Amazon(NASDAQ:AMZN), the world's largest online retailer just announced that is hiring 70,000 new employees for Q4 and I see this as a big positive for this stock. I have been positive on Amazon for some time now, but I see this fourth-quarter as being a potential (knock it out of the park) quarter for this company.

Amazon(NASDAQ:AMZN), the world's largest online retailer just announced that is hiring 70,000 new employees for Q4 and I see this as a big positive for this stock. I have been positive on Amazon for some time now, but I see this fourth-quarter as being a potential (knock it out of the park) quarter for this company.

I recently purchased some bicycle parts from Amazon, and as usual Amazon delivered, as promised, on time, and the parts were perfect. I'm not sure how it is with your friends and family, but it seems that all of my family and friends order from Amazon.

Millions of people purchase from Amazon(NASDAQ:AMZN) over the course of the year, and that trend isn't likely to slow down anytime soon unless there is a major Black Swan catastrophe. Why do so many of us love doing business with Amazon? My belief is because Amazon, like Apple makes it so easy to enjoy their products and services.

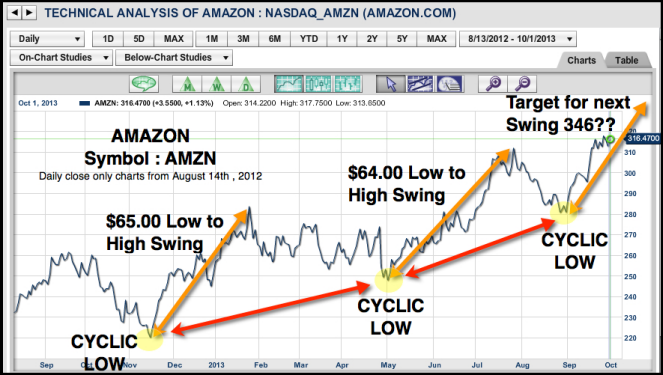

Okay, now let's take a look at the chart and the technical picture for Amazon(NASDAQ:AMZN). The most important technical element is that all of the Trade Triangles are in a positive mode, indicating higher prices to come.

Now let's take a look at what has happened in the recent past. There is an old Hungarian proverb, "The past is the teacher of the future". Looking back, you can see that Amazon made an important cyclic low back in the Nov/ Dec period last year. From that cyclic low of $219, the market rallied to reach a high of $284, which represents a $65 swing from low to high (see first orange arrow on the chart). Continue reading "Amazon beefs Up For Q4, Are You Buying?"