I'm confident that there are thousands of blog lurking gold bugs who are going to want to comment on this article from Mark Leibovit of VRGoldLetter.com. Mark hits on a number of issues, which include a possible conspiracy theory. Mark will be on PBS tonight talking about Gold, and if you visit VRGoldLetter.com, be sure and use the promo code "INO" for a discount.

But more importantly read the piece below and let the comments fly! It's time for all of those blog lurkers to make their thoughts and opinions known!

----------------------------------------------------------------------------------

In the short term, the precious metals, especially Gold, are trading counter to the stock market, but we have also seen precious metals rally along with stock market during the 2003 and 2008 bull cycle. Regardless, in the long-term, precious metals should rally because of currency debasement and the resulting inflation which follows. I have recently inaugurated the VR Gold Letter (which covers most other metals as well) to focus on the unique opportunity ahead in the natural resource arena.

Heretofore, Gold has been rallying recently, even when the US Dollar Index rises, as investors seek its safety because both stocks and bonds are falling. A stock market rally and any greater intervention by 'Helicopter' (or is it 'B-52') Ben Bernanke could change this. Overall the bear market in stocks, huge budget deficits, increased government spending, and nationalization of the banking system has led many investors seeking the safety of gold. Ultimately, the objective here is to protect ourselves from fiscally irresponsible central governments, not to mention the risk of their bankruptcy. Gold will never go to zero and history shows Gold as the ultimate and longest lasting store of value - not worthless fiat currency. I want to be long on the day when gold gaps up $500 an ounce and you can't buy it at any price. The world's largest debtor nation is trying to solve its debt created crisis with more debt! The risk is on the table that our own US Treasury could default on debt and even greater risk that the rest of the world will not buy our debt realizing our country may never be able to pay them back. Skeptics says that is nonsense as they can always print more money. It is clear this cannot go on for long without paying the consequences for such irresponsibility. Once central governments (ours included) realize that running the printing press 24/7 debases currency and ultimately leads to significant if not 'hyper' inflation - the only solution is a Gold standard. Alan Greenspan himself has said that "You didn't need a central bank when you were on a gold standard."

The United States has the largest gold supply in the world, estimated to about 261 million ounces, unless there is another huge fraud being perpetuated on the American public at Fort Knox. I have gone out on the limb in the absolute belief the United States will return to the Gold standard which was abandoned back in 1971 by then President, Richard M. Nixon. If the United States allows the Gold price to rise (or drives it higher) and then pegs the US Dollar to an inflated Gold price, a great deal is accomplished. The ever-growing United States debt now has collateral. The national debt would now be on its way to being balanced. If the national debt is 10 trillion dollars and Gold is trading at $10,000 an ounce, the United States now has 2.6 trillion dollars in Gold or roughly a 25% backing. My belief is that the size of the United States Gold reserve is much greater than reported and what the United States doesn't have it can easily confiscate either by demanding redemption of Gold from private holdings, or by creating a new North American currency (the rumored 'Amero') which would then include very valuable mineral resources of Canada and Mexico. Though the latter event currently appears very unlikely, the former could easily occur.

A run on Gold and Gold assets was one of the triggers that helped grow our fledgling nation. Recall, the California Gold Rush of the 1840s and the resulting migration and expansion of the United States toward the Pacific Ocean. We're headed for another Gold rush! This is not the 1840s, but Gold could (and will, in my opinion) become the next driving force, the next 'bubble' so to speak. It will become the internet shares of the new millennium. Just as US home prices soared ten times in value, just as internet stocks soared ten and in some instances 100 times in value, and just as the Dow Industrials soared rising from the 1982 to 2000 over ten times in value, i.e., from 1000 to 10,000, Gold, my friends is next! Recall, the Dow Industrials traded between 800 and 1000 for many years (1966 to 1982) with 1000 being a supposed 'insurmountable' barrier. When we finally cleared 1000, we were off to the races and 1000 became the floor! Think of Gold in the same terms. Once it blasts through, there is no stopping it. Buy your ticket for the Gold Express and sit back and enjoy the wild ride ahead!

