Its easy to over-think a trade or completely miss profitable trades because you are looking for complex setups. We here at the INO.com like to keep things as simple and profitable as possible. Today we have asked Brian Heyliger of SixFigureTrader.com to share one of his favorite setups with us, its simple and effective. Be sure to comment and let us know what you think.

Its easy to over-think a trade or completely miss profitable trades because you are looking for complex setups. We here at the INO.com like to keep things as simple and profitable as possible. Today we have asked Brian Heyliger of SixFigureTrader.com to share one of his favorite setups with us, its simple and effective. Be sure to comment and let us know what you think.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For you swing trade traders out there, I like to share with you my most valuable setup in emini S&P 500.

The setup is fresh in my mind because just last week my subscribers and I used the setup to take a 28-point profit in the S&P 500.

I call it the ‘box trade.’

As with many things in trading, the more simple, the better. I live by that principle both in my personal life and in my trading career as well. And I think you’ll be hard pressed to find a more simple trading setup than my ‘box trade.’ So whether you’re new to trading, or you’ve been trading for years, this setup is right for you.

To fully understand the methodology behind the setup, you first need to understand how markets work. And what I’m about to tell you is true of all markets.

Markets trend and they consolidate, they expand and contract. It’s just the nature off all markets, and it has been for as long as man began trading goods.

When a market is trending (or expanding) it is making new highs and new lows. It’s at times like this volatility is a at a premium, and traders stand to make a good deal of money on the bigger moves. However, trending markets only occur a small percentage of the time. The rest of the time, markets consolidate. And it’s during this consolidation time as traders we must be prepared to catch the next big move.

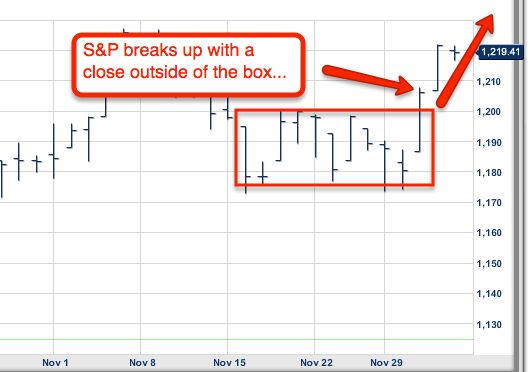

In the S&P 500, these big moves normally occur after it’s been consolidating in a range for at least two weeks - this forms the box. See below:

That movement back and forth forms the box, and we need to pay very close attention to where the market trades, and where it closes.

For this setup to be valid, the S&P 500 much touch both the top, and the bottom of the box at least twice while consolidating in the range. As you can see here, the range of this box was approximately 30 points from 1170 - 1200. And the price action ‘kissed’ both the top and the bottom of the box on more than one occasion. It was a text book box trade:

Now, after this occurs, it’s our job to watch for the break.

Usually within a few weeks the break will occur - the market will stop consolidating, and begin trending. However, there really isn’t a way to know which way the market will break, so we wait.

The direction of the break really doesn’t matter, because we can take either side and profit. So we wait for the break to occur and then take the trade.

Here’s when you take a position: after the S&P closes either above the top of the box, or below the bottom of the box, the trade is on. If we break to the upside, we go long. If we break to the downside, get short, and that’s it.

In this case the S&P 500 broke to the upside:

Once the break occurs, you can expect the market to move a distance equal to the height of the box - in this case 30-points (1200-1170 - 30 points).

Once you’re in the trade, the only other thing you need to watch is your stop loss. And I close out the trade if the market ever closes back inside the box - because that would invalidate the break.

And there you have it my ‘box trade.’ This trade works 75% of the time, and occurs about 3-4 times per year.

As I mentioned earlier I use the setup to trade the S&P 500 emini. However, the beauty of the setup is that you can use it to trade any instrument that tracks the movement of the S&P 500 - So if don’t trade futures, you can trade ETF’s like SPY, SSO, and the like... Just remember to watch the action of the emini futures contract for the signal to take the trade.

So the next time you feel the market is range bound, pull up a daily chart, and see if the emini is forming a box. If it is, there may be a profitable trade right around the corner...

Good Trading,

Brian Heyliger

SixFigureTrader.com

P.S. Brian just shared with us one of the setups he uses as for swing trading, but Brian makes the majority of this money as a day trader. To learn more about how Brian day trades the futures markets you may want to take his FREE 7-Day Professional Traders e-Course. To learn more click here.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Teeter,

As regards your question number 1, as any breakout requires, you need confirmation. Just piercing through the top or the bottom is not enough. That could just be a widening of the box or a simple fake breakout or Bull/Bear Trap. So you'd better wait for confirmation that your security is actually trading outside the range/box. You may even use other technical tools to confirm that the breakout has a good chance of being a real one. That is regarding your entry. Now you could definitely set your rule to exit when your box gets broken out, should that be part of your trading plan and P.O.

The system works in any regular volume standard market.

Regards

Alex

No doubt this is a great system. I agree with the writer 100%. However, with all due respect to Brian Heyliger, this idea was created by Dancer Nicolas Darvas 50 years ago or so. The System is described in his book.

It is a great system, and it's simplicity is what makes it wonderful. I agree with you Brian.

I just believe Darvas should have been mentioned within the article, which despite the omition, is very realistic and worth reading.

If Adam agrees, I could provide traders interested in this system, with a PDF version of the book.

Thanks.

Alex

Also my question, does it work on other vehocles, not linked to S&P500?

Is the entry only after the daily bar closes outside the bok, or at the actual break?

"Thank You Very Much" says Elvis Presley

Have you back tested this on commodities, I presume the market dynamics would be same/similar and such a trade should work.

Yes this is a pretty known setup with a few variations depending on each trader personality. I would put a fixed stop before the other side of the box ( the side opposite to the one just broke to) just in case.

A simple Flat Base Breakout Trade....nicely described.

thank you for this ... i love the simplicity of the technique, i trade similarly but i love the 'touch twice' approach and closing above, or below, the box. Can't wait to try it out.

Great explanation of the ''Box Trade,''

and I learned just recently to watch those futures contracts for the tip off.

One cautionary note is to watch for the double-top pull-back from 1227 Level.

Sometimes it's safer to take the trade on the first pull-back after the breakout

and the higher low is set, and maybe in this case, after a breakout

of the double-top @ 1227.

You can day trade inside the box. When there's a kiss, go the other way. Tight stop just outside the box. You would make 30 points two or three times inside the box in this example.

Jack be nimble.

Where exactly do you place your stop? How do you take profit with this sort of trade? The exact way the pattern is traded can bring down your 75% to much lower...

NO COMMENTS YET.

Hey Adam:

A very simple, concise, easy to understand, and also believable. It's what you've been teaching me for a few years, but in a different view. I liked it, and printed it for reference. thanks, Doug.

I use plain English. That is a short term sideways trend. By sideways fotrend I mean that it could lead on to a down or up , as opposed to a pause in a down or uptrend. See May to r a longer one. We might be in a higher amplitude one now starting end

Sadly sideways trend in not in technical analysts' vocabulary, for it is not common.