It's been a wild ride for Wall Street this past week as the broader indexes collapsed for several days before rebounding sharply back to the upside. The short correction was mostly blamed on the fallout from the Chinese stock market crash which triggered panicked selling across all assets and dragged down every segment of the stock market. But panic selling can be a great buying opportunity for value shoppers.

Sometimes a perfect storm can take a stock way down below its fair value. An earnings miss combined with a macroeconomic crisis can amplify losses well beyond a reasonable range. However, if the long-term fundamentals hold strong, investors can pick up a great value buy at a discounted price.

A solid company in the wrong place at the wrong time

The Fresh Market (TFM) is a grocery store with 168 stores in 27 states known for its organic foods selection. The stock has suffered mightily this year – down roughly 50% year-to-date. The company's recent earnings miss coupled with the recent events in the global financial markets have contributed to the stock's weakness.

The company reported earnings of $0.36 per share which missed analysts estimates of $0.40. Revenues came in short as well at $442.1 million compared to the expected $458.34 million. Looking ahead, the company lowered guidance to $1.55 to $1.65 per share citing a more challenging macro environment. Despite the miss, the stock was upgraded this month by an analyst at Northcoast.

Management maintained a positive outlook long term in their earnings statement saying, "We are on track to open 18 stores for the year. While the success of our most recent store openings give us confidence that there are significant opportunities for unit growth, we also believe it is prudent to continue to review our current pipeline."

It's good news that the company is still growing despite the setback.

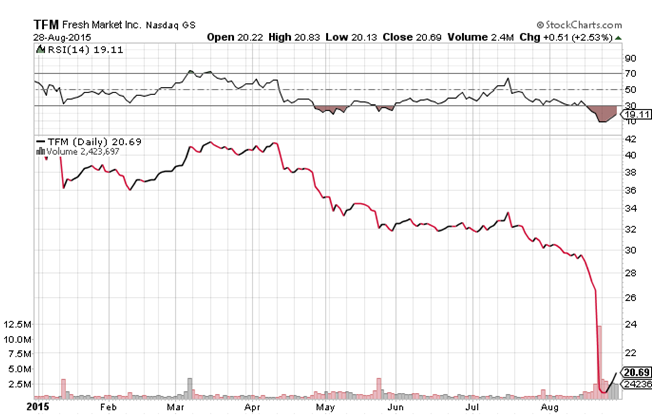

Taking a look at The Fresh Market's chart, we can see the huge dip in price following the earnings miss.

Chart courtesy of StockCharts.com

However, the stock has tracked higher since then and yet the stock continues to be greatly oversold based on it's RSI rating of 19.11. There isn't much downside pressure at this point making upside movement almost a given right now.

From a fundamental standpoint, the stock still looks very strong. It trades cheaply at just 11.9 times earnings with a long-term growth rate of 11.3%. That gives it a very attractive PEG ratio of about 1 – a strong sign of being undervalued.

Investors should also note that the company carries very little debt. Long-term debt liabilities are only around $33 million while total cash holdings sit at about $89 million. The price-to-sales ratio is attractive as well at 0.56 – higher than the industry average.

Even given the lowered guidance, estimating the stocks P/E puts it at $28 per share – a 35% discount at its current price. Given the stock's precipitous fall in value, it seems likely that management will implement a more aggressive stock buyback program which will contribute to its performance going forward as well. If that's the case, the target price of the stock could be even higher creating more value for investors.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Thanks for the heads up Daniel!