Healthcare is one of the few sectors that enjoy inelastic demand and can easily pass on an increase in cost to consumers. Therefore, healthcare stocks are attracting investor attention amid the current economic uncertainties.

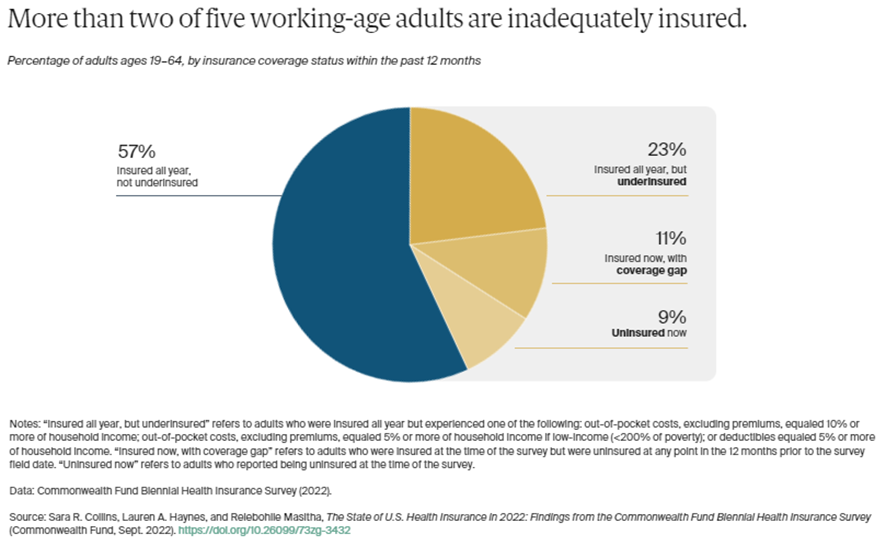

However, the persistently high inflation is raising healthcare expenditures, and many Americans still remain uninsured or inadequately covered. This could drive the demand for health insurance.

The U.S. health insurance market is expected to grow at a CAGR of roughly 10.1% to $846.34 billion by 2027.

Given the sector’s resilience and long-term growth prospects, one could consider investing in shares of health and well-being company Humana Inc. (HUM), given its potential to deliver solid returns.

Despite the broader market’s significant decline, HUM has gained 22.8% over the past six months and 17% year-to-date. The stock is currently trading above its 50-day and 200-day moving averages of $495.97 and $457.09, respectively.

As a diversified healthcare company, HUM operates primarily through three segments: Retail, Group and Specialty, and Healthcare Services. The company provides medical and supplemental benefit plans. In addition, it offers commercial fully-insured medical and specialty health insurance benefits, administrative services, and military services.

HUM’s value creation framework continues to gain operational momentum. The company raised its full-year 2022 adjusted EPS guidance to approximately $25 from the prior guidance of approximately $24.7, reflecting an increase of 21.1% over 2021.

In addition, HUM introduced a mid-term adjusted EPS target of $37 per common share for the fiscal year ending December 31, 2025, representing 14% CAGR over the company’s updated FY 2022 adjusted EPS outlook. “We are confident in our ability to deliver compelling, sustainable earnings growth, both in the near and longer term, which will continue to drive shareholder value,” said Bruce D. Broussard, HUM’s President and CEO.

“Our strong competitive positioning and unique capabilities in the highly-attractive individual Medicare Advantage market, coupled with the opportunity to scale and further integrate our CenterWell healthcare services capabilities, positions us for durable leadership in the value-based care industry,” he added.

HUM’s Board of Directors declared a cash dividend to stockholders of $0.7875 per share, payable on January 27, 2023. It pays a $3.15 per share dividend annually, which translates to a 0.58% yield on the current price. Its four-year dividend yield is 0.65%. The company’s dividend payouts have grown at a CAGR of 12.5% over the past three years and 15.5% over the past five years.

