This week was undoubtedly a busy week for FX traders, with the utter meltdown of the Russian Ruble followed by Putin’s speech, the across-the-board selloff in emerging markets and the surprise negative rate announced by the Swiss National Bank. What this week won’t be remembered for is a Pound Sterling turnaround, yet I intend to illustrate in this article that that might just be in the cards.

Across the Channel

The fact that the Pound Sterling has shed value against the almighty Dollar might not come as a surprise; after all, the Dollar has rallied across the board as the Fed turned hawkish and the economy accelerated. But what is a surprise is why the Pound Sterling, the currency of an economy which has grown at an annual pace of 3%, has been essentially flat versus its European peer, the Euro? In short, after a robust performance from the UK economy, investors are beginning to get the sense that rather than continue accelerating the UK is been dragged down by the woes across the Channel with Europe pulling UK growth potential down. Below, the two major charts that made investors ponder and Sterling stagger.

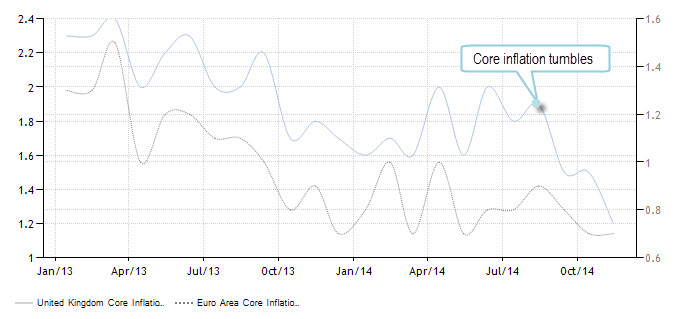

The first and foremost piece of data is inflation, but not just headline inflation which is also affected by external factors such as Oil prices (which, as we all know, happen to be collapsing) but core inflation that isolates external volatile factors including energy and food. As you can see in blue, UK Core Inflation just took a nose dive, hitting 1.2%, just 0.5% above the Eurozone’s 0.7% core inflation rate. With such a collapse in inflation expectations investors are beginning to question the UK recovery, wondering instead if growth is about to slow rather than accelerate, or perhaps that wage growth is not just around the corner as the pundits have said, and that maybe the Eurozone’s own stagnant growth is dragging the UK down along with it.

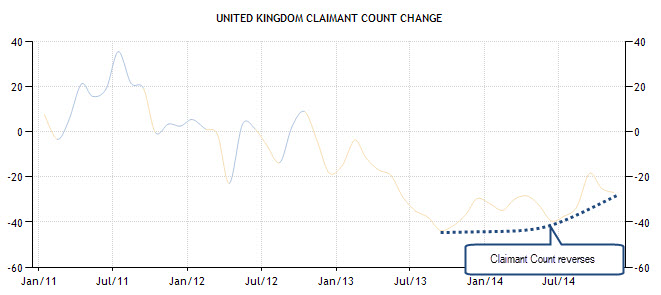

Thereafter, comes job market data; although unemployment has fallen to 6% it’s stubbornly fixed at this level and the claimant count rate, which measures the fall in unemployed (as seen in our second chart) has slowed down in pace. That had led investors to ponder that perhaps the job market is about to reverse some of its earlier job gains and that unemployment could nudge a bit higher.

This has all led to one very basic question; are rate hikes in the UK really on the table next year? What with inflation in a nose dive, wages failing to rise and unemployment perhaps on the verge of a hike? Certainly, the possibility of a rate hike being pushed back into 2016 seems, especially after those readings, more probable. And that pretty much explains the flat performance of Sterling even against a battered Euro.

Retail Sales Changes the Game?

So what is the game changer? We have established the reason(s) why Sterling has been stagnant thus far but what makes investors think the game has changed? In two words: retail sales. The robust retail sales figure coming out of the UK on Thursday, a 6.4% (YOY) gain, surprised even the most optimistic investors. That unexpectedly positive figure has resulted in yet another possible scenario for Sterling watchers; say, the one in which the recent mild UK data was just a temporary bump or a minor glitch, and that the UK is actually gearing up towards another fall in unemployment, a rise in wages and maybe even a rate rise in 2015.

Matching Technicals and Fundamentals

As seen in the chart below the reaction in the market was not too late to arrive and the EUR/GBP quickly took a nose dive amid renewed Sterling bets. This could very well be the start of another push south for the pair, especially considering the formidable resistance the pair has generated and how this resistance pattern was reinforced today. But, and although this could be the signal for the start of another bearish push in the pair, more needs to happen. Next week’s final Q3 GDP reading may very well provide that fuel, that impetus, which can push the pair below the 0.777 level. However, most investors are eying December’s CPI data and 4th quarter GDP which is due out next month. Because if those two readings follow suit after the robust retail sales numbers, the 0.777 support could be broken, and as the chart illustrates below, the next support for the pair may be quite distant, creating a potentially long bearish cycle for the pair and taking the Sterling bullish bet back into the game. So, if you are in it for the long haul, be patient; Sterling just may surprise you for the better.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.