A story from the London Times speculates whether there is any Gold in Fort Knox - said to be the most impregnable vault on Earth which is built out of granite, sealed behind a 22-ton door, located on a US military base and watched over day and night by army units with tanks, heavy artillery and Apache helicopter gunships at their disposal. The worry is that no independent auditors appear to have had access to the reported $137 billion (96 billion) stockpile of brick-shaped gold bars in Fort Knox since the era of President Eisenhower. It has been several decades since the gold in Fort Knox was independently audited or properly accounted for, said Ron Paul, the Texas Congressman and former Republican presidential candidate. "The American people deserve to know the truth. Mr Paul has so far attracted 21 co-sponsors for a Bill to conduct an independent audit of the Federal Reserve System - including its claims to Fort Knox gold - but an organization named the Gold Anti-Trust Action Committee (GATA) is taking a different approach. A month after President Nixon resigned over the Watergate affair Congress demanded to inspect the contents of Fort Knox but the trip to Kentucky was dismissed by critics as a photo opportunity. Three years earlier Mr Nixon brought an end to the gold standard when France and Switzerland demanded to redeem their dollar holdings for gold amid the soaring cost of the Vietnam War. Many gold investors suspect that the US has periodically attempted to flood the market with Fort Knox gold to keep prices low and the dollar high - perhaps through international swap agreements with other central banks - but facts remain scarce and the US Treasury denies that any such meddling has gone on for at least the past decade.

We already know from Paul Craig Roberts was Assistant Secretary of the Treasury in the Reagan administration saying: "How long can the US government protect the dollar's value by leasing its gold to bullion dealers who sell it, thereby holding down the gold price?" In other words, manipulation of the Gold market is an old, old story. The fear that Gold will return to its rightful place as the store of value and the basis for valuing all monetary transaction is so great, anything will be said and done to suppress it. You and I know when once again becomes the world monetary standard, printing presses will come to halt and sanity will return to an insane world addicted to credit and indebtedness.

There have also been rumors of a possible secret agreement between the United States and China and Japan pledging access to this country's gold bullion in the event we default on our debt or should hyperinflation occur. This apparently occurred following China's concern for our mismanagement of our economic affairs. Recall, Chinese Premier Wen Jiabao said, hes worried about Beijings vast holdings in US-Treasuries and wants assurances that the investment is safe. We have lent a huge amount of money to the United States. I request the US to maintain its good credit, to honor its promises and to guarantee the safety of Chinas assets. Of course we are concerned about the safety of our assets. To be honest, I am a little bit worried.

Another story circulating that last week the ETF GLD holdings were unchanged at 1,127 tons. The ECB reports that one central bank sold 0.63 tons worth 14 million euros. Deliveries have taken the registered category in silver down from 80 million ounces in December to 63 million. It could be that SLV is getting silver from the Comex out of HSBC warehouses. That means SLV is short silver probably because they cannot buy and get delivery, so with slight of hand they borrow it. This could prove explosive as silver rises sharply or if major other deliveries take place. The paper market is a disaster waiting to happen. This is why we have repeatedly cautioned about FIRST taking delivery of the physical Gold and Silver and not relying on GLD, IAU, or SLV or equivalents when investing. We do like Central Fund of Canada (CEF) more, but it is not a replacement for the physical metal.

The contrarian in me says this break in Gold into the 800s is a 'gift', but between negative cycles and the lack of upside volume, I'm picking and choosing real carefully.

