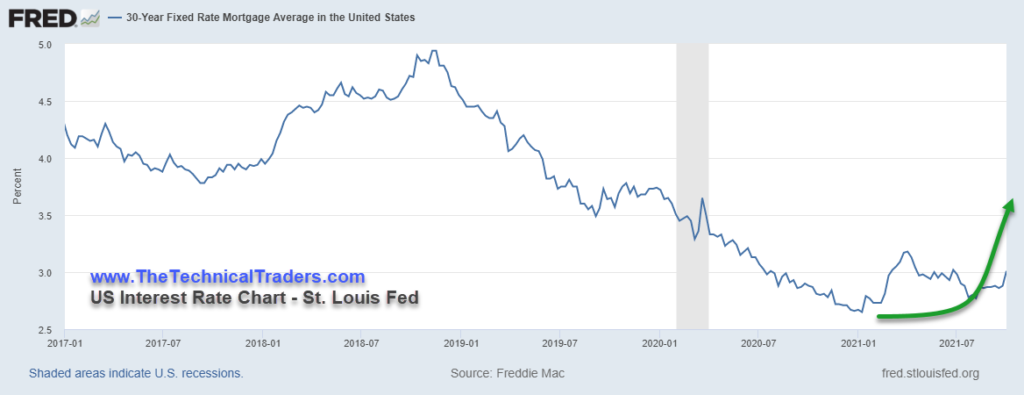

US Mortgage Rates have risen from levels near 2% to 2.25% earlier in 2021 to levels now above 3%. This increase in the cost of borrowing money for home purchases has a downward effect on home prices and sales. The affordability of homes is directly related to the sales price and the cost of the mortgage to secure the purchase of the home. As interest rates rise, home affordability becomes less attractive and feasible for many potential buyers, and home prices start to fall in an attempt to allow a quicker sale.

The Making of Another US/Global Housing Crisis

The easiest way to think about this is to consider the ability of buyers to secure and satisfy mortgage payments for homes. The more expensive the sales price of the home and the interest rate of the loan is, the more likely the affordability of the home is going to be perceived as undesirable.

As concerns related to the US economy, and the indication by the US Federal Reserve that rates will likely start to increase before the end of 2021 or very early in 2022, mortgage rates have already increased by nearly 45% over the past 60 days. A $500k home would have cost about $2500 a month at a 2.25% mortgage rate (including property taxes, homeowners insurance, mortgage insurance, and principal & interest). That same $500k home costs more than $2700 a month at a 3.25% interest rate (including all fees and costs).

Over the lifetime of the loan, the total costs of buying the $500k home have now increased by more than $70k for the buyer. If rates rise to 4.25%, the new monthly cost of that same $500k home rises to nearly $3000 per month. Raising the total cost of buying that $500k home by more than $180k over the lifetime of the loan for the new buyer.

Home prices will usually fall while interest rates rise because new buyers are unable to secure the loans at rates that far exceed their ability to repay the loans. In short, the past 5+ years of extremely low interest rates have driven home prices towards upward extremes, and the rising interest rates are putting downward pricing pressures on home prices faster than many traders and homeowners understand.

Affordability And Income Growth Are Keys To The Equation

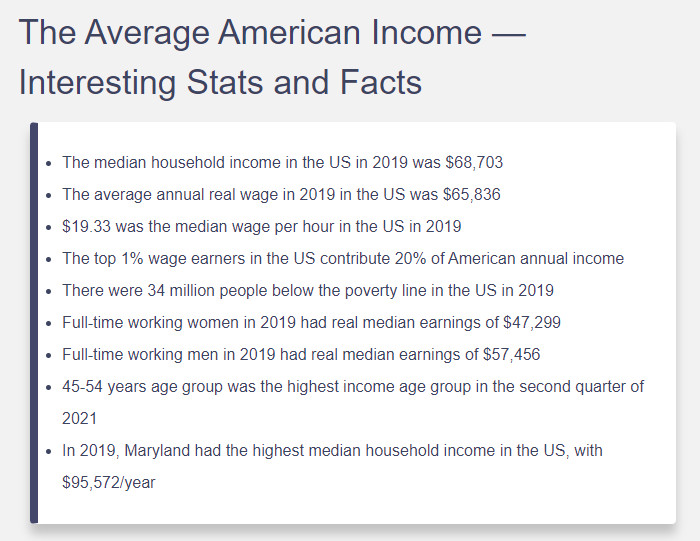

The median income for US households was just under $69k in 2019. That breaks down to $5,725 per month in total income. When average home prices are rising, and interest rates are rising at the same time, the affordability of buying a home starts to collapse the DEMAND side of the equation.

As I’ve explained in the previous paragraphs, even a simple 0.5% to 1% interest rate increase can push home affordability off the chart for average buyers. This creates a dual dynamic for buyers and sellers. If sellers want to sell their homes, they have to price them where buyers are willing to engage and can afford the payments. Secondarily, buyers will look at homes and determine if they are getting their money’s worth in terms of costs and features. If potential buyers can’t afford a $500k home, they’ll start looking for cheaper homes in other areas.

This process of pricing homes in a manner that is suitable for the market operates along the SUPPLY/DEMAND equity curve. As prices rise and costs rise, affordability becomes a serious issue for buyers. Rising rates typically result in a moderate decrease in home prices over time. Sellers that want to sell their home must price it at a level that attracts buyers. If the Real Estate market starts to see decreasing home values over an extended period of time, this may push buyers into thinking the housing market is starting to collapse after years of price appreciation. That may push potential buyers into waiting for the best deal as sellers continue to adjust home prices to attract more buyers. It becomes a vicious cycle of “where’s the bottom” if it goes on long enough.

In Part II of this article, we’ll take a look at some Real Estate ETFs that are starting to show signs of a downward price trend and attempt to see if the US Fed’s future actions could shift the housing market into a decline.

You don’t have to be smart to make money in the stock market; you just need to think differently. That means: we do not equate an “up” market with a “good” market and vi versa – all markets present opportunities to make money!

We believe you can always take what the market gives you and make CONSISTENT money.

Learn more by visiting The Technical Traders!

Chris Vermeulen

Technical Traders Ltd.

Disclosure: This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation for their opinion.