I invited Blain from StockTradingToGo.com back to give us his analysis on Lehman. He's missing the 4th key to selling Lehman...TRADE TRIANGLES! If you're a MarketClub member pull up Lehman in MarketClub...then take a look at where the Trade Triangles signaled you.

===============================================================

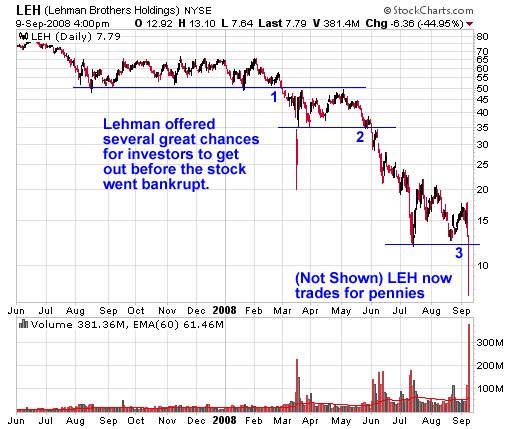

The following stock chart of Lehman Brothers (LEH) offers a great example of simple support and resistance. Support and Resistance is a basic form of technical analysis used commonly every day to mark potential buy and sell points on a stock chart.

Lehman Brothers is a good stock chart to observe for both new and seasoned investors because the recent Lehman bankruptcy offered three key sell signals for investors on the way down.

Note: This chart of Lehman Brothers is a 16 month daily stock chart:

1. The blue 1 show us how at the end of February Lehman stock fell through its first key support trendline at $50. This was a big sign that the bears had control of the stock and longs should get out.

2. The blue 2 shows us where Lehman eventually collapsed below its 2nd major support trendline at $35. This was another key sign for investors to get out of the stock.

3. The blue 3 shows the tipping point for Lehman before it moved to pennies. The break below $12 a share was the last major support Lehman had, and the stock never recovered. Bankruptcy shortly followed.

View More Examples of Technical Analysis.

What do Lehman Bros LEH and Apex Silver Mines SIL have in common?

Not much at all but look at how the share prices changed since the start of the year. (they fell in synchronization never deviating by more that about 10% from Jan 2008 and both down 90% for the year as of last week)

If Lehman had hung on until news of the "bailout" would it too "recovered" like SIL did? (popped up about 15% of its Jan price since last week from $1.25 to $3.50).

/ this is a comment on technical analysis