Amazon(NASDAQ:AMZN), the world's largest online retailer just announced that is hiring 70,000 new employees for Q4 and I see this as a big positive for this stock. I have been positive on Amazon for some time now, but I see this fourth-quarter as being a potential (knock it out of the park) quarter for this company.

Amazon(NASDAQ:AMZN), the world's largest online retailer just announced that is hiring 70,000 new employees for Q4 and I see this as a big positive for this stock. I have been positive on Amazon for some time now, but I see this fourth-quarter as being a potential (knock it out of the park) quarter for this company.

I recently purchased some bicycle parts from Amazon, and as usual Amazon delivered, as promised, on time, and the parts were perfect. I'm not sure how it is with your friends and family, but it seems that all of my family and friends order from Amazon.

Millions of people purchase from Amazon(NASDAQ:AMZN) over the course of the year, and that trend isn't likely to slow down anytime soon unless there is a major Black Swan catastrophe. Why do so many of us love doing business with Amazon? My belief is because Amazon, like Apple makes it so easy to enjoy their products and services.

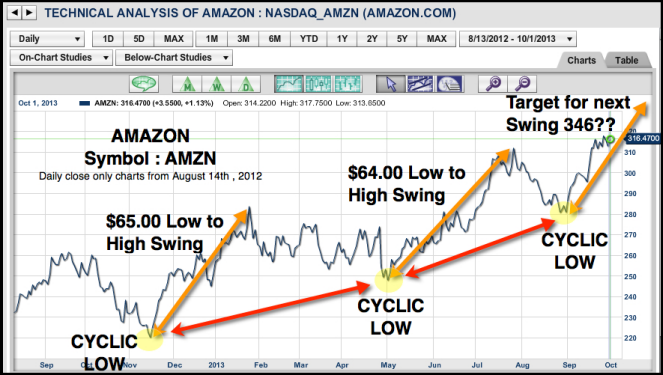

Okay, now let's take a look at the chart and the technical picture for Amazon(NASDAQ:AMZN). The most important technical element is that all of the Trade Triangles are in a positive mode, indicating higher prices to come.

Now let's take a look at what has happened in the recent past. There is an old Hungarian proverb, "The past is the teacher of the future". Looking back, you can see that Amazon made an important cyclic low back in the Nov/ Dec period last year. From that cyclic low of $219, the market rallied to reach a high of $284, which represents a $65 swing from low to high (see first orange arrow on the chart).

The next important cyclic low for Amazon occurred in May 2013 around the $248 level. Amazon(NASDAQ:AMZN) once again rallied from that cyclic low hitting a high around $312 which was a $64 rally.(see second orange arrow).

The most recent cyclic low occurred last month in September around the $282 area. Amazon has rallied about $35 from that low period. The question is, is Amazon going to swing up the full $65 and reach a target between $342 and $346?

What do you think of Amazon? Would you be a buyer at current levels based on this analysis or are you negative on this stock?

In summary, I'm looking for a very strong quarter from Amazon(NASDAQ:AMZN) and for its shares to hit the $340 to $345 area during this next swing. Just remember that there are no guarantees in stock trading only probabilities.

Have a great trading day,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

I have no Idea how far AMZN will go tomorrow. What I do know is that all the technicals are pointing out for a climb up (MA's MACD, and my favorite Williams %R 30 days...(Price have done extensive data studies to find out that a strong trend stay strong more than otherwise... and for him above the -20 line of Williams%R is not overbought it is a buy...)

I am in AMZN since some days with a stop of 311.40 (day close). Regarding who caries the bag......Like in any other issues in life one need to have an exit strategy in life events as well in trading/investing. One who has no exit strategy should not invest/trade the market ...one man opinion of course.

GZ

No doubt that Amazon.com is a powerhouse in the internet retail space, and is trying to expand into other technology areas. However, although the Technicals may look positive, the fundamentals have not changed. By any rationale valuation method, AMZN is substantially overvalued and is riding the stock market bubble created by the easy money policy of the Federal Reserve. So, this is not a buy and hold but only a momentum play on the LONG side. Its the same question as the one for stocks like NFLX, TSLA, FB, etc., and that is, at one point due you grab the terrific profits on the LONG side, or ride AMZN back down to reality at some unknown time in the future? It is usually not the WALL STREET pros that get holding the bag in the end, but those easily manipulated MAIN STREET investors instead.

How right you are James. MAIN STREET investors will be the ones left holding the bag when this bubble burst.

Cheers,

Jeremy

Interesting way to estimate the move and makes sense. I agree that AMZN looks like it should push higher from here. The move from the August 28 low so far has 2 impulse moves and 2 corrective moves.

I think we are completing the 2nd corrective move right now and based on the action today, starting this last push up. Since the first 2 moves were about equal, I'm looking for this last one to extend. Target of $352. Nice Post. - Joe

Thanks for you additional view of the analysis Joe.

Thanks,

Jeremy