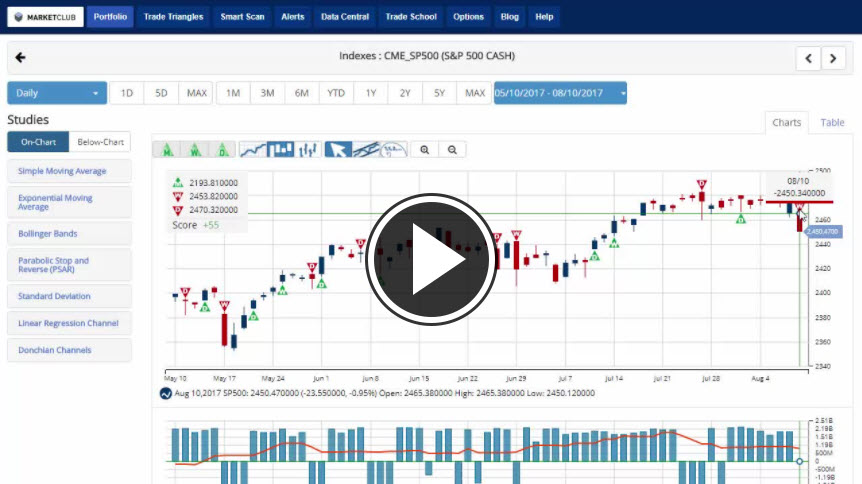

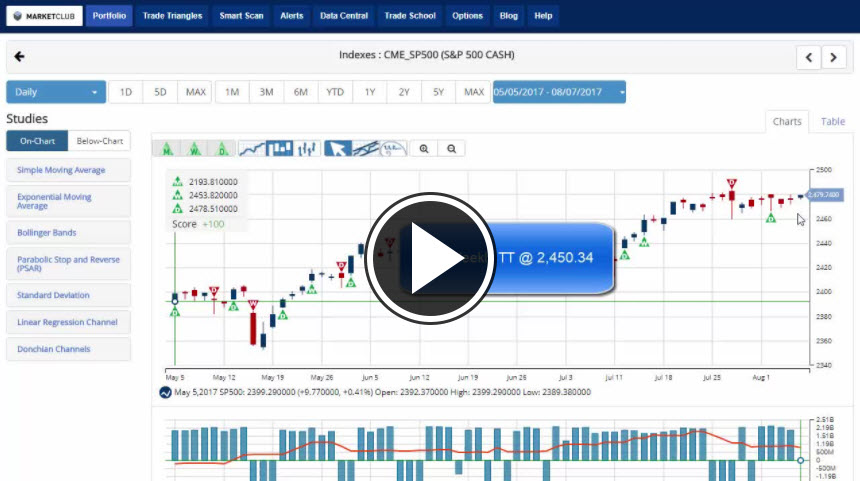

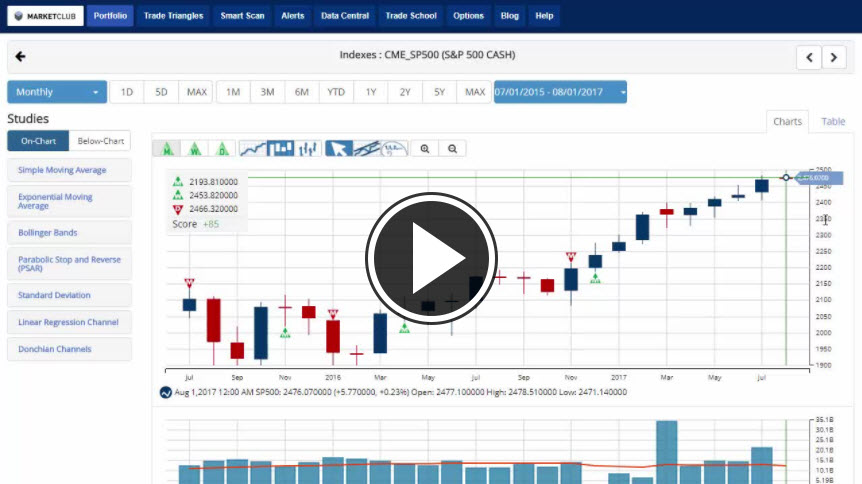

The S&P 500 (CME:SP500) closed for the week at 2,472.10, after hitting an all-time record, after gaining 10.5% year-to-date. The S&P’s forward Price-to-Earnings ratio, a key ratio for investors, is 17.8 above the 10-year average of 14. And this brings up the inevitable pondering; is there any juice left in the S&P 500?

In searching for an answer, the intuitive starting point might be the S&P’s valuation. We’ve already pointed out that the S&P 500 is trading at a high valuation compared to its 10-year average. Furthermore, according to Factset research, earnings for the 500 companies which comprise the S&P 500 are expected to rise by 9.3% as compared to 9.26% in 2016. Now, while that is a solid figure, it also suggests earnings growth is not accelerating and may even suggest the acceleration in earnings growth is over. And if earnings growth is likely to decelerate in the coming years it cannot account for the S&P500’s 17.8 PE ratio. So, there’s no valid reason why the S&P’s valuation would be the catalyst for another surge. Why not? Simply because it's too high. In fact, the real catalyst isn’t within the S&P500 or even within the stock market; instead, the real reason lies within the Bond market. Continue reading "S&P 500: Any Juice Left?" →