During March, the price of Bitcoin fell just about 35%. It started the month at $10,805 and ended just below $7,000. Bitcoin’s decline in March has been massive, but what I find even more interesting is this decline has been somewhat slow and steady. In the past when Bitcoin would crash, 30%, 40%, 50% or even more, it would happen in a matter of days or even hours.

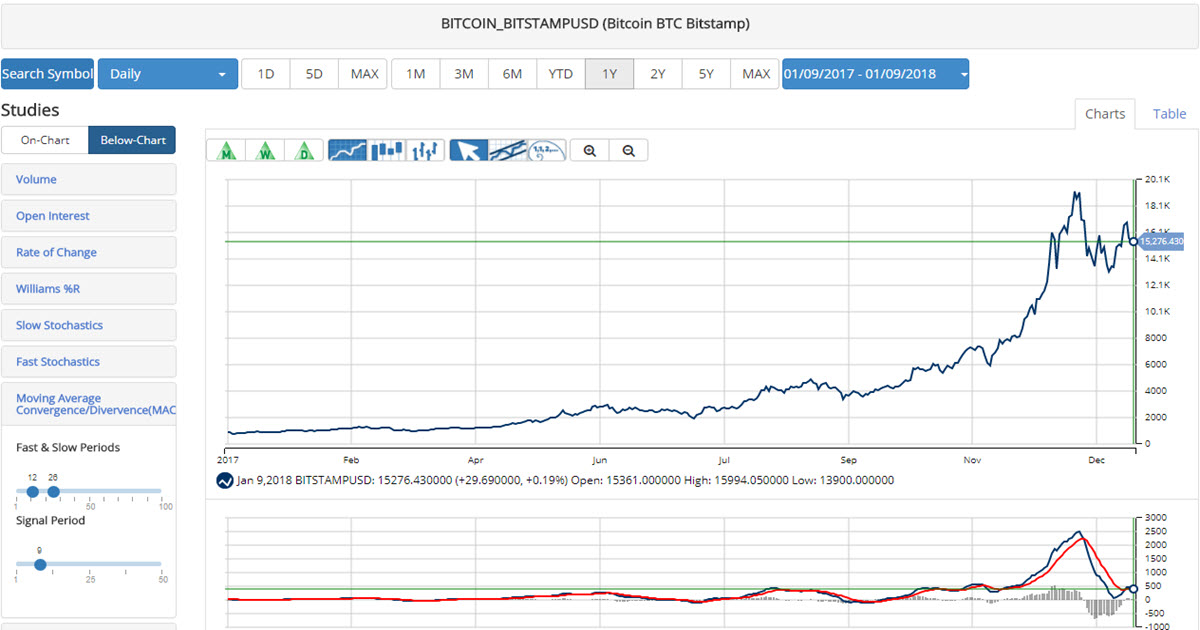

The slow decline is an indication that the Bitcoin craze or Bitcoin Bubble is likely over. When the craze hit a fever pitch following the Thanksgiving Holiday in the US, the price more than doubled in just about 25 days. The Bitcoin rally hit a peak on December 17th, 2017 when they were trading for more than $19,205 per coin. More so than that, the last time Bitcoin traded in the low $6,000 range, was before the Thanksgiving Holiday when it is believed many families sat around the dinner table and discussed the “can’t miss opportunity in cryptocurrencies.” Those discussions helped fuel 100,000 new accounts being opened that weekend and the price of Bitcoin hitting $9,000 for the first time.

The Thanksgiving dinner table conversations helped foster the “fear of missing out” trend that we saw catapult Bitcoin both into the limelight and at breathtaking prices. That fear soon faded as Bitcoin fell hard, from $19,205 to $14,500 in just five days, following it hitting its record and still all-time high. Ever since then the cryptocurrency has been on a downward trajectory.

The declining price has lessened interest from both the general public and big investors, and even now we have seen the media outlets reducing coverage on Bitcoin and other cryptocurrencies. Even Alphabet’s Google searches (Fig.1) are down dramatically since the peak. A further look at the price of Bitcoin (Fig.2) and the Google search trend of Bitcoin may tell another story. The two charts side by side look very, very similar. Continue reading "Bitcoin Fell 35% in March" →