The Bitcoin world is in turmoil this morning as Mt.Gox, once the largest Bitcoin exchange (based in Japan) in the world, closed its website amid rumors of the biggest hacking heist of all time.

You may remember that Bitcoin was created as an alternative currency and that it took some serious programming and algorithms to create it.

This morning there were allegations that there has been a $350 million hack at Mt.Gox. Mt.Gox appears to have closed its virtual doors and may no longer be in business. Bitcoin insiders have been bracing themselves for weeks against something like this happening, but the magnitude of the virtual heist has shocked even the most astute Bitcoin observer.

This morning there are people speculating that Bitcoin (BITCOIN:BITSTAMPUSD) is the biggest scam and Ponzi scheme ever developed in the virtual world, but I am going to withhold judgment as, quite frankly, we do not know all the facts. This may be the end of Bitcoin or may be just a big bump in the road for this virtual new currency-the jury is still out.

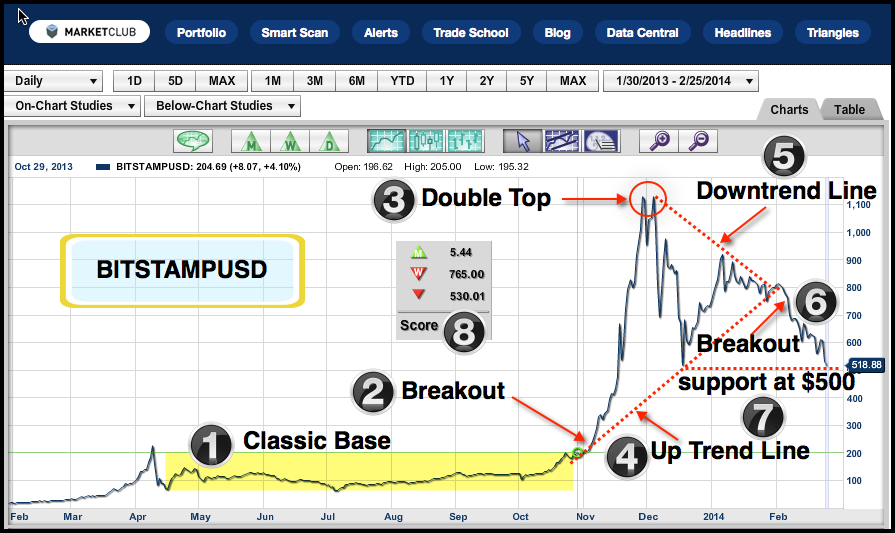

I thought it would be interesting today to look at the Bitcoin phenomenon and see just how well it tracks and charts with the Trade Triangles. You can follow Bitcoin (BITCOIN:BITSTAMPUSD) on MarketClub and on our public website, INO.com.

Chart Legend & Technical Picture For BITSTAMPUSD (Black Numbers)

1. Classic base

2. Classic chart breakout

3. Double top

4. Uptrend line

5. Downtrend line

6. Breakout to downside

7. Trade Triangles

Generally speaking, I would say that Bitcoin and in this case BITSTAMPUSD charts extremely well. The reason I say that is because charting is only a reflection of human emotions. As you can see with the massive upward move we saw after the breakout, it created a double top and then a dramatic fall, which fell back into a Fibonacci support level. The rest of the chart numbers are pretty self explanatory and reflect classical charting methods. The key level of support for Bitcoin is going to be a close below the $500 support line. Should that happen, I suspect we would see further liquidation and a move back down to the original breakout point around $200.

Do you think Bitcoin is a scam or is it a legitimate alternate currency?

