This has been the stock market’s worst first-half in over 50 years with inflation serving as the main culprit and a slew of ancillary pressures from China’s Covid lockdowns and the Ukraine/Russia conflict.

Through the first six months, no sector has been immune from the breath and reach of this bear market. The S&P 500, Nasdaq and Russell 2000 are well in bear market territory at June’s end.

Risk appetite across the spectrum has been eroded. The crypto market has collapsed, traditional IPOs and SPACs have dried up and several commodities have collapsed as of late.

Despite this massive wealth destruction, strategists from major Wall Street firms are forecasting that stocks will recapture most of their losses in the back half of the year.

The S&P 500 is expected to finish the year more than 20% higher from the end of June’s levels per the average year-end target derived from the top 15 Wall Street strategists. This forecast translates into the market recapturing most of the year’s losses, albeit finishing the year with a negative return of ~3%.

Deploying Capital

During bear markets or an extended period of a market-wide bear backdrop, investors have the unique opportunity to purchase heavily discounted stocks at a fraction of the price when compared to their peaks.

As history indicates, establishing long-term positions during corrections can lead to outsized gains over the intermediate and long term. As the selling pressure abates and the macroeconomic backdrop resolves, building equity stakes in high-quality companies bodes well for long term investors.

As the macro issues resolve over time, the markets will regain their footing and appreciate higher. The current market backdrop is the exact scenario where investors should be deploying cash on-hand to snap up heavily discounted merchandise in a diversified and dollar cost averaging manner.

Behind the Inflation Curve

The Federal Reserve has fallen far behind the inflation curve, putting through reactive interest rate hikes of 1.5 percentage points, with more to come throughout 2022.

Many politicians and executives have been sounding the inflation alarm since Q4 of 2021 to no avail while the Fed continued to buy bonds and pump liquidity into the system.

The latest inflation numbers by the Labor Department came in at 8.6%, the highest since December 1981. The reactionary Fed and runaway inflation have caused havoc on Wall Street while the Fed attempts to slam the breaks on the economy.

Second Half Bounce?

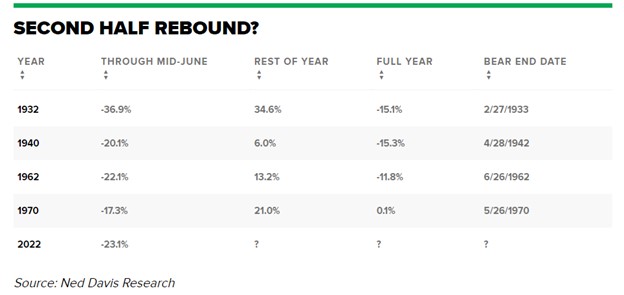

Although the first half of this year ranks among the worst in history, the selling may ease in the second half if history is any guide.

When the S&P 500 plunged 21% in the first half of 1970, it promptly reversed those losses to gain 26.5% in the second half and post a slight gain for the year. 1932, 1940, 1962 and 1970 saw first half decimation on par with 2022 however every one of those years saw a second half rebound.

Only one year saw the market recover the losses it incurred during the first half, in 1970 (Figure 1).

Recession Possibility and Type

With the possibility of recession, there’s different underpinnings of a bear market that are broken out into cyclical-driven, structural-driven and “event-driven” stock declines of 20% or more.

Goldman Sachs (GS) holds the position that investors are experiencing a cyclical bear market which is marked by high inflation and rising interest rates. This combination results in price-to-earnings multiple contraction and thus a reduction in valuations.

The current climate is buffered against a structural bear market that is buoyed by strong corporate and household balance sheets. The positive side is that the average cyclical bear market lasts two years, far shorter than the average three in half years for a structural bear market. The average price decline during a cyclical bear market is only about 31% versus 57% during a structural one per Goldman.

Cash On-Hand

Deploying cash into an environment where the selling is relentless and indiscriminate can be a daunting task. However, for any portfolio structure, having cash on-hand is essential and in these environments is where this cash should be deployed in equities.

This cash position provides investors with flexibility and agility when faced with market corrections. Cash enables investors to be opportunistic and capitalize on stocks that have sold off and have become de-risked.

Initiating new positions and dollar cost averaging during these extended periods of weakness are great long-term drivers of portfolio appreciation. Absent of any systemic risk, there’s a lot of fantastic entry points for many high-quality large cap companies. Investors should not remiss and capitalize on this buying opportunity because it may not last too long.