Here is what could influence HUM’s performance in the upcoming months:

Recent Positive Developments

On October 26, HUM and kidney care provider Monogram Health entered a new value-based care agreement for most Humana Medicare Advantage HMO and PPO plan members. This agreement enhances in-home kidney care in four states, including Tennessee, Alabama, Mississippi, and Louisiana.

On October 25, HUM announced offering Medicare Advantage health plans in two new states, Rhode Island and Wyoming, and 140 new U.S. counties, expanding cost-effective health plan choices for Medicare beneficiaries. Expanding Medicare Advantage health plan offerings might boost the company’s revenue streams.

Furthermore, in the same month, HUM and USAA Life Insurance Company (USAA Life) launched a new Medicare Advantage plan designed with veterans and their families in mind to provide a robust coverage option that complements healthcare benefits received through Veterans Affairs (VA). The new co-branded Humana USAA Honor with Rx plan is being offered in eight states starting in 2023.

Robust Financials

For the fiscal 2022 second quarter ended June 30, 2022, HUM’s adjusted revenues increased 15.3% year-over-year to $23.72 billion. The company’s adjusted pretax income grew 26.7% from the prior-year period to $1.43 billion, while its adjusted earnings per share came in at $8.67, up 25.8% year-over-year.

The company’s operating cash flow improved 116.4% year-over-year to $959 million during the same period.

Favorable Analyst Estimates

Analysts expect HUM’s revenue for the fiscal 2022 third quarter (ended September 2022) to come in at $22.78 billion, indicating an increase of 10% from the prior-year period. The consensus EPS estimate of $6.27 for the to-be-reported quarter indicates a 29.8% year-over-year increase. The company has surpassed the consensus revenue and EPS estimates in each of the trailing four quarters.

Furthermore, analysts expect HUM’s revenue and EPS for the current fiscal year (ending December 2022) to increase by 12% and 21% from the previous year to $93.03 billion and $24.98, respectively. Also, the company’s revenue and EPS for the next year are expected to rise 8.4% and 11.8% year-over-year to $100.85 billion and $27.93, respectively.

High Profitability

HUM’s trailing-12-month EBIT margin of 5% compares to the 0.08% industry average. Its trailing-12-month EBITDA margin of 3.29% is 63.5% higher than the 3.29% industry average. Likewise, the stock’s trailing-12-month net income margin of 3.47% compares to the industry average of negative 3.14%.

In addition, HUM’s trailing-12-month ROCE, ROTC, and ROTA of 20.72%, 11.09%, and 6.71% compared to the industry averages of negative 38.79%, 21.44%, and 29.63%, respectively. The stock’s trailing-12-month asset turnover ratio of 2.13% is 515.2% higher than the 0.35% industry average.

Technical Indicators Show Promise

In addition to looking attractive from the fundamental point of view, HUM shows strong trends, which makes it a solid stock to buy now and hold forever.

According to MarketClub’s Trade Triangles, HUM has been trending UP for all the three-time horizons. The long-term trend for HUM has been UP since April 20, 2022, its intermediate-term trend has been UP since September 19, 2022, and its short-term trend has been UP since October 14, 2022.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, intense swings in price.

In terms of the Chart Analysis Score, another MarketClub proprietary tool, HUM scored +100 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the uptrend is likely to continue. Traders should protect gains and look for a change in score to suggest a slowdown in momentum.

The Chart Analysis Score measures trend strength and direction based on five different timing thresholds. This tool considers intraday price action; new daily, weekly, and monthly highs and lows; and moving averages.

Click here to see the latest Score and Signals for HUM.

What's Next for Humana Inc. (HUM)?

Remember, the markets move fast and things may quickly change for this stock. Our MarketClub members have access to entry and exit signals so they'll know when the trend starts to reverse.

Join MarketClub now to see the latest signals and scores, get alerts, and read member-exclusive analysis for over 350K stocks, futures, ETFs, forex pairs and mutual funds.

Best,

The MarketClub Team

su*****@in*.com

Health care stocks are up. No wonder health care is so damn expensive.