Every success,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Gold and Silver are not currencies, they are commodities that behave as currencies because of their universal acceptance and ability to be put into coin form. But the level of purity can lead to fraud in the exchange of even gold and silver. Digital transactions are common among real currencies such as the US Dollar, underwritten by the US Federal Reserve. The vast majority of US dollar transactions today exist in digital form - credit cards, stock purchases and sales and so on. Bitcoins are a digital transaction register with no underwriter and no one is responsible for anything. Mining bitcoins is just a game scoring system that could be replaced with high scores in Donkey Kong. The illusion that the value in bitcoins lies in the software limit to the number of coins to be issued and is highly subject to hacking. Currencies demand an answer to the question: who is being trusted to maintain stability? - that demands an underwriter. Even many nations are not effective underwriters of their currencies - but they are there to be judged and evaluated. Gold and silver are commodities who's value is set by a marketplace calculated with a currency. But many people will make lots of money because people will trade in digital form real underwritten currencies for numbers in the bitcoin register before they disappear into the either of the internet.

Gold and silver are primarily commodities now, but most definitely they have always been a medium of exchange, ergo currency. And all currencies need to be currencies is a social agreement to claim them as such. Puka shells, tally sticks, Rai stones, feathers have all been currency. No underwriters required. Just social contract. So if we all agree that Bitcoin is money - then it is.

Almost anything can be a "medium of exchange" - even puka shells or tally sticks, that does not make it a currency. There are many ways to record barter transactions - with puka shells, beany babies or bitcoins - but that does not make it a currency unless it is backed by some issuing body or underwriter. In the game of monopoly there is money used to record transactions but it is not a currency. If anything can be described as a currency then the definition itself becomes meaningless. People who trade in bitcoins need to understand that there is no underwriter with an interest in preserving value. There are only people with something to lose trying to protect their interest. As digital transactions become the basis for almost all business transactions people need to understand a more narrow concept of currency to value the transactions. People who do business transactions are at risk until the commodity (maybe gold) or currency are withdrawn from the transactions process. More often we leave our resources in the accounting process bitcoin wallets or bank accounts until we use it for the next transaction. More to say but gotta go

Sorry but - you're wrong.

http://en.wikipedia.org/wiki/Currency

"A currency in the most specific use of the word refers to money in any form when in actual use or circulation, as a *** medium of exchange ***, especially circulating paper money. This use is synonymous with banknotes, or (sometimes) with banknotes plus coins, meaning the physical tokens used for money by a government.[1][2]

