Certain sectors of the economy have predictive qualities. Known as leading indicators, changes in these industries tell investors whether the economy is expanding or contracting before more solid data comes out.

Transportation is one of those sectors that tells investors how healthy the economy is. When transportation companies are doing poorly and missing earnings, it's often a sign that the economy isn't doing well. On the other hand, when profits are up it can mean that businesses are shipping and manufacturing more goods that need to be delivered.

After a rough start to the year, the transportation sector has rebounded strongly. Just tracking the SPDR S&P Transportation ETF (PACF:XTN) since it dipped in January shows an improvement of 17% to date. Hedge funds have also been expressing an interest in transportation stocks lately with large purchases in a number of trucking companies.

One thing that's been helping trucking companies, railroads and airlines is the price of oil. Prolonged depressed prices haven't helped out the energy sector but has boosted operating margins and reduced costs for the transportation sector.

A Trucking Company That Investors Can Get Behind

JB Hunt Transport Services Inc. (NASDAQ:JBHT) is a $9 billion trucking company with operations throughout North America including Canada and Mexico. The company does business through both an employee and contractor model providing logistics services for its customers.

JB Hunt will be reporting 1st quarter earnings next month and investors could be pleasantly surprised. The company beat 4th quarter earnings at $1.01 per share versus the $0.99 most analysts expected. Operating income for the quarter gained 5.46% to $192.86 million as well while revenues inched 0.71% higher but fell slightly short of expectations.

Wall Street has already started targeting trucking companies for profits with two analyst upgrades to "buy" and "outperform" and one reiteration to "outperform" as well. The company expects revenues to grow by 9% to 12% this year

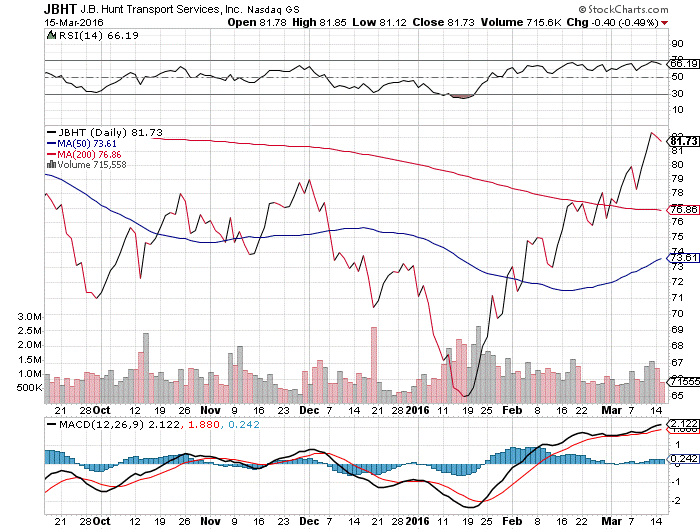

Based on JB Hunt's chart, there's a lot for bullish investors to get behind.

Chart courtesy of StockCharts.com

Notice how the 50-day moving average is quickly rising to meet the 200-day moving average – a bullish signal of strengthening momentum. This is further supported by the stock's high positive MACD and overall upward trend of the stock price since late January. An RSI of 66.19 is fairly high indicating that it could be overbought, but with so many strong bullish momentum indicators, the RSI may not hold as much value right now.

The stock trades roughly on par with the industry average at around 20 while long-term growth is a similar story at 15% to 17%. Even at fair value, the growth rate of the trucking industry exceeds the S&P 500 average growth rate of 13%. The stock does offer investors a 1.1% dividend yield helping protect against downside swings.

Based on the stock's P/E and full year earnings estimates, this stock could easily be worth at least $90 per share. That represents about a 10% gain from current prices. If the company reports another earnings surprise next month, full year estimates may be revised upwards and the potential profit could be even larger.

Check back to see my next post!

Best,

Daniel Cross

INO.com Contributor - Equities

Disclosure: This contributor does not own any stocks mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.

What's going on with the dollar? Are budget deficits coming home to roost?