Natural gas futures on Friday dropped below $3 for the first time since September 2012, on an intraday basis. December is now on track for the dubious distinction of producing natty’s largest one-month drop since 2008 – currently about a 26% month-to-date (MTD) decline – as producers continue churning out the commodity even while mild weather has resulted in below-normal consumption.

Crude oil, by comparison, has declined about 17% in December (MTD).

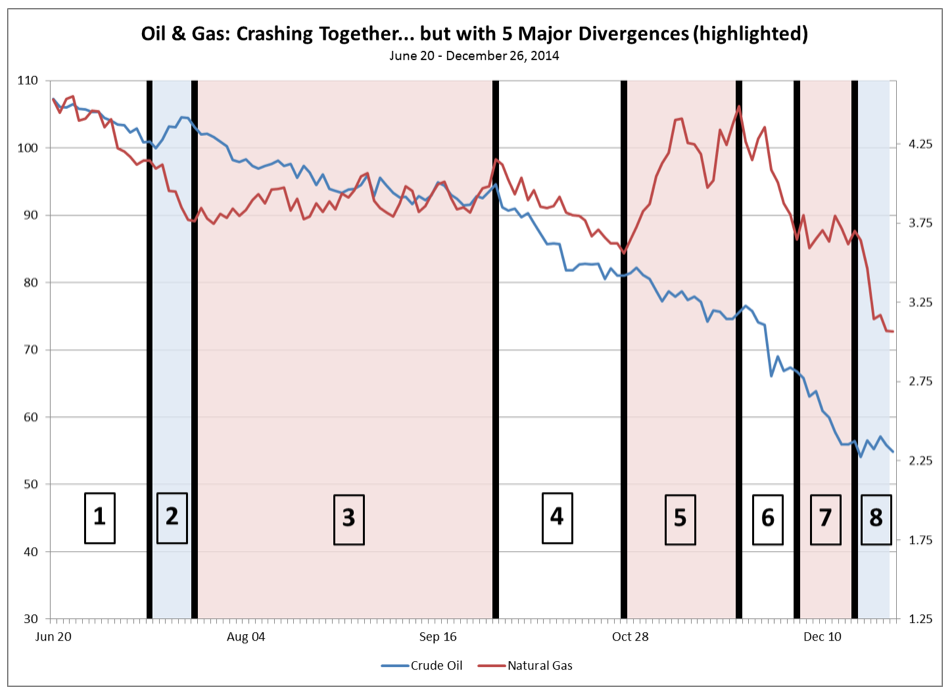

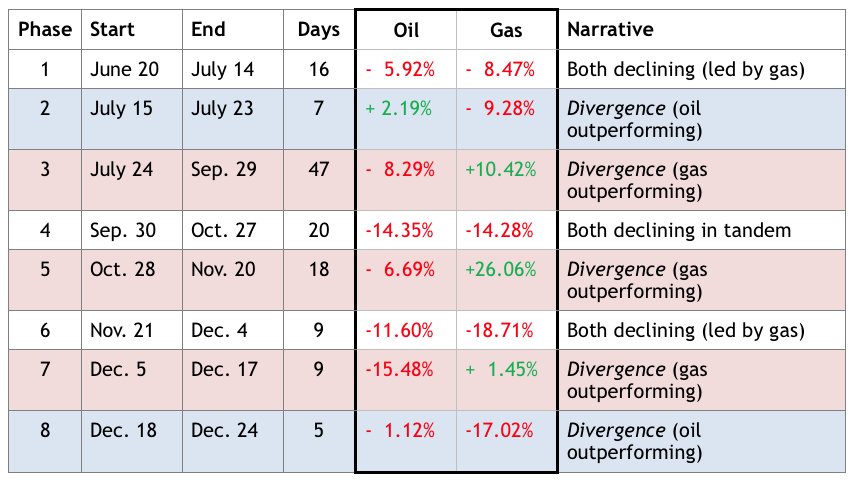

Natural gas and crude oil prices have taken turns out-dropping each other over the past 6 months. This simple graph (and accompanying chart) shows how oil and gas have crashed both together and separately for the last 6 months. What do I mean by that? Both have nosedived, but with 5 distinct periods of divergence (highlighted in blue when oil is outperforming, and highlighted in red when gas is outperforming). See for yourself:

In total:

- Oil & gas have crashed “together” for 3 of the 8 periods, for a total of 45 trading days in which gas has generally declined more than oil.

