The S&P 500 slumped 19% in 2022, registering its biggest decline since 2008. Besides geopolitical turbulence and supply-chain disruptions, the market pullbacks were mostly driven by fears of a looming economic slowdown as an undesirable side-effect of the Federal Reserve’s fight against high inflation with aggressive interest rate hikes.

Since there is still a long way to go before inflation can be reined in to around the desired 2% mark, the central bank, by its own admission, is far from done with interest rate hikes. Hence, the market, subdued by the ever-increasing risk of a recession, is unlikely to stabilize anytime soon.

In fact, bearish sentiments have become so pervasive that the strengthening dollar has also been unable to offset the increasing luster of precious metals, such as gold. Such commodities are gaining popularity among market players as ballast during panic-driven market sell-offs and a time-tested hedge against a potential economic downturn.

The VanEck Vectors Gold Miners ETF (GDX) is expected to offer downside protection. The fund is managed by Van Eck Associates Corporation. It offers exposure to some of the largest gold mining companies in the world.

Since gold mining stocks strongly correlate with prevailing gold prices, the ETF provides indirect exposure to gold prices.

Here are the factors that could influence GDX’s performance in the near term:

Fund Stats

GDX has about $12 million in assets under management (AUM). The ETF has an expense ratio of 0.51%, compared to the segment average of 0.52%.

GDX pays $0.48 annually as dividends, which translates to a yield of 1.66% at the current price. Its dividend payouts have grown at a 22% CAGR over the past five years.

GDX saw a net inflow of $691.68 million over the past three months.

Top Holdings

GDX’s top holