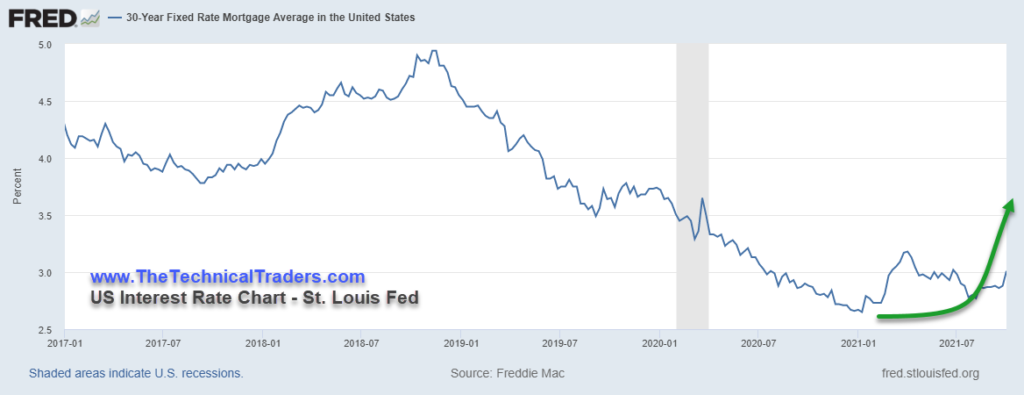

As the Real Estate market shifts away from super-low interest rates and skyrocketing home prices throughout the COVID-19 crisis, we are starting to see the Real Estate ETFs weaken in trend and start to move lower. The recent rising Mortgage Rates will likely continue to weaken sales trends and push home prices a bit lower over the next few months. The Real Estate ETF, IYR, is already reflecting a roughly 10% decline in valuation since early September 2021.

In the first part of this research article, I shared a historical chart of the US Average Mortgage rate and some data suggesting the average US consumer is somewhat bound to certain home price constraints based on Average Income. Typically, mortgage payments should stay below 50% of the borrower’s total take-home income. Depending on the borrower and the home price, many US borrowers may already be priced out of the market – even with 3.25% interest rates.

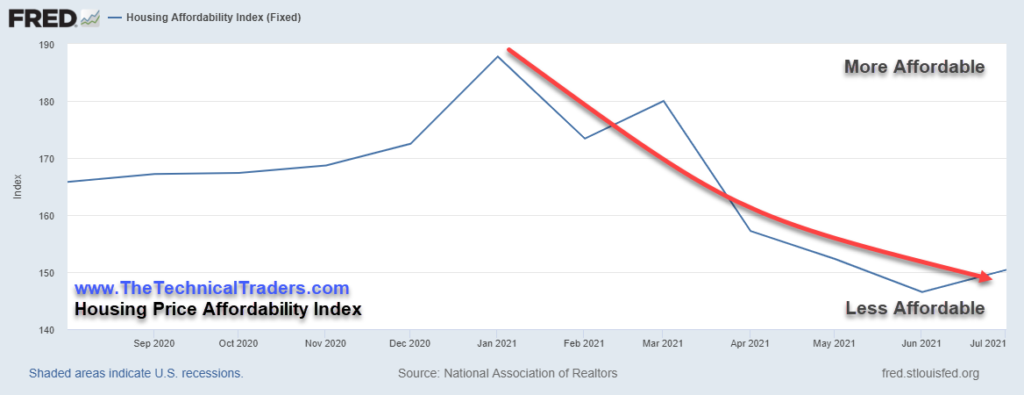

Peak Home Price Affordability Was Reached In Early 2021

Peak affordability appears to have peaked in December 2020 & January 2021 – just after the COVID-19 crisis. This likely correlates to the lower interest rates, at one point below 2% in most of the US, for home buyers while home prices were 20% to 40% lower than they currently are in most areas.

Case/Shiller National Home Price Index Has Skyrocketed 30% Higher Since May 2020

A great measure of the National Average Home Price is the Case/Shiller US National Home Price Average Index. From the chart below, you can see the almost parabolic rise in home prices after the March 2020 COVID-19 event. This incredible rally represents a 30%+ increase in home average US home prices in a little over 13 months. Continue reading "Real Estate ETFs React To Rising Mortgage Rates - Part 2"