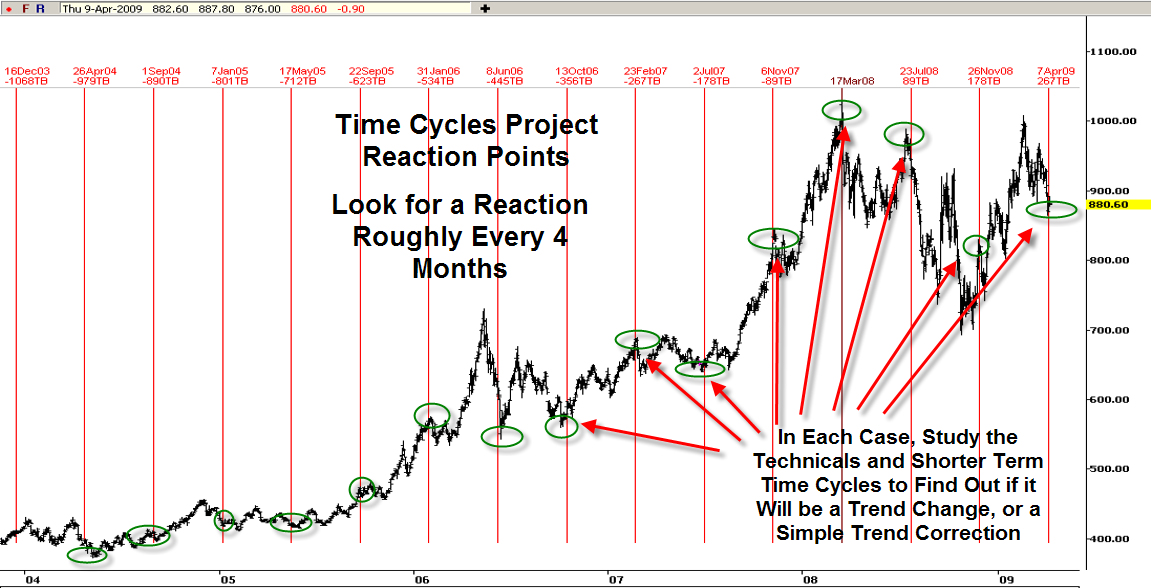

Here is another perspective. When traders look to the technical backdrop of gold or any other commodity or equity, there is always reference made to support and resistance levels, price patterns, etc. One of the most neglected, yet most valuable tools is time. It is one thing to say that gold should find support at this level or that level, but WHEN should it get there? Think of technical analysis as a three legged stool. One leg is the price action (support, resistance, momentum indicators, etc.). The second leg is pattern, as in what patterns are being formed by the price action (Elliott wave, wedges, triangles, etc.). The third leg is TIME. When will price reach its objective, or better yet, when can we look for turning points? Without any one of the three legs, the complete technical analysis stool is difficult to balance. The concept of pattern, price, and time has been explored and written about in detail by Robert Miner. In today's example, we will take a broader look at time cycles in the gold market followed by a close up look at where we are now with regard to pattern, price, and time.

The chart below shows a longer term view of a dominant time cycle in gold. The cycle lasts roughly 4 months and is usually culminated by some sort of reaction in the price of gold. It does not necessarily lead to a change in trend, but at the very least a reaction, or price correction against the prevailing trend can be expected. Notice the small green circles in the chart that show how price reacted around the cycle change points. In each case, a close up look at price and pattern would give reliable clues as to whether price would merely correct or if a trend change was developing. Remember - whenever looking at technicals, use a `weight of the evidence' approach. Do not rely on only one indicator. Always use time as one piece of evidence as to when major reaction points can be expected. Looking at the chart, you can see that the four month cycle came in on Tuesday, April 7. So that tells us to be on our toes looking for a reaction of some sort in this time frame.

