Today, I am going to be analyzing the relationship between Starbucks Corp. (NASDAQ:SBUX) and its main raw commodity, coffee beans.

Let me start off by saying that I really like Starbucks and the coffee it sells. In fact, my favorite drink at Starbucks is a Venti Coffee Frappuccino with one third the ice, blended five times.

Major Challenges

Starbucks faces a major challenge, one it cannot control - the price of its major commodity, coffee.

With one of the worst droughts in history hitting Brazil's coffee belt region, it is rapidly pushing prices higher. This is no ordinary drought as it is forcing more than 140 cities in Brazil to ration water. Reports in Brazilian newspapers indicate that some neighborhoods are receiving water only every three days. This is serious, as Brazil produces most of the world's coffee.

With Coffee (NYBOT:KC.H14.E) prices at 14-month highs, there is little to suggest that this trend is going to change any time soon. It would appear as though early predictions are indicating that coffee supplies could be 5 million bags lower than consumption for the 2014–2015 season.

The other side of the coin is that there are more and more people drinking coffee. We are seeing that in developing markets such as Brazil, India, and China where they are acquiring a taste for this delicious beverage.

I'm sure that Starbucks can put pressure on the growers and the wholesalers, but that will only go so far in savings. Eventually, they're going to have to take a hit on their bottom line because of the drought in Brazil and higher raw commodity prices.

When does the consumer eventually say that cup of coffee at Starbucks is just too expensive? Will consumers, instead of having one cup every day, cut back to maybe every other day?