- Oil has “diverged” to the upside in 2 periods (highlighted in blue), for a total of 12 trading days.

- Gas has “diverged” to the upside in 3 periods (highlighted in red), for a total of 74 trading days.

Actually, at its recent peak on Nov. 20th, natural gas prices were only a few pennies below their June 20th level; so effectively all of natty’s 2014 crash has occurred in just over 23 trading days since just before Thanksgiving.

What happened to natural gas from Oct. 28th through Nov. 20th, when it rose about 26%?

Remember the polar vortex, which returned to the US during that time? Investors wondered if the country might be in for another long, cold winter like the last one. But that idea – along with natural gas prices – hit a nice, warm wall of resistance around Nov. 20th. Since then, mild weather has allowed natural gas prices to basically freefall along with its crude cousin.

In trading on Friday, Dec. 26th, natural gas lost about 0.16%, and oil lost about 1.72%.

All told, oil and gas futures have both regurgitated 30-50% over the last 6 months, but they haven’t declined together very much of that time. Which somewhat makes sense. Aside from weather, both oil & gas are subject to many similar pressures – oversupply, the US shale boom, shrinking demand due to slow global growth, etc. (Oh… sorry for the “puke” references, by the way; my wife, kids, and I have been sick all week; ugh!).

Implications

Investors are starting to look for bottom-feeding opportunities. Many are trying to find a theme, such as energy-sector stocks that haven’t deserved the punishment they’ve have been dealt. I read a Kiplingers article that was published a few days ago, but used price quotes from Dec. 16th. Unfortunately, a lot has changed since then!

One of the article’s main premises was that certain companies who deal predominantly in natural gas should not have seen their share prices lose as much value as companies who deal mostly in oil. Oops! Natural gas prices have fallen more than 15% in just the few days that article was apparently awaiting publication.

Still, the article probably had some very valid points, in the long term. In fact, I added a couple of the article’s recommended stocks to my MarketClub watchlist, just to keep an eye on them and see when their price movement turns around. Whenever an uptrend begins, I don’t disagree with Kiplinger’s sources that these natural gas companies may represent opportunities to “buy low.” Of course, none of the 5 stocks are showing any strong technical signs right now. All have 2 or 3 red triangles and very weak MarketClub scores. I prefer to be patient before buying an investment, in order to allow the market to provide signals that demand is taking control. I do also love to “buy low,” so I’m eagerly awaiting any positive signals, especially in energy investing. I’ll keep you posted.

Keep an eye out for next week's post,

Adam Feik

INO.com Contributor - Energies

Disclosure: This contributor owns Enterprise Product Partners (EPD), but not any other stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Natural gas futures historic historic monster squeeze up and move higher A dollar in a day and keep the move

Natural gas futures historic historic ignition. Higher now it can become a currency . It will replace oil as number . It will help oil go up big now . Natural gas can spike up a dollar and more in a day . It will go higher than most believe . 17 is possible . Protect you trades

Natural gas futures monster squeeze up . Historic historic move can go to 16. Natural gas can ignite above a dollar in day

Natural gas futures up a dollar in day or more can be seem

Natural gas futures infinity up huge move up can up above.50 before the open move to well above 15

Natural gas futures infinity up now can go up above .50. On hour historic historic move as high As15 for the commodity in 2015.