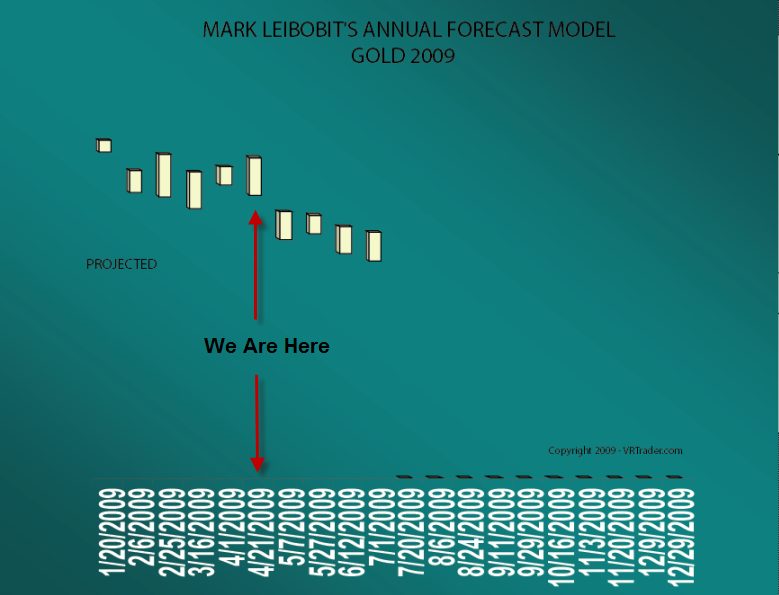

At the same time, a glimpse of our proprietary Annual Forecast Model for Gold shows the current cyclical picture, so it appears a bounce may be temporary.

For the balance of the cyclical forecast please go to VRGoldLetter.com or VRtrader.com if you do decide to become a member use the promo code "INO" for a discount.

Mark Leibovit

What a uselessly crap article.

Original

Comment by Scabby Butthole

2009-05-05 14:58:33

What a uselessly crap article.

Response:

I had nothing to do with this article butt

at least tell us why so we can learn from you.

I had nothing to do with this article butt

at least tell us why so we can learn from you.

The simple reason that the fiat currency fractional reserve debt creation system can not work in perpetuity is because the INTEREST demanded by the system is NEVER CREATED! The only way the system survives is by an exponentially increasing number of new loans. Since it is essential to expand the money supply FASTER than the rate of loans being repaid, that with interest takes as much as DOUBLE the money OUT of circulation, eventually like any pyramid scheme, it collapses of its own weight.

What we see now is the unpayable interest accumulating as mountains of debt at all levels, DEBT that can not be repaid and will probably be inflated away if the government continues its failed policy of stepping in to borrow when corporations and individuals are increasingly tapped out and unwilling to go further into debt even at historically low rates of interest!

The end game for this particular Ponzi scheme is near, the only solution is at least a partial restoration of the gold standard abandoned in 1971. Unlimited printing of fiat currency can only lead to hyper inflation down the road, and it may be a short one.

Following through on this "golden thread" it appears that a person should have a mansion in California with active oil wells in the back 40 acres, selling off some oil or the converted LNG to mine the gold/silver/copper/platinum/palladium mines, also in the back 40, while also turning some of each into paper money to pay for the onerous property taxes and security guards to protect it all.

I can relate to all that. What disturbs me is that my visit to Fort Knox and periphery. During several one-on-one conversations with "some in the know" the comment often heard was "there ain't no gold in Fort Knox". Is it now underground in Colorado?

The new currency in one word - CARBON. Where do we think this administration is planning to raise money to pay for all these printing??? It's Carbon taxing! Every one of us, individuals and business would be tax for every ounce of CO2 gas we produce, all in the name of saving the environment. It's like we'll be taxed for breathing. LOL! This is going to become the new global currency. Trade wouldn't happen until everyone has met their so called carbon standards.

One thing I've come to realize is that, instead of only talking about the unfortunate things happening in the world today, we should better position ourselves....so as not to get washed out by the "tsunami" coming our way. Cos the fact is that it's going to get pretty ugly for the average man/woman - the masses.

It is becoming ever more clear to me that a new monetary system needs to be created. Our current money which is based on debt needs an ever growing amount of bank credit to perpetuate itself resulting in an unsustainable exponential growth rate.

Four questions need to asked;

1 Why does Governments around the world choose to borrow money from private bankers at interest when governments could create all the interest free money it needs itself?

2 Why create money as debt at all, as the debt is paid that money disappears, so why not create money that circulates permenantly?

3 How can a monetary system that depends on ever increasing growth be used to build a sustainable economy? Isn't ever increasing growth and sustainability incompatable?

4 So what needs to be changed to create sustainable growth and a sustainable economy?

ED makes a good point. confidence in an investmet is #1 to any invester! China,russia and all other countries investing in USA debt are losing confidence in our ability to pay off loans with less valuable dollars. they would rather invest/buy copper mines, oil fields , commodies or make deals with countries having valuable assets! integrity is still important to investers around the world and because it is in short supply in the USA the dollar will be replaced. a sad day for all!

