Let’s get right to it. In the third quarter of 2021, trading volume in NFTs (Non-fungible Tokens) hit a staggering $11 billion. That’s up 704% from the prior quarter and a mind-numbing 38,060% from the year-ago period.

That’s right: NFTs have grown 38,060% compared to 2020. And frankly, these nosebleed numbers took me by surprise.

To add even more bullish power, the first NFT-focused ETF, Defiance Digital Revolution ETF (NFTZ), just hit the streets.

These developments meant it was time to take another look at NFTs and what’s really under the hood of this brand new NFT ETF, the NFTZ.

If you missed my article in October about NFTs, take a look when you can. In the meantime, it won’t hurt to do a quick review of NFTs before we dive headlong into the nuts and bolts behind NFTZ.

What Is An NFT Again?

NFT stands for Non-fungible Token. And to understand what that means, you have to get your head around fungible and non-fungible.

Fungible means that an object, like an asset or commodity, can have many copies of itself. And each one is identical to any other. They all have the same value and authenticity and can be easily interchanged. One fungible object does not have an intrinsic value greater than any other.

Take a share of IBM stock, for example. Shares of IBM stock are fungible. One share of IBM is the same as any other share of IBM. So if I own 100 shares of IBM, it doesn’t matter to me exactly what 100 shares I own. They are all the same. And that holds true even though shares of IBM stock have a unique identifier called a CUSIP number. (That happens to be 459200-10-1 if you’re curious!)

On the other hand, take an original work of art. There is only one, and it’s unique. Take a look...

As you can see from the image above, I have inserted a copy of Renoir’s In the Meadow. It is one of my favorites: The colors and setting are just wonderful, and the mood is youthful and innocent. I have a print of the original at home.

Obviously, the print I own of In The Meadow and the image above are not the originals. There is only one of those, and it’s in The Met in New York. And no matter how many copies I make of it or prints that The Met sells, none of these will ever be the original. Again, there is only one original.

Renoir’s In the Meadow is a perfect example of a non-fungible object. There is only one authentic version of it. And while it can be duplicated and reprinted, those copies can’t be interchanged with the original.

So, when it comes to NFTs, Non-fungible tokens, each one is like the original of In the Meadow. The only substantial difference is that instead of the original created using canvas and paint, NFT’s are created using digital software. And while the original In the Meadow lives on the walls of The Met, an NFT lives on the blockchain. And finally, while the authenticity of In the Meadow requires the services of art experts, the authenticity of an NFT is verified using the cryptography and security of the blockchain.

What’s So Great About NFTs?

That’s a fair question. But if you read between the lines of what an NFT is, you will hit pay dirt.

Think back about Renoir’s In the Meadow. If I really wanted the original, I would have to hire an army of art experts to make sure the painting I was buying was the original. If it passed that test, I would have to build a secure facility to make sure it was safe. Then I would have to insure it to make sure I was covered in the case of loss. Once all this is done, I would have to let only a few people view it since the more people, the more security concerns.

NFTs solve all these problems. Authenticity is verified by the blockchain, where a network of computers looks at my NFT and makes sure it’s the original. That same network also uses cryptography to ensure that my NFT was safe and secure. And finally, because my NFT is in digital form, I could make it available for viewing to anyone I wanted.

So, as you can see, NFTs make collecting art easier, more democratic, and more accessible than traditional art collecting. Plus, since NFTs are made using smart contract technology, my NFT could be programmed to pay the original artist a fee every time my NFT changed hands. And that’s a big advantage for artists over traditional collecting.

What Is NFTZ?

Certainly, if you wanted to invest in NFTs, you could hop on over to a marketplace like Rarible or Opensea. These are super-fun sites to explore. And even if you’re just looking, they’re a good place to learn.

But if you’re looking for NFT exposure without the leg work, you could take a look at the Defiance Digital Revolution ETF (NFTZ). It began trading on December 2nd and trades on the NYSE.

Similar to BITO, the Bitcoin ETF, NFTZ does not invest directly in cryptocurrencies. And unlike BITO, it doesn’t invest in derivatives. Rather NFTZ gains exposure to the NFT space through investing in stocks that have either thematic exposure and/or direct exposure to NFTs. That means that NFTZ invests in...

- Companies that are actively involved in the crypto and fintech space, including crypto asset management and trading, crypto banking, crypto payments, crypto mining, and blockchain technology.

- Companies that are directly involved with services, investment, or financing around NFT creation and commercialization.

