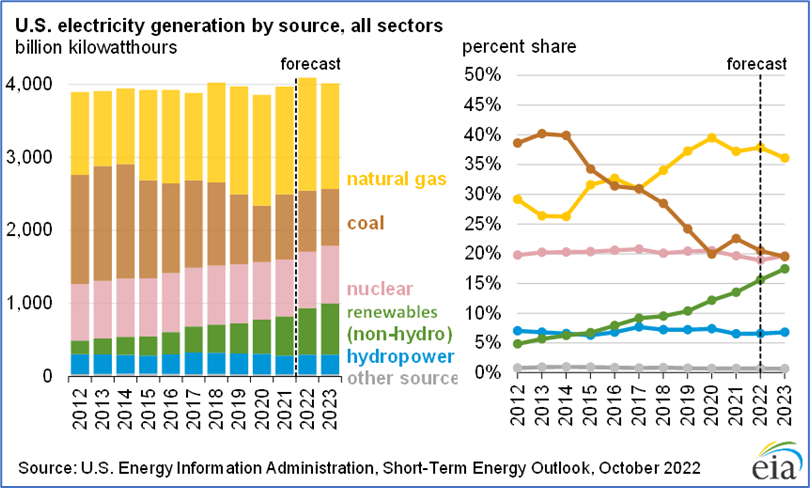

According to the short-term energy outlook released by the U.S Energy Information Administration, the U.S. residential price of electricity will average 14.9 cents per kilowatt hour in 2022, up 8% from 2021. Higher retail electricity prices largely reflect an increase in wholesale power prices, driven by higher natural gas prices.

Besides, energy demand is expected to grow in the long run due to increased economic activity and the effects of climate change. The global energy as a service market is projected to grow at a 7.6% CAGR to reach $112.7 billion by 2030.

Hence, it would be opportune to load up on energy stocks ConocoPhillips (COP), Murphy Oil Corporation (MUR), and Tidewater Inc. (TDW) as some technical indicators point to their upside. Continue reading "3 Energy Stocks for the Rest of 2022"