*** A much more general use of the word currency is ANYTHING that is used in any circumstances, as a medium of exchange. In this use, "currency" is a synonym for the concept of money" ***

~~~

So yes, anything can be called currency - as long as we all agree that it is currency. And such a thing does have meaning - when we all (most / enough) agree that it has meaning.

Your fixation on the need for a currency to have some sort of underwriter is false. Sure fiat currencies like the U.S. Dollar, in today's world, has a backer in the form of the U.S. Military. "The U.S. Government ""SAYS"" this is money." - and therefore - it is money. But only because they say it is. For no other reason; aside from the fact that they are willing to confront (and threaten violence) anyone who says the dollar isn't money.

You are correct the argument is semantic. It is interesting that you use Wikipedia which is known for its limited editorial review of its articles. Look at it this way, You are in the island nation of Wanga Wanga and Puka shells make great money until someone brings in a truck load of puka shells from the beach and at that point they are just puka shells. But if the government of Wanga Wanga keeps people from getting puka shells from the beach, they are in effect underwriting the value of the shells as currency and protecting there use as a medium of exchange in Wanga Wanga.

You are confused to say the US Military has anything to do with the full faith and trust of the US Government declaring the dollar as legal tender for discharge of debts and payments, that is the role of the Treasury and Federal Reserve.

This discussion started as what is the role of bitcoin as money. It is a form of money. But people must be aware that there is no one to trust when it comes to the protection of bitcoin as money, except some software in the either of the internet. There is a real need for clarity as to what medium of exchange merits a high level of trust and what mediums of exchange are high risk. I use the word currency for that purpose. You don't have to agree.

Like my example with puka shells, if the government of Wanga Wanga does not control the supply of puka shells they will quickly lose they ability to function as money and there is no underwriter for the currency of Wanga Wanga.

The same is true of bitcoin. The public register was supposed to keep coins for vanishing, but vanish they did. So who is the underwriter that will insure the loss of those coins? Who will function as the governments did during the financial crisis of 2008? The worlds economies got hurt, but they kept going because the governments that underwrite the dollar and the euro took actions to protect their currencies.

Bitcoins are issued by someone that wrote software to give numbers called coins to people who solve puzzles called mining. That writer of the software and the programs take no responsibility for the value of the coins they issue. They say the coins are protected because everything is in a public register - but that software failed and there is nothing like FDIC insurance, a government underwriter for the dollar as currency, for the coins that disappeared.

There has to be some way to differentiate bitcoins from dollars and euros and pounds and loonies and to do that I use the word currency.

Bitcoin is not and never was a currency. To be a currency there has to be a known underwriter. In the old days the banks issued their own currency, but the banks were a known entity that could be examined and audited. Today either governments underwrite their currencies or as in the US today the individual banks are joined together under a government sponsored entity called the Federal Reserve to underwrite our currency. Bitcoin existed in the either of the internet as a transaction accounting system and created a false currency as points scored by solving puzzles with no responsible underwriter for its phony currency. I say phony currency because solving puzzles is not a basis for creating secure value. They could have used high scores in Pacman and Donkey Kong as a basis for issue bitcoins without going to the effort of creating mining puzzles. The fact is that without a known underwriter there is no currency just the trading of scores for solving puzzles. Bitcoin scores do form a market just the same as Beany Babies, Magic Cards, Sports Cards and so many other collectables, but they do not exist as a currency. Why anyone would want to collect a bitcoin score is beyond me, but, as with any collectable, such as pet rocks, the first one in that takes real money (underwritten currency) out is the winner of the game.

No thanks says the world, we will keep adding to our gold and silver reserves instead.

Markets, all kinds, move up and down because there are people that thinks north and others think south. Otherwise there would be no market at all.

When the main trend is upwards and there is a movement downwards, there is a high probability for this last movement to be what we call a correction and not a change in main trend’s direction. Especially when the pattern is clearly an “A,B,C” which is the most common for corrections.

Once the correction finished, the value of this merchandise will retake his way up.

Bitcoin is a fictional play written by Mr Ponzi with the actors in their 'King's Clothes' grabbing the best parts and the bit players left with scraps if they are lucky .

Mt Gox was a Ponzi scheme. Bitcoins is no more a Ponzi scheme than the Dow.... wait a minute...

The concept was good but the implementation was flawed because all computer code/systems are flawed. Once it became a craze its days were numbered because that brought in the uber hackers who reduced this "currency" to its intrinsic worth. It must have been good for the creator(s) though - they must be billionaires by now.

The model of block chain validation of information is one aspect of Bitcoin that is not going to just go away. The mechanism used has valid uses outside that of money laundering.

BTC's underlying concept is also one that will be hard to just roll over and roll on. Virtual currencies are not going away. What is missing is a real player to take a stand and commit true resources to secure accounts. Transactions are already secure. It's the repositories that are not. Think 'ol West and the banks that got robbed continuously. Once the banks were made secure society was then able to build a base of interaction that swelled the size of towns, cities, territories and eventually states.

BTC needed to get hammered. The Winklevoss twins needed to get slapped back down into the dirt. But BTC2.0 is coming. Just which major entity steps in to anchor it is yet to be determined.

Don't put all your eggs in one basket. Where have we heard that one before?

And Bitcoins, you can put them in a safe or a deposit box, away from hackers. Why store them in another country outside of your control, with people who have shown themselves to be unreliable if not untrustworthy for the past two years?

A "currency" like BitCoin that exists only in the digital realm is more subject to theft than any of the world's fiat currencies. The thefts seem to be accomplished with some regularity and with anonymity for the thieves. I guess the question could be what good does it do to steal a currency that can depreciate even faster than the countries can devalue their own currencies? BitCoin only seems to have value when no one can use it.

I really don't understand the point of stealing/hacking bitcoin. If each unit is unique as they say it is, how could you ever use it? It would be like stolen money with an ink bomb on it, completely worthless and useless to you. No one would take it for anything.

I really don't understand why anyone would accept a make believe piece of virtual currency as having any value either. I guess we accept make believe pieces of paper currency. The virtual thing isn't much of a leap now that I think about it....

Well that's one scam out of the way, then...