Weeks after the Election Rally initiated a moderately strong upside breakout rally, our Custom Index charts suggest the US stock market may be ready for a brief pause in trending before any new trends continue. Global traders and investors jumped into the US stock market just days before the US elections expecting something big to take place. The rally that initiated just days before the US election pushed our Custom Index charts well into the upper range of the 2016 to 2018 upward sloping price channel. This suggests the US stock markets have ended the downward price reversion and are now attempting to extend into the upward price channel – attempting to resume the upward trending that started after the 2016 elections.

Weekly Smart Cash And Volatility Indexes

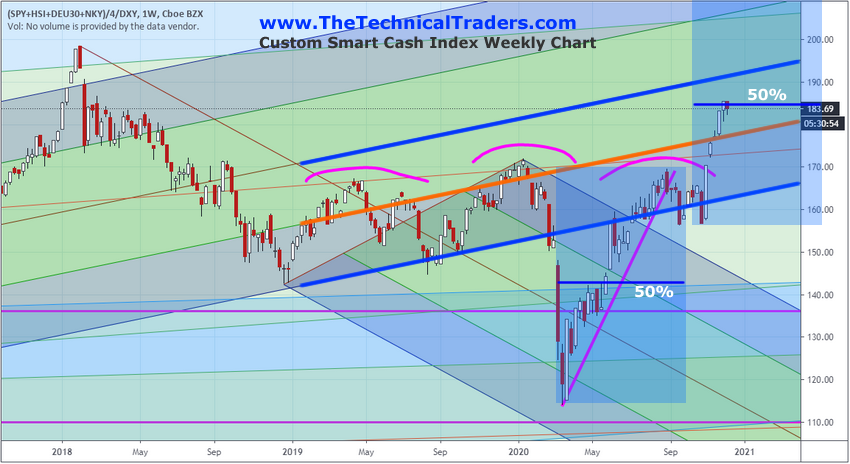

The Weekly Smart Cash Index, below, highlights the impressive rally recently and the upward sloping price channel that is back in play for price. The highlighted range of the upward sloping price channel is actually the lower half of the std deviation range of the 2016 to 2018 price channel. So, as of right now, the Smart Cash Index price level has yet to really breach the middle of this channel and is still only within the lower half of the channel. Still, the support near the lower boundary of this level has been retested two or three times over the past six months and held. This suggests the lower channel level (the lower heavy BLUE line) is now acting as moderate price support.

The speed of the recent upside price rally on this Smart Cash Index chart suggests that current price congestion may be an indication that the US stock market has reached a point where it will pause and stall a bit before attempting any new rally. From the recent lows near the end of October to the current highs, the current rally represents a 50% Fibonacci price expansion of the range from the March 2020 lows to the highs in August 2020. The 50% expansion range is a very common Fibonacci level that can typically prompt market price pauses or reversals. Continue reading "Stock Market Ready For A Pause"