Anchoring and Dollar Cost Averaging

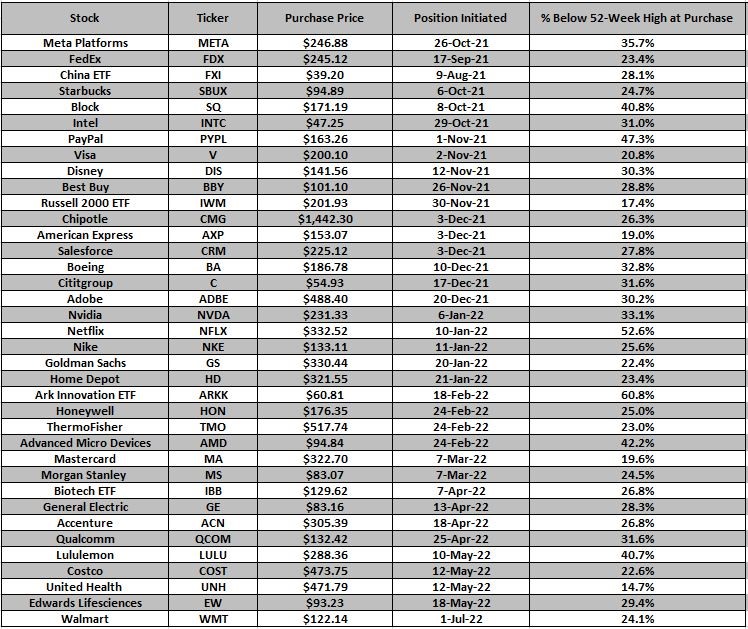

Purchasing stocks at the exact bottom is nearly impossible however purchasing stocks at attractive valuations in a disciplined manner over time is possible.

Dollar cost averaging is a great strategy to use when anchoring down into a position with an initial sum of capital and following through with additional incremental purchases as the stock declines further. The net benefit is reducing the average purchase price per share in a sequential fashion (i.e., reducing cost basis). An example of building out a high-quality portfolio with subsequent dollar cost averaging throughput this market weakness can be seen in Figure 2.

Conclusion

This has been the stock market’s worst first-half in over 50 years where no sector has been immune from the breath and reach of this bear market. The S&P 500, Nasdaq and Russell 2000 are well in bear market territory at June’s end.

Despite this massive wealth destruction, strategists from major Wall Street firms are forecasting that stocks will recapture most of their losses in the back half of the year. The S&P 500 is expected to finish the year more than 20% higher from the end of June’s levels per top Wall Street strategists.

Purchasing stocks at the exact bottom is nearly impossible however purchasing stocks at attractive valuations in a disciplined manner over time is possible. During bear markets, investors have the unique opportunity to purchase heavily discounted stocks at a fraction of the price when compared to their peaks.

As history indicates, establishing long-term positions during corrections can lead to outsized gains over the intermediate and long term. As the selling pressure abates and the macroeconomic backdrop resolves, building equity stakes in high-quality companies bodes well for investors. The current market backdrop is the exact scenario where investors should be deploying cash on-hand to snap up heavily discounted merchandise.

Noah Kiedrowski

INO.com Contributor

Disclosure: Stock Options Dad LLC is a Registered Investment Adviser (RIA) firm specializing in options-based services and education. There are no business relationships with any companies mentioned in this article. This article reflects the opinions of the RIA. Any recommendation contained in this article is subject to change at any time. No recommendation is intended to constitute an entire portfolio. The author encourages all investors to conduct their own research and due diligence prior to investing or taking any actions in options trading. Please feel free to comment and provide feedback; the author values all responses. The author is the founder and Managing Member of Stock Options Dad LLC – A Registered Investment Adviser (RIA) firm www.stockoptionsdad.com defining risk, leveraging a minimal amount of capital and maximizing return on investment. For more engaging, short-duration options-based content, visit Stock Options Dad LLC’s YouTube channel. Please direct all inquires to

in**@st*************.com

. The author holds shares of AAPL, ACN, ADBE, AMD, AMZN, ARKK, AXP, BA, BBY, C, CMG, COST, CRM, DIA, DIS, EW, FB, FDX, FXI, GOOGL, GS, HD, HON, IBB, INTC, IWM, JPM, LULU, MA, MS, MSFT, NKE, NVDA, PYPL, QCOM, QQQ, SBUX, SPY, SQ, TMO, UNH and V.