China has resorted to its old habit of stimulating the economy by allowing the Yuan weaken. But while the "remedy" has yet to work its wonders. The side effects, are already emerging—inflation is on the rise.

The People's Bank of China, China's central bank, ought to decide - support China's manufacturing or curb inflation.

What will the Chinese central bank do? And equally important, how will the dollar respond?

China's Central Bank: The Logic

In order for us to try and gauge the next move by China's central bank, we must delve first into the logic. In other words, what is the central bank considering? Now, that's not an easy undertaking, by any stretch of the imagination. Nevertheless, the task has turned a tiny bit simpler. Last month, in an interview with the Caixin Weekly, the Governor of the People's Bank of China, Zhou Xiaochuan, outlined the central bank's policy.

Here are the points to focus on:

• The central bank sees China's manufacturing sector as weak;

• The central bank is not overly worried about inflation; and

• The central bank wants the Yuan to move in tandem with Chinese fundamentals.

The takeaway is this: The central bank is not concerned with inflation, but it is concerned about manufacturing.

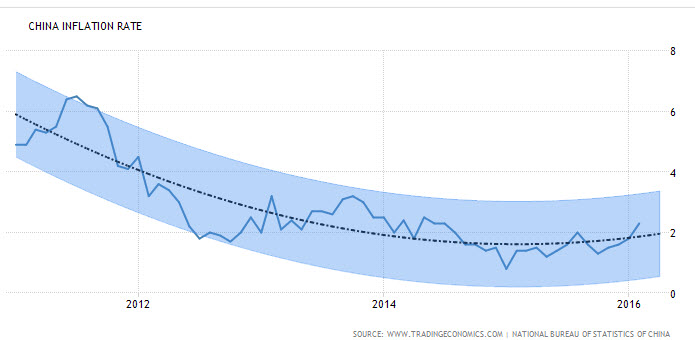

Since that interview, we can see (below) that China's Manufacturing PMI has continued to deteriorate, falling to 48. Over the same period, inflation nudged above trend at 2.3%.

The central bank is more worried about the strength of manufacturing than the rise in inflation. Given that, the Chinese central bank will likely avoid any attempts to curb Yuan weakness. That is, unless (and until) manufacturing starts to recover.

Chart courtesy of tradingeconomics.com

The irony here is that if manufacturing in China recovers, the Yuan will likely strengthen anyhow. Certainly, the Chinese central bank will have more success if fundamentals are on its side. At least, then (and unlike last summer), there won't be a panic sale and Yuan meltdown.

Chart courtesy of tradingeconomics.com

But there is, of course, a twist. Once the Caixin Manufacturing PMI surges above 50 (signalling expansion) the Chinese central bank will need to strengthen the Yuan and curb inflation.

How It Impacts The Dollar

This isn't the first time we've discussed the impact of China's economy on the dollar. Yet, compared to our last analysis, inflation seems stronger, and the framework for China's Yuan policy clearer. Consequently, we must revisit this position.

First, there is the immediate impact. Manufacturing is still weak and as long as it is the Yuan won't strengthen. China's central bank will keep on buying dollars and dollar appetite will remain intact. That means, essentially, the immediate impact hasn't changed.

But the mid-term impact has changed. Before, China's central bank had an interest in a low Yuan because both manufacturing and inflation were weak. Now, the central bank only has weak manufacturing to worry about. When manufacturing recovers (i.e. the Caixin Manufacturing PMI surpasses 50), sentiment for the dollar could quickly shift.

Having fundamentals on its side, the central bank could confidently move to strengthen the Yuan. And markets' appetite for all that is China—the Aussie, the Kiwi and even the Euro—will rise while dollar appetite will fall.

The extent of China's manufacturing recovery (if and when it occurs) will determine how strong and how long the dollar selloff will be.

Look for my post next week.

Best,

Lior Alkalay

INO.com Contributor - Forex

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

Once Again I Repeat, US and China are so inter connected as well inter depended that US and China both are required to maintain all such "Balancing Factors" which can be destroy overall common Financial Structure of each other. So if and when, any of them will try to turn or twist such factors to exploit situation in only to it's own favor, that will create "Imbalance" which will ultimately proven extremely harmful for both together.

This situation will last until any major changes, either positive or negative, will taken place in a significant commanding fundamentals of Both, and there after, entire financial command and supremacy of comparatively fundamentally stronger country, and that stronger country will hit and control currency of counter part.

Considering all above, I don't think, any policy decisions of China can possibly succeeded to hit the US Dollar, and even if it will happened too, that will be make far more dangerous and harmful for China itself.