I get the distinct feeling that a lot of investors are feeling like the action last week in the equity markets may be a harbinger of good things to come. In other words, we might be out of the woods.

As much as I’d like to believe that I can’t jump on board. I still feel there’s more downside pain to come for stocks, tech, and other risky assets like Bitcoin (BTC) and crypto. But before I tell you why, let’s take a win, no matter how ugly it is.

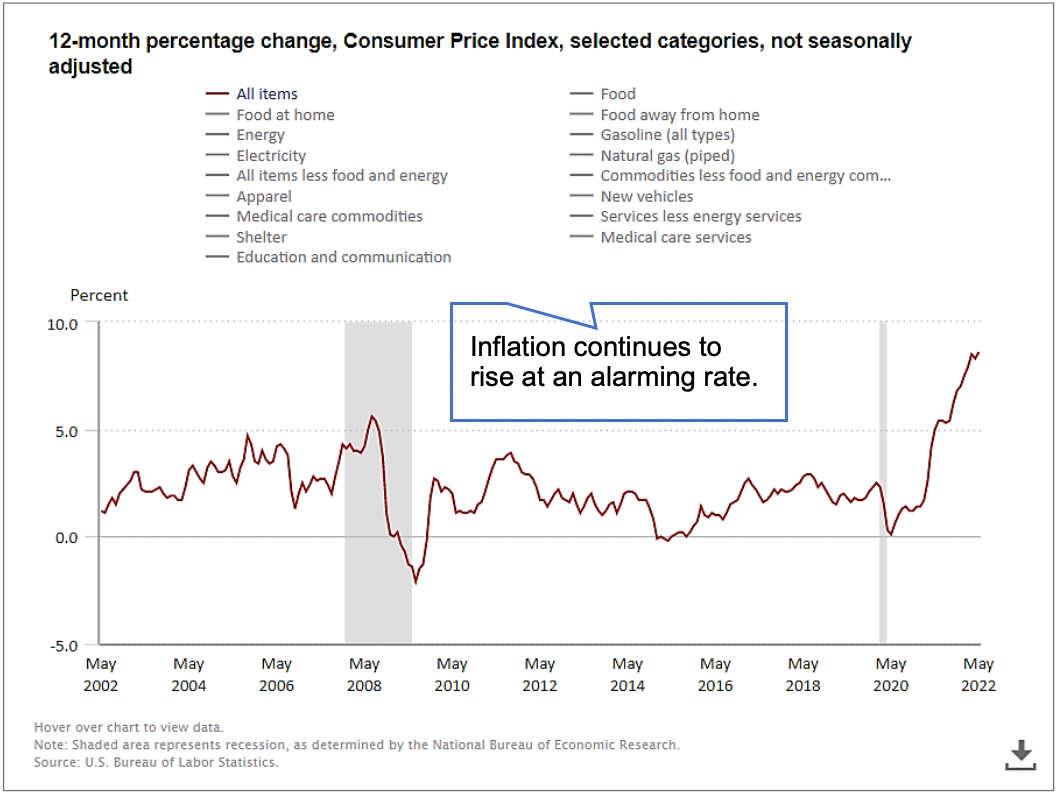

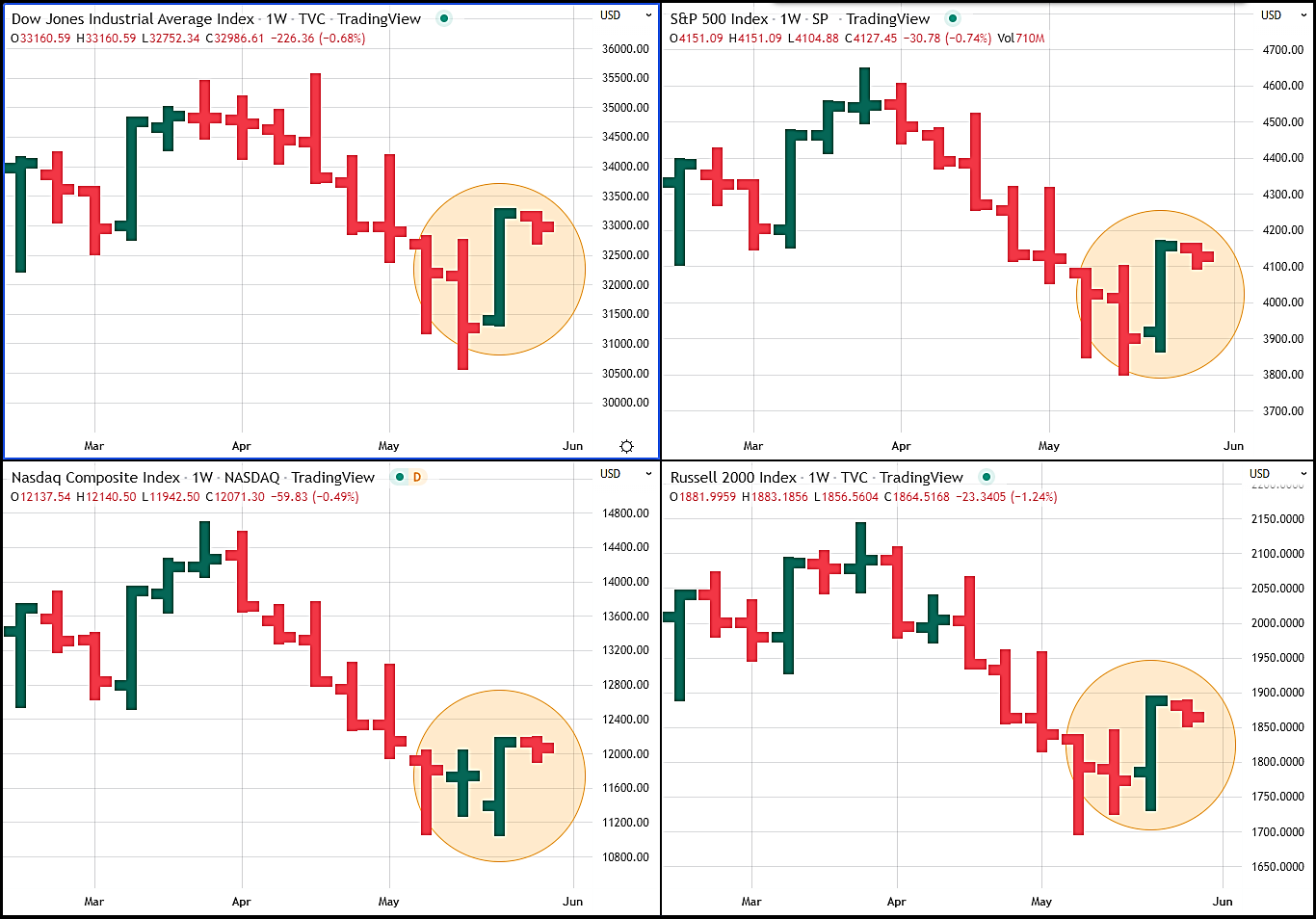

Fact is, across the board last week equity markets were up. See for yourself…

As you can see from this collection of multiple weekly charts, stocks booked a win last week. The Dow was up 5.4% and the S&P 500 - a good proxy for the broader stock market - was up 6.4%. Meanwhile, the Russell 2000 - a good gauge of all stocks - was up 6%. And probably most surprising of all, the tech-heavy Nasdaq was up 7.5%.

In addition, last week’s action in all four the indexes reversed multi-week slides. It was the first positive week in four weeks for the Dow, the S&P, and the Nasdaq. For the Russell 2000 it was the first up week in the last three weeks.

But as you can see from the above charts, last week’s action was an anomaly compared to the action we’ve been seeing over the recent past. In fact, if you take the above charts and drill out to what’s been happening over the past year, it’s clear the overall trend in all these markets is bearish. No ifs, ands, or buts.

As I warned about in my article at the beginning of June, the scant positive weekly action in these markets is now confirmed as little more than a series of “dead cat bounces.”

If you remember, a dead cat bounce can masquerade as a reversal to the upside. But it’s only a temporary reprieve and quickly resumes its prior downtrend. Unfortunately, that’s what we’ve been seeing in all these stocks markets. And while I’d love to be wrong on this point, the numbers don’t lie.

