I don't know about you, but right now, I'm breathing a little sigh of relief.

And with good reason. Finally last week, we got some good news out of stock market action. And pretty much across the board, the news was positive. Here’s what I mean:

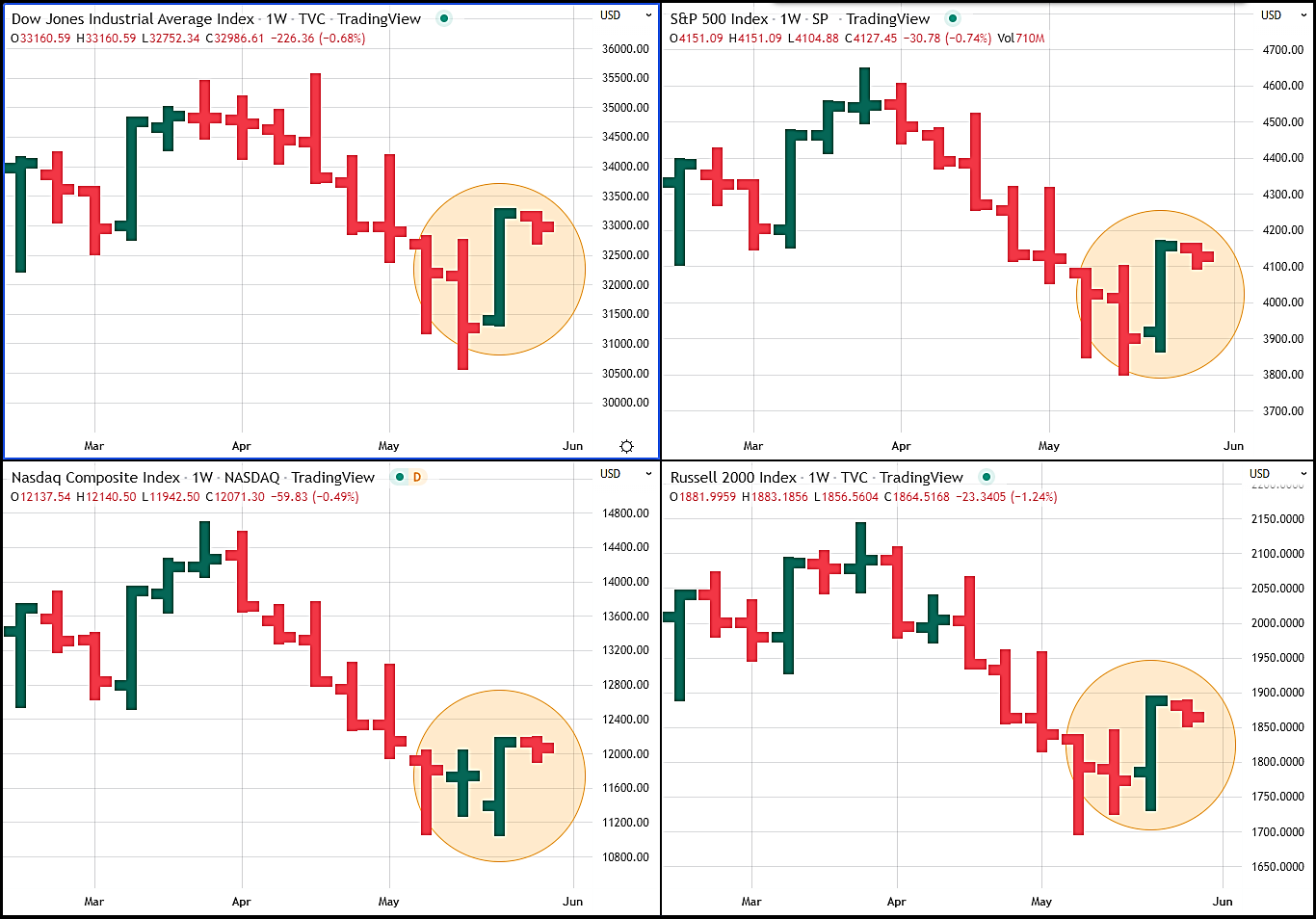

As you can see from this set of multiple weekly charts, stocks booked some decent action last week. In fact, the Dow was up 6.2% for the week. Meanwhile, the S&P 500, a good proxy for the broader stock market, was up 6.6%. Also, last week, the Nasdaq was up 6.8%, and the Russell 2000, a good indicator of what all stocks are doing, was up 6.5%.

You have to admit that's broad positive action across all equity asset classes. And it's welcome news considering what the markets have been up to over the past two months. Continue reading "Here's Why Stocks Rallied Last Week"