There is no shortage of people wanting you to buy gold now (right in it's mature peaking cycle) just as there was the last time gold was at dollar levels similar to today.

So let us go back there and see how well you would have fared if you listened to the proponents back then and invested say, USD250000 in gold over that year at a mix of prices.

1980 Gold Year High: USD 850 Year Low: USD496

Close price end Dec 1980: USD 651

After all the argument is that you will beat inflation by buying gold.

Unfortunately folks you would have lost big time if you had bought gold in 1980 and held it as a store of value to now. Yet the arguments back then were the same as we are getting now.

Your USD 250000 worth of 1980 gold, even at todays higher prices, would buy you now, in goods and services, less than about one quarter of what it would have bought you in goods and services back in 1980 (and that's being very conservative).

If instead of gold you invested your USD250000 in quality californian city real estate at 1980s prices(with no loan), your 250000 investment would be worth much more than 1.0 million today even at currently depressed prices - and only a small proportion of rental revenue would have been needed to cover your fixed expenses over that period. ( What investment return do you get on gold whilst you are holding it? None actually and you do incur storage and insurance costs to slowly eat away at your investment).

Gold is subject to peaks and troughs as it runs through its various cycles like other commodities. Currently it's in a cycle peak. So, if you like buying in peaks - good luck.

Oh but of course "IT'S DIFFERENT THIS TIME". Er - but that's what they told us back in 1980!

Exercise caution in all your investments and it is never prudent to buy in cycle peaks - no matter what you like to invest in. If you do, you had better have a very efficient and fast exit strategy.

Guys, buy precious metals. Au, Ag or Pt. One day they will stop printing paper that doesn't cost them much for now and they use it to sell not to expensive options, to keep prices low. One day!!!!

If you buy metals, they cost you nothing to hold, you can dig a hole about any where or even sink it in a pond, you will have allways access to it even if it burns. But if you buy oil, any other commodities it will allways cost you storage, unless you take delivery and burry it in your front lawn or pond. There again your county will find a way to tax you , if not then you'll end up with the ecologists with thier friends the environmentalists....???

Or buy an investment home, Shur you can make a quick revenue, but only on a short term basis, please. Listen to the experienced man up there, where he mentions that the $30,000 home went to 1 mil. and is now falling down. He didn't tell you all the money you had to continue to put into it to maintain it and the taxes that keep going up-up-up, plus all the money the banks, insurance ect. ect made on your back while looking at you working your ... off. He right don't keep it for the long haul.

Stocks ...... their manupulated like the metals are, by a couple of Wall Street biggies who only care of their balance sheets.Can some one give me a logical explaination, why a large healthy corporation is valued at lets say $100.00 one day and the next is worth only $10.00????

Well what can we say or do....... "BUY GOLD & SILVER"

As a simple investor my humble opinion:

1.) Gents follow capacity utilisation for sign of inflation, if greater than 80% start to get inflation (when look at historical graph). Presently dropping of cliff

2.) As US savings comes from negarive to 0-5, aproximate 1 trillion dollar of demand lost in us economy. Also add asset price losses, hence stimulus inflationary at later date.

3.) Consider Gold as an Insurance that can be cashed at a black swan event (remember never believe a man who wears a tie)

4.) Trading is just that, Trading no one can predict the future...

I think this article makes a lot of sense. And the comment that oil is a good hedge against US Fed bent upon bankrupting the country is also good.The only thing right now about oil is that there is growing demand destruction because of the deepening recession. I read where China has been accumilating gold for some time and their reserve position is a whole lot greater than had been reported in the recent reports. It would be interesting to know if other countries such as those in the far east have been acquiring gold. If international transactions start to get difficult in the sense that their currency starts to tank or there is wide spread suspision concerning a countrie's solvency then it wouldn't surprise me if a lot more countries begin to demand gold as payment. There are some countries now refusing to accept the american dollar for international payment. If more start refusing the us dollar then look out for trouble.