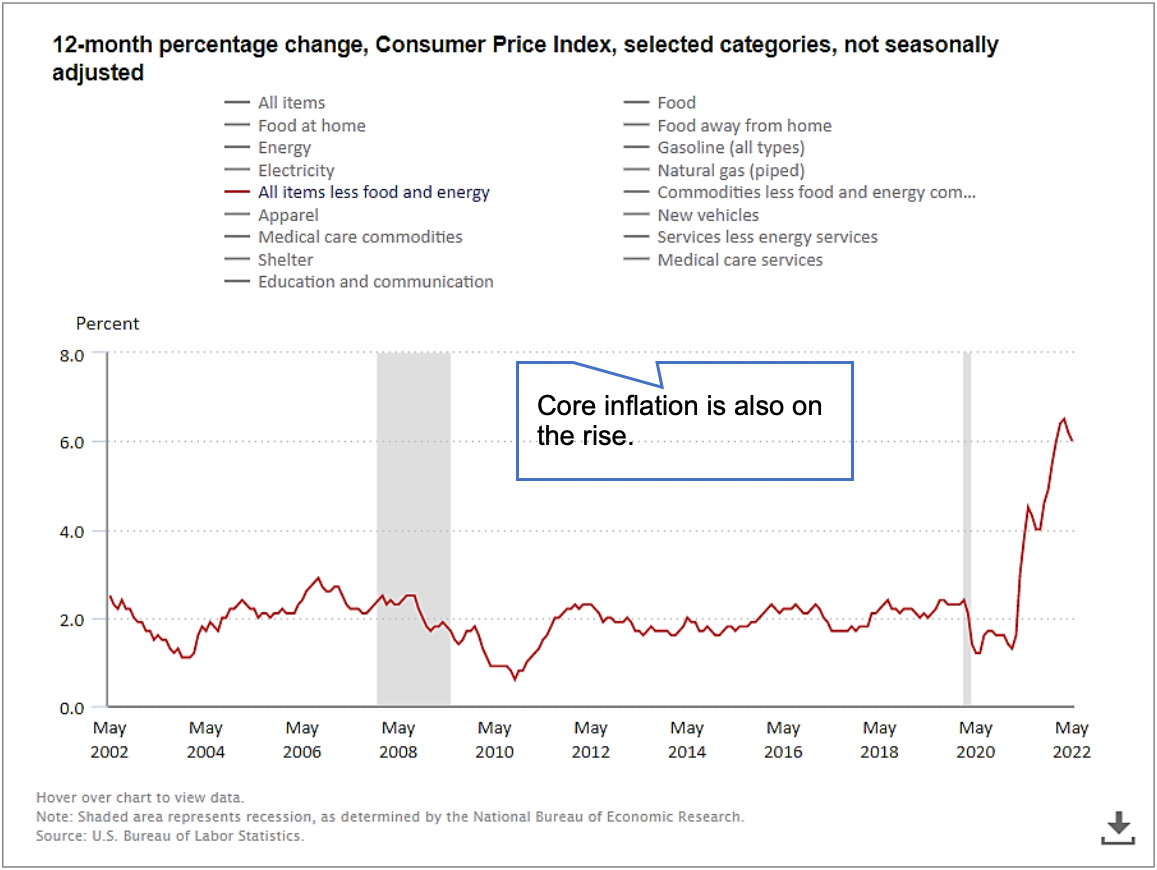

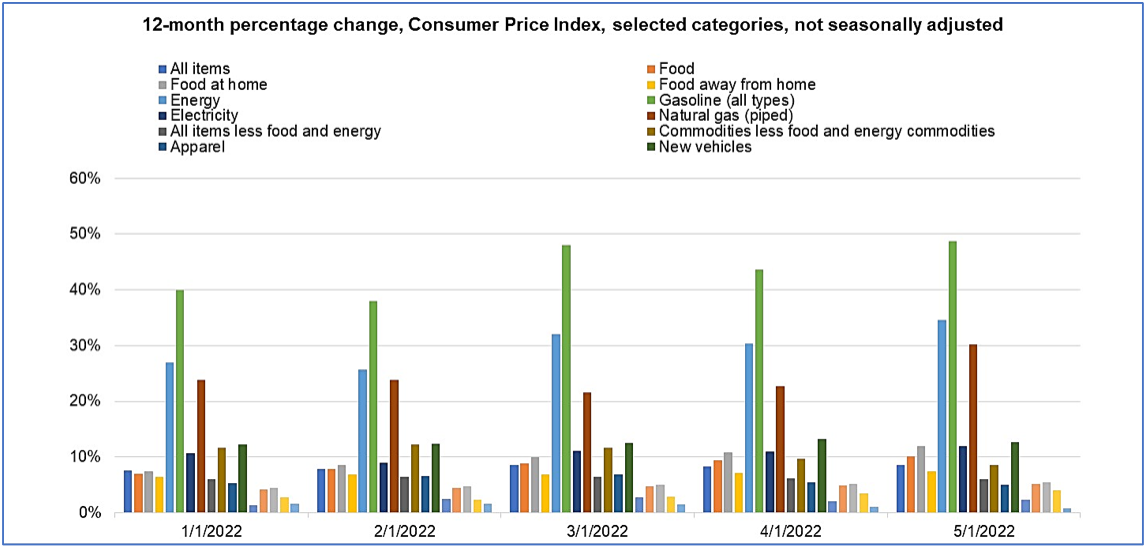

Stubborn Inflation Means More Downside

But it’s not just these technical patterns that tell me the markets have more downside pain to come. The other huge factor pressuring stock prices: Inflation and what it will take to bring it under control. Here’s what I mean.

In general inflation can drive investors to sell stocks. And that because inflation wears away at the value of invested dollars. If your money is worth 8.6% less this year that it was last year, nobody is happy.

But the biggest reason inflation drives investors to sell stocks is that that the “medicine” that’s needed to bring inflation down - higher interest rates - can have unpleasant side effects.

Fact is if higher rates do their jobs and bring prices down, companies have less money to do the things that investors want, like sell more goods, expand operations, and develop new products. And if companies aren’t doing what investors want, those investors sell their shares.

Result: A bear market like we’re seeing right now.

But as unpleasant as that is, not bringing inflation down is much, much worse. In fact, inflation can decimate entire economies. The last thing we want is to look in the rear-view mirror and see the current inflation rate of 8.6% as “the good old days.”

That’s why as unpleasant as the side effects of higher interest rates can be, the Fed must do everything in its power to get inflation under control. But don’t take my word for it: Here’s what Fed chairman Jerome Powell told Congress last week in his testimony and semiannual monetary policy report:

I will begin with one overarching message. At the Fed, we understand the hardship high inflation is causing. We are strongly committed to bringing inflation back down, and we are moving expeditiously to do so. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses. It is essential that we bring inflation down if we are to have a sustained period of strong labor market conditions that benefit all. Source

So far, so good. What exactly are they going to do about it?