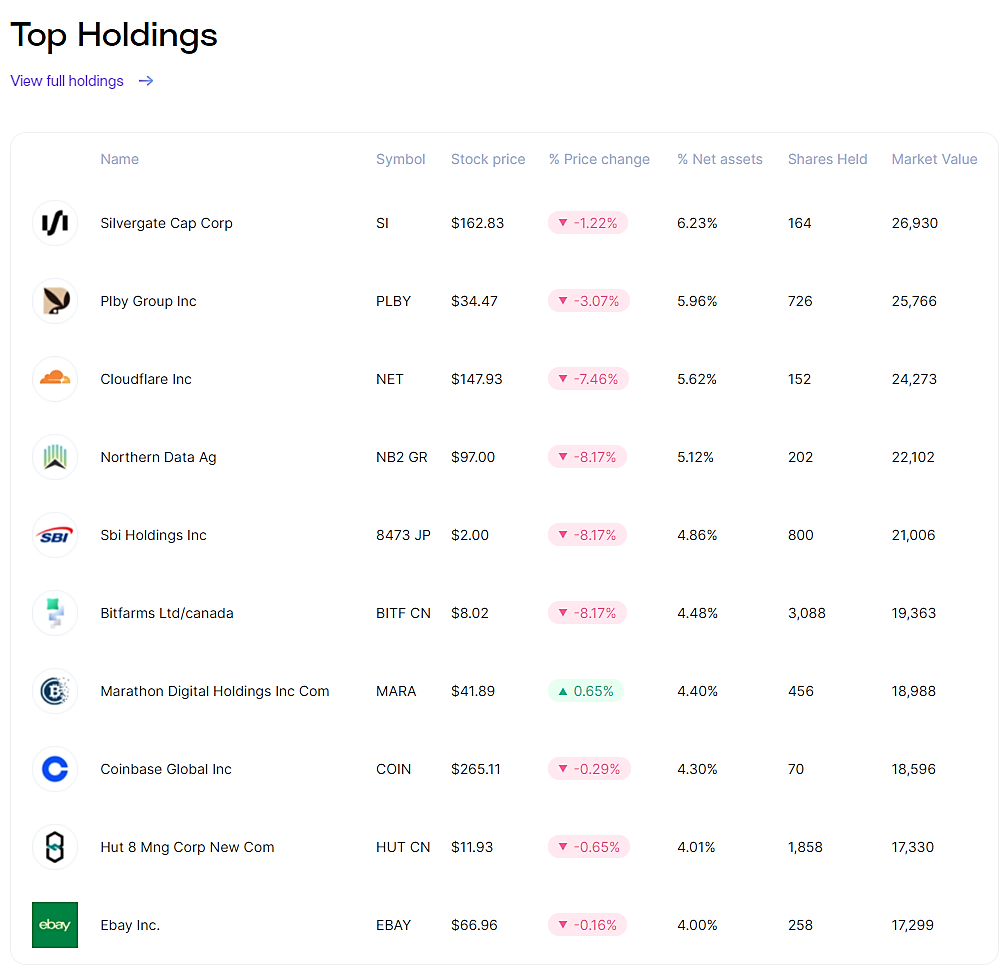

As of December, the top three holdings included Silvergate Capital (SI), Plby Group (PLBY), and Cloudflare (NET). Here’s a snapshot of NFTZ’s top holdings...

The ETF tracks the composition of the BITA NFT and Blockchain Select Index. The index is rebalanced and reconstituted quarterly.

NFTZ carries an expense ratio of 0.65%, which is a bit less expensive than BITO (0.95%), but more than the average ETF (0.45%)

A recent price for NFTZ was $21.50, with a daily trading volume of just over 100K shares. That’s not a ton of liquidity. So if I were to get involved, I would use limit orders and stop losses for sure. And, of course, I’d put on my seat belt and invest for the long term.

Should You Buy NFTZ?

The NFT space is super-interesting. And I really like that it can be the beginning of a metaverse where artists and digital creators can do business on a more even playing field.

That said, like crypto in general, NFTs are fraught with uncertainty and volatility. Add to that the general subjectivity of art prices, and you could get burned easily. But if willing to stomach those features and don’t want to buy individual NFTs, the NFTZ is worth a look. But as always, don’t devote any more than 1% to 2% of your portfolio to crypto in general, including NFTs.

Wayne Burritt

INO.com Contributor

Disclosure: This contributor may own cryptocurrencies mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.