We have had inflation. Now we are having deflation. It's the historical cycle. Wishful thinking will not change that. When the $30,000 house sells for 2 million, and a 15 cent loaf of bread sells for 6 dollars, that is inflation. Forget about the printing press theory. Cash is unchanged. It is a very, very small amount. Save your dollars as they will be very valuable. You will be able to buy that new car for $300 again. Take it from a 91 year old economist.

Con-s-piracy.

The con is by the government, or rather the private Federal Reserve.

The piracy is also done by the federal reserve, that prints fiat to squash gold.

The conspiracy "theory" is fact for those who are not brain dead.

Gold is the enemy of central bank operations. Every time it approaches 1000 they call out their partners in crime in the bullion banks and short the beejesus out of the yellow metal. So far they have been successful. At some point they are going to lose control. I don't know when but as long as it stays well bid as it has, I'm in.

Who would have thought it would be below 1000 with all that has occurred? Clearly someone has their foot on it. I suspect it will rise when they have accumulated all they want.

I have been reading the utterings of gold proponents like this person for years now and they are still going on with the same tired old lines. Now I am sceptical (although an occasional investor in precious metals).

At the end of the day it's supply and demand which ultimately determines the price of gold. As we have witnessed in the recent past, gold is subject to the same speculative activity that other commodities are. It is also a product that is slowly increasing in supply as more is continually mined. The higher the price the greater the incentive to mine even more.

There is never a shortage of gold investors who are writing articles, newsletters and blogs etc trying to push the demand button and hopefully inflate the value of their holdings.

1. If you go back a few years these people were telling you that gold would hit USD2000 - 2500 per ounce by now and silver at least USD50. I'm still waiting, and waiting ....and waiting. I suppose that "eventually" they will be right but when is "eventually". They will always come up with a reason why their predictions did not come true. "Governments are manipulating the market" is a common one. "Somebody is selling too much gold" is another.

2. We are now witnessing the worst debasement of the value of national currencies by the monetary policy actions of various western governments we have seen in living memory. The US is by far the worst culprit. Logically, on future expectations, gold should now be well above USD1000 but it's not.

3. Will gold be a good hedge against the inevitable inflation in front of us? Well maybe - that's the big guess. Perhaps the likes of oil and some other commodities will prove very much better hedges. At least we know the world is virtually totally dependent on oil, oil is traded in USD, oil is running out and what's left is becoming increasingly expensive to find and extract. Within 5 years, and given a resurgence of world growth, oil will likely be at least double (perhaps even thrice) the USD price it is today. We have seen it at these prices before!! Can you say the same of gold Mr leibovit? Well I guess, at worst, you can use it to pay for your increasingly expensive gasoline in the future!

In reply to James:

You are correct, it is supply and demand. Governments and financial institutions are manipulating the supply by engaging in naked short selling, i.e., selling short contracts for gold that they do not physically have. This holds the price down, although if all the holders of these contracts demanded delivery at once (which they ought to but probably won't), the price would explode through the roof, since there's no way all the outstanding contracts could be fulfilled: there simply isn't enough physical gold in existence.

You assert that the supply of gold is constantly being expanded by mining, and this is true. However, the easily extracted deposits of gold are dwindling, meaning the only remaining gold in the earth's crust is going to get very much more difficult and expensive to extract. This will cause the rate of supply expansion to slow, and the price of gold will go up to cover the increased cost of mining it.

You also assert that the market should have already reacted to the expected continued currency debasement by pricing gold well above $1000 FRN. I read as many articles every day saying there will be no inflation in the future as I read saying there will be hyperinflation, so clearly not everyone believes that the currency is actually being debased. Frankly, I'm glad there are people who don't believe it: there have to be huge losers for me to have huge gains, since it's a zero-sum game.

Oil will be a good hedge, too, but there are still a lot of untapped oil reserves in the world, so its supply will not dwindle as quickly as that of gold. However, the demand for oil will likely continue to grow, probably more quickly than the demand for gold will grow, so oil may keep pace with gold or even outpace it. We'll just have to see.

What happens when the USD is no longer the standard world currency because it is so devalued (or collapsed). China and Russia have already publicly made mention of the notion. It may be getting blown off right now, but when people finally see how thinly spread our worthless dollar has become I think the other countries of the world may reconsider.

