The fabled group of five large-cap tech businesses, so-called FAANG — Facebook (currently Meta Platforms), Amazon, Apple, Netflix, and Google (currently Alphabet) — dominated the stock market through late 2021.

However, a challenging macroeconomic environment in 2022, characterized by stubborn inflation and removal of Covid restrictions, saw big tech struggling to meet and exceed the high expectations of growth in subscribers/users and advertisement revenues set at the height of the pandemic.

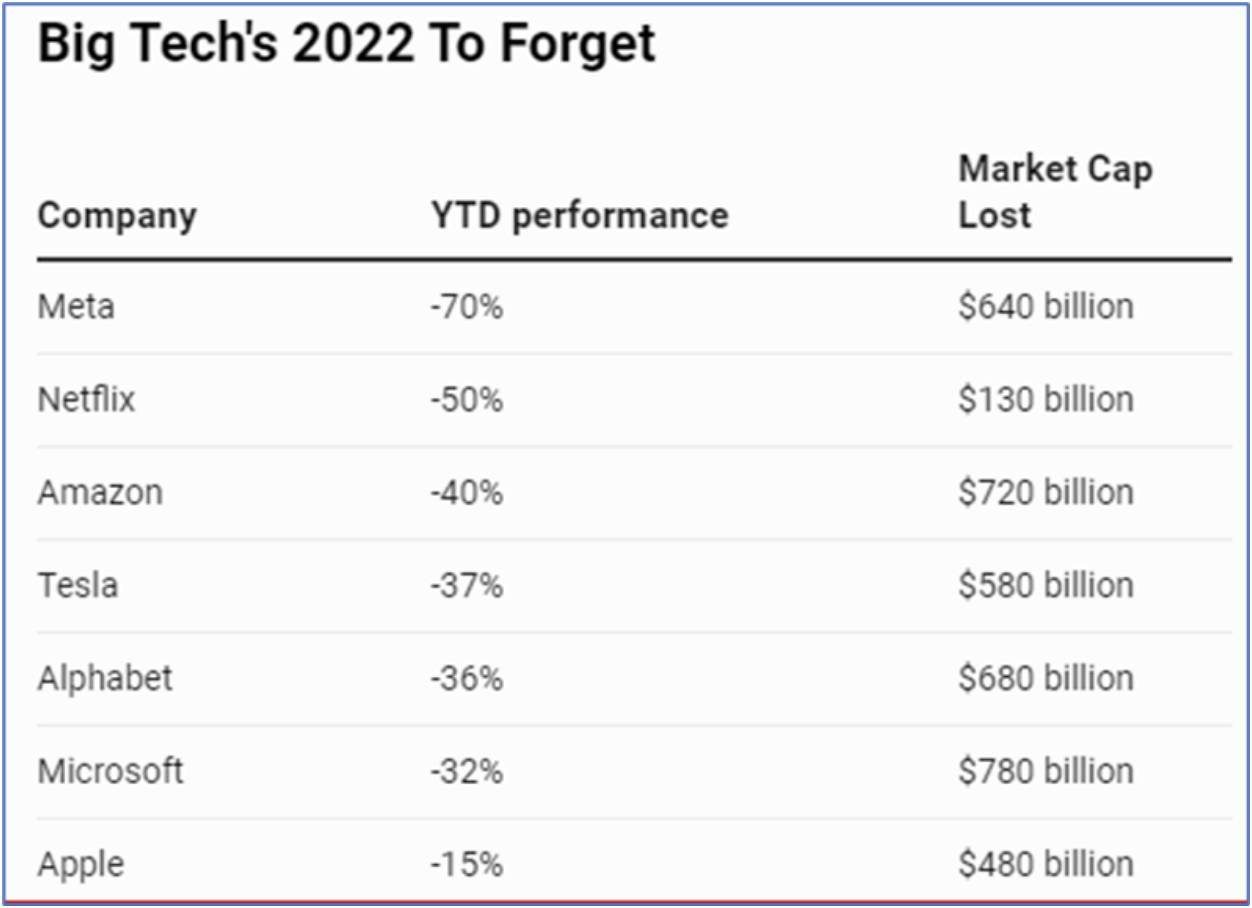

The slump in the performance of these tech businesses was soon reflected in the price action of their stocks. Their dismal year can be summarized by the below snapshot at the end of October 2022.

However, the drawdown brought the valuations of these compounders to a more comfortable buying point while they did the needful to recapture lost demand and improve the efficiency of their businesses.

Continue reading "2 FAANG Stocks Staging A Comeback"