Over coming months, we will be looking for compelling evidence that inflation is moving down, consistent with inflation returning to 2 percent. We anticipate that ongoing rate increases will be appropriate; the pace of those changes will continue to depend on the incoming data and the evolving outlook for the economy. We will make our decisions meeting by meeting, and we will continue to communicate our thinking as clearly as possible. Our overarching focus is using our tools to bring inflation back down to our 2 percent goal and to keep longer-term inflation expectations well anchored. Source

So, what does this tell me? With benchmark target fed funds rate now at a range of 1.5% to 1.75%, it’s clear that that’s just the beginning. More interest rate increases are coming. In fact, I think the Fed won’t slow down until it hits 3.5% and higher.

In addition, I now think the Fed is willing to take on a higher risk of recession in exchange for lower inflation. In fact, during his testimony Powell said that a recession could be in the cards: “It’s not our intended outcome at all, but it’s certainly a possibility … we are not trying to provoke and do not think we will need to provoke a recession, but we do think it’s absolutely essential” that prices come down. Source

Here's What to Do

There’s no doubt about it: Until inflation gets under control, rates will continue to go up. The Fed is making it clear that they’re going to do everything in their power to control rising prices.

And that means that there’s likely more downside to stocks as well as other risky assets like Bitcoin (BTC) and other cryptocurrencies. So, I wouldn’t be adding to any positions right now. And as always, don’t devote any more than 1% to 2% of your portfolio to crypto of any kind, including BTC.

Stay safe,

Wayne Burritt

INO.com Contributor

Disclosure: This contributor may own cryptocurrencies, stocks, or other assets mentioned in this article. This article is the opinion of the contributor themselves. The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. This contributor is not receiving compensation (other than from INO.com) for their opinion.