The problem with oil and other commodities is 99.9% of people can't take delivery of it. So you're always owed something. With gold you can have it in your possession. Even is oil and other things stay in USD based denomonations, gold will as well go up in value with everything else. Worst case it stays proportioned to oil, but I guarantee you it will buy more assets than the dollar will be buying!

Since you own gold, keep holding it. "Eventually" may be a while off still with the govt's 'smoke and mirrors' show they continue to put on with the financial sector..... but when the day comes you will be glad you own that gold.

Best of luck on your investments - and at the least stay diversified in times of uncertainty!

They say a broken clock is right twice a day, but now we're in cyclical upmove, so perhaps the clock will strike.

Blah blah blah. Hey Mark; say something when there is something to be said. In the meantime, find another way to make money.

That's disrespectful.

Politicians and the Federal Reserve Bank hate gold. It imposes monetary discipline, which they reject. After the hyper-inflation about to scald us in the next few years, a return to a gold standard might be the only thing that rescues our country from its fiscal miscreancies, especially those perpetrated by titular leaders of our financial system. Let there be no confusion over this--only governments have the power to inflate a currency--not labor unions, not businesses, not consumers, not farmers, not manufacturers or miners.

The United States has engaged in wars for far less important resources than "all the gold in Fort Knox." The United States would be willing to start a war to protect what little gold holdings it may still have remaining in Fort Knox, and it would also be willing to go to war, I believe, to cover up a lie that there is any gold whatsoever is in Fort Knox at all, when, in fact, there may indeed be none. We just do not know, and we have the right to know.

Great comment.

In 1939 I bought gas for $0.139/gal. Today its higher and tomorrow it will be much higher When the Dow is 36,000, a little debt such as todays will be insignificant. If the US kept books as most businesses, the assets would probably be much greater than the liabilities and we would all want the surplus devided. Perhaps Congress is sharing with us now. Be thankful.

Interesting thought. Thank you.

I have followed Mark Liebovit for many years, he is one of the good guys.

I am glad PBS is having him on again, thanks for the heads-up.

Gold, you either love it or hate it. No fever like gold fever.

It is the only thing stopping the banksters inflation and greed.

They have to bash it down.

Gold or Goldman who will win?

Goldman Sachs should be shut down IMHO. It has been cause of most of Wall Street's questionable activities.

"Mr Paul has so far attracted 21 co-sponsors for a Bill to conduct an independent audit of the Federal Reserve System"

Update: that's now 91 cosponsors. (Thomas.gov is always behind.)

We're making progress! Thank you.

http://www.goldensextant.com/Complaint.html

The price on gold is a true indicator of the dollar. That's why politians hate it. Greenspan and Clinton held gold way below true value.

Thank you for the link.

If the current cost of carrying all U.S. debt is exceeded by the total return on all U.S. assets AND the U.S. has both the ability to protect and expand those assets, why bother with endless speculation on gold conspiracy theories? My belief is that U.S. return on assets easily covers the cost of all U.S. debt .

I am not sure whether to laugh or just really feel sorry that you believe the US has enough true assets to cover it's debt. The assests we have they already own a large amount of, and there's nowhere near enough to cover China's investment in our 'service sector' economy. I love the USA, but we are in a level of debt that is unrecoverable if we don't stop spending (and it keeps growing at record rates!!!). Do what you want, but I for one will have as little of my wealth in US dollar-based anything. Gold and commodities of true tangible value are a no-brainer when it comes to diversification of your investments. Keep your useless green paper.... horde it.... you will be sorry when the inevitable collapse occurs and that large sum of "wealth" you had will not buy you 1/10th what it did. Worst yet, keep trusting your politicians that they are acting in YOUR best interest! LOL

Check out this link:

http://www.truthin08.org/widget/

Are you serious?

The US already went bankrupt on Aug 16, 1971.

The completely unrecoverable debtload for Amerika now, is merely the resulting flameout in progress, that started almost 38 years ago.

There's no way out, the numbers are just too ludicrous. Another bankruptcy is assured. It will take the form of "Inflate or die".

Bring on the Amerikan Peso.