A Tale Of Two Charts

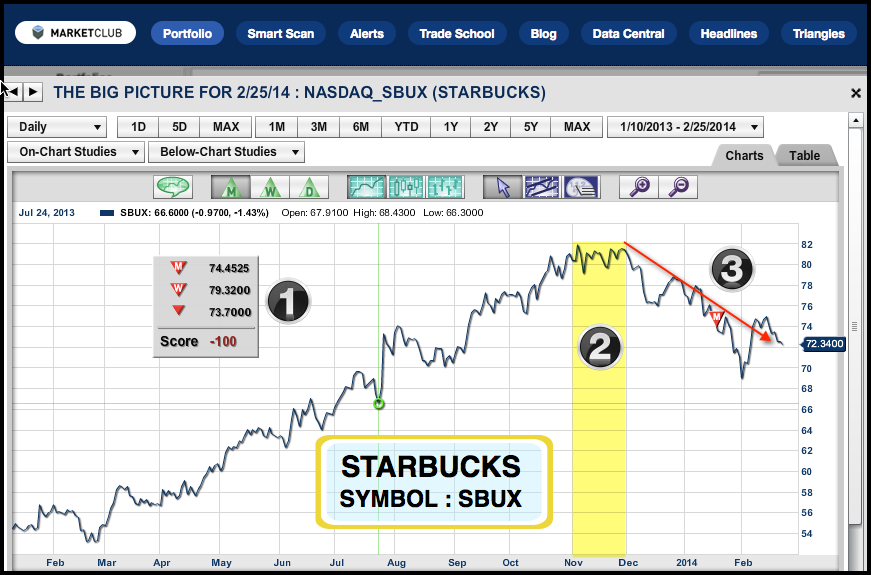

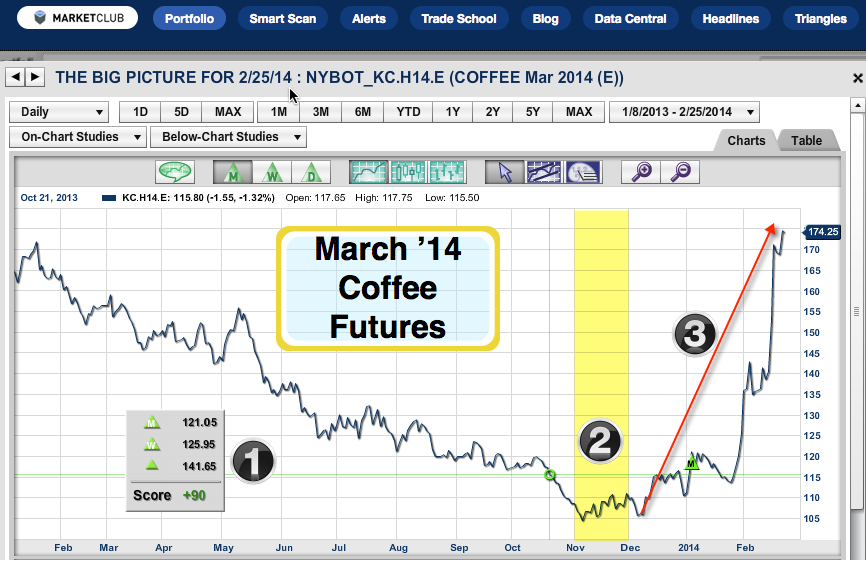

In the two charts below, you'll see a broad yellow column highlighting the same time frames on each chart. It shows the high period in Starbucks and a low period in coffee prices.

What Does This Company Do?

Starbucks Corporation operates as a roaster, marketer, and retailer of specialty coffee worldwide. Its stores offer coffee and tea beverages, packaged roasted whole bean and ground coffees, single serve products, juices and bottled water.

Chart Legend & Technical Picture For Starbucks (Black Numbers)

1. All Trade Triangles are red and negative

2. Yellow column shows high in stock prices and inverse in coffee price

3. Downtrend firmly in place

Chart Legend & Technical Picture For Coffee (Black Numbers)

1. All Trade Triangles are green and positive

2. Yellow column shows low in coffee prices and inverse in stock price

3. Uptrend firmly in place

To summarize, I expect the current downtrend in Starbucks to continue unless there is a dramatic reversal in coffee prices or a reversal with the Trade Triangles.

If I am correct in my analysis and these two trends continue, Starbucks could move down to the following Fibonacci support levels:

38.2% @ $67.85

50% @ $63.31

61.8% @ $58.77

You may want to check out my earlier Starbucks post here. I hope you found this Starbucks Corp. (NASDAQ:SBUX)/Coffee (NYBOT:KC.H14.E) comparison informative and helpful.

Every success,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

Thanks Adam for posting this. I am going to hang on. Howard S. is a great ceo, and I agree with comments above.

We don't fool with SBUX but are long coffee ETF $JO, already waaaay in the money. Just moving our stop up daily just below the 10 day. It's been a great trade but it's not to late. The damage has been done to the Brazilian crops at the most critical time of year. This trade may be in place for a couple of years, through May is a no brainer. Look for "flowering news" come fall.

Interesting and well written. Don't underestimate Starbucks' ability to continue to broaden their profits through non-coffee products and services. Additionally, you might want to factor in their coffee futures holdings and the fact that they do not purchase a major amount of Brazilian coffee. I realize that the drought will send Brazilian buyers to other producing countries but Starbucks has super relationships in place in most of those and could easily be a "preferred buyer". Because they are focused on quality and culture, I look for Starbucks to remain strong going forward.

Well written article but you fail to account for the fact that SBUX has been at this game a long time and reading thru company materials they essentially have the full year of coffee needs hedged and under contract already. Starbucks maybe going down in price because of this perception that higher coffee prices will eat their margins but it would take two years of sustained high coffee inputs to do so assuming they can't pass iton to their cult like consumers. There is a great likelihood that SBUX will surpass the new low expectations. That being said the chart does not look overly positive especially short term. If one wants to play the coffee rise one can look at NYSE:JO that is an ETN which tracks the coffee price (ETNs have their own dangers) or even a small play that hedges coffee and is a supplier like Coffee Holding Company NYSE :JVA.

Perhaps it should be borne in mind that Brazil only produces 33% of the worlds coffee (South America accounts for about 50% of world production), and that there are other producers...

What is the source of your percentages? They are incorrect.