Natural gas futures historic infinity infinity move up in day can go above 1.28 in day we see a move 11 to 17 or higher

Natural gas futures historic infinity higher first day of the year we see a dollar move up in a day possible 1.28 or more historic move to 11 and higher

Natural gas futures historic historic historic historic historic historic infinity move up now 1.46 or more in a day we see it moving above 10

Natural gas futures historic infinity move up higher right now huge move a 1.46 or higher in day we can move upto10 gast

Natural gas futures historic historic historic historic historic infinity move up district trading day of year

Natural gas futures historic historic historic rise higher I. A single day 1.25to1.50 or more

Natural gas futures can see a historic move up 1.20 in day to 1.35 historic historic move up in day it can see above9 commodity of the year

Monday an explosive move up for natural gas . It will see a huge move higher. It will move on its own. We see nuclear plants off line coal plants. Natural gas heating expanding. LNG fuel of the world china buyers want 25yr contracts of supply .

Natural gas futures historic blastoff higher now can ignite much higher

LNG demand will grow on the ceiling. Us will become major player. Natural can spike now polar vortex. Nuclear facility going off line in New England. Natural gas power plants big. Coal needs to be changed. We see futures skyrocketing up right now above4.60 previous highs. We can see a move well above 9.75 for real. Natural futures huge spike higher now . Wishing everyone a healthy happy and prosperous 2015

Natural gas futures monster squeeze higher historic move up

Natural gas entire gas futures historic move up now we can ignite straight up now to above 5 to9

Natural historic move higher on futures now . Continue move higher it will be commodity now of 2015. It can see well above 10 to possibly 17

Natural gas futures can gap up in historic fashion now

Natural gas can go as high as 12to17. LNG above 40

Natural gas futures infinity up move now monster squeeze up.we can ignite up a dollar in a day for real. The move can extend above 10.

We see natural gas going 4 ,5 beyond fast double digits 10plus.we can go above 3.50plus today .

Natural gas futures infinity up now for real . We can see a historic spike a dollar in day . We see move going above 10

We see oil trading up

Now too . Natural gas will skyrocket on it own it can go to 10

Their eyes correct

Natural gas can spike above 4 to 5 before anyone blinks there eyes. We see a move truly historic up

Natural gas can see a spike above.50 up in day . It will have everything going it way

Above 3.20 fast today this can spike up in a truly historic fashion

Natural gas can ignite above .25 cents or more in a single day. Supply of several power plants going off line in northeast

We see natural gas going much higher on its own. a massive short cover,now

We can natural gas going up and surpassing oil in huge way . It will replace oil as number fuel IEa reference. Natural gas should take out 4 and5 area fast.

We see a historic move higher in natural gas now. It will take out 3.60 fast and can go above 10. Supply imbalance will disappear fast . Several power plants nuclear and coal going off line . The demand for LNG will grow at a large pace . It will be major fuel of the world . Us will allow greater exports of nat gas and lng. The supply to Europe of nat gas is not strong. We see many things coming together for natural gas here. We see Polar vortex possible too.

We see a historic move in natural gas going above 5.50to 9.it will move fast.

The title of this deserves a Pulitzer.

Haha. It was inspiration, Mark! 🙂

I won't hold my breath at the award ceremony.

It really has been a busy puke-bowl of late, hasn't it?

Few comments:

Oil/energy has been so good for so long, it should be no wonder that folks instinctively perceive bargains in beaten down oil stocks. Whether that strategy works or not is a matter of how long one is willing to hold them. The biggest majors pay decent dividends. Some of the smaller ones are going to suffer, perhaps all the way to BK.

There is a massive distinction between/among oil/energy cos that explore & produce (so-called E&P) and those that only transport (so-called midstreams) There are also companies that, while they for the most part transport, are also levered to the price of oil or gas. Why shouldn't they? Time and time and time again, we see in the markets: When there is a frenzy (energy) it is not just dumb (and smart) investors who pile in; it is the companies themselves.

So, my point is that when you are shopping a bashed sector for bargains, not all are equal. Consider KMI, trading at ATHs. Transport only. Look deep into the financials of some of the MLPs and NGLS, one of my fave stocks. Down considerable from its highs. (half of that, in NGLS case, is the extinction of a buyout rumor. Half, though = 20%, is the production tie-in) Why? Because they also have ownership interests in production facilities. I have no objection to buying the major oils, but I don;t think they are especially going anywhere in the medium-term future.