In all the years I've been tracking the Fed and the previous chairmanships, Janet Yellen is coming across as being totally out of her league and just plain incompetent. Now before anyone says that's a sexist remark, I would say the same thing about her predecessor "Helicopter Ben." Whose big idea was to do everything the opposite way of what they did in the "Great Depression" and that is, to print money, print money and print even more money. The bottom line is the Fed has no idea how to get out of this quandary that they created themselves and for the country.

What's going to happen no one knows for sure, but one thing is certain, the markets will tell us where they want to go eventually. The other thing that's certain is that the Trade Triangles will get it right. I'm 100% confident in saying that.

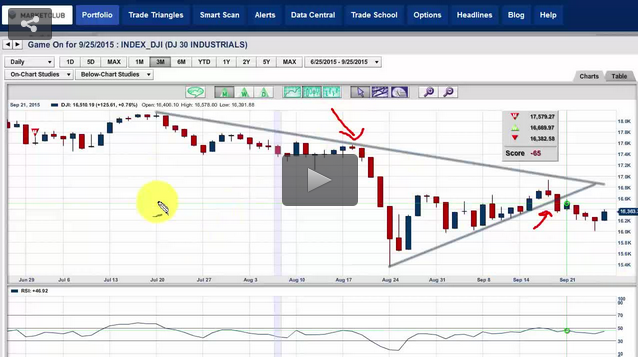

Let's just take it and look at where the markets closed last Friday.

Dow (INDEX:DJI) - 16,384.58

S&P 500 (CME:SP500) - 1958.03

NASDAQ (NASDAQ:COMP) - 4823.92

Gold (FOREX:XAUUSDO) - $1139.08

Euro (FOREX:EURUSD) - 1.1308

Crude Oil (NYMEX:CL.X15.E) - $45.07 in the November contract.

As I write this before the market opens all the indices are still lower for the week, gold and crude oil are higher and the Euro is lower against the U.S. Dollar.

Here is how the Trade Triangles see the markets right now:

Dow - intermediate trading range - sidelines - longer-term negative

S&P 500 - intermediate trading range - sidelines - longer-term negative

NASDAQ - intermediate trading range - sidelines - longer-term negative

Gold - $1139.08 - intermediate bullish

Euro - 1.1308 - intermediate trading range - sidelines

Crude Oil - intermediate negative - longer-term negative

Here are the key levels I mentioned in yesterday's post for the major indices:

Dow - 15,979

S&P 500 - 1,903

NASDAQ - 4,614

Yesterday all the indices came very close to these areas before reversing, these levels now represent key support. If they are broken today or next week on the downside, it will turn the green weekly Trade Triangle to red accelerating the market's downward momentum.

We are now rapidly coming to the end of the third quarter and all the major indices are lower for the quarter. This is the first negative quarter we have seen for the NASDAQ index that previously had shown gains every quarter for the past ten quarters.

One last thing to remember, 2015 represents the sixth year of this bull market. Historically this market is getting very old and only once in history have we seen a seven-year run. I think the odds of it continuing in 2016 are slim.

Have a great weekend everyone, I'll be back on Monday.

Every success with MarketClub,

Adam Hewison

President, INO.com

Co-Creator, MarketClub

HI! I think incompetence stems from taking wrong decision and often from untimely indecision. Thus, it is very important that one decides upon a plan of action before embarking on the stock market for invstement/ trading. Here are some tips for the same:

1. Learn the warning signals you should be monitoring on a regular basis. 2. Rigorously research and determine what your bear market game plan will be BEFORE the market takes a dive and panic sets in. 3. Identify what triggers you need to see in the market to give you the green light to activate your plan. 4. Commit to sticking to your plan even through the chatter of the pundits and news media.

Source: http://www.amazon.com/Avoiding-Bear-Traps-Factors-LakeshoreATS/dp/1502472090/ref=sr_1_1?ie=UTF8&qid=1441465112&sr=8-1&keywords=avoiding+bear+traps

I think nobody can confidently say that Ms.Yellen is taking any decisions, of her own, she is just announcing which is decided by concerned or interested class.

the only thing the fed knows how to do is to add yet more debt to the economy.

our economy currently suffers from too much bad debt. more debt does not solve a debt induced problem.

the fed has outlived its usefulness.

The fed has had a complete disregard for our seniors and those who save a portion of their income. A zero interest rate has only helped prop up the fat cats on Wall Street and the CEOs who make millions each year. Our seniors helped make this country great! Why should they be penalized for six years with practically no interest on their savings???

Big Blue- true enough about seniors, but what about every other saver, too who is being chisled by the very banks that own the Fed and which are getting funds virtually interest-free from them (to the extent that new national debt can be created.) It really is an evil twist, and one which bankers never even dared to try before: nearly 0-percent money for them, which they use to justify near- zero-percent to the savers. (with bail-ins being a not just evil but sadistic twist.)And the latest proposal, to counter the obvious pawn move ("I'll just put it under my mattress"): a cashless society. In Econ 101 (Economics, the Samuelson edition), it is taught "Savings is the engine of investment." It was always the tradition, and in the interest of business, if not bankers, to provide the saver a real return for his deferred gratification.

The sucking sound that H. Ross Perot described as jobs heading for foreign shores could as easily apply to savings if, say China, using its own banks in the U.S. were to offer what used to be considered a risible return on savings: imagine- a 1% APR return would be 10x what U.S. banks are paying.

Sir, you are absolutely correct. Treasury dealers are now seeing a disconnect emerging between where the market perceives the price of risk and what the US Fed understands. It is becoming a chasm highlighting the demise of Laissez-faire economics and consequently the value of the USD comes under question when the price of Treasuries ,according to the open market, is something completely out of touch with the views of the US Fed. Bill Gross was interviewed on Bloomberg few days back and perfectly stated that this zero interest rate policy disguises bad business models which stutter on and hurt free market efficiency of risk allocation. The free market economy has now come under threat if the price of credit can be officiated by the US Fed rather than the US Fed seek the market and follow the bid/ ask range as a guideline.

Yellen is even more incompetent than Bernanke, who was clever enough to pass on the "poisonous baton" to an unsophisticated grad student....The only way out for Janet now is to bail due to "medical conditions" (the trap she is in would make anyone prone to getting sick), or to blame everything on the Chinese and emerging markets.

Anybody watch this video today? It looks like the pressure is getting to Janet Yellen.

https://m.youtube.com/watch?v=1YAEHJvNscs

Yellen doesn't seem to be doing well.

Cheers,

Jeremy

What the fed is doing, so far, is spot on what is needed to keep this modest recovery going. I'm not sure it will stand any interest rate hike this year, though. That is a bad idea.

i agree with your assessment of ms. yellen. the what she and the fed are/are not doing is questionable. and their approach to communication leaves A LOT to be desired too.

the combination of those two things..........is going to make things a real rough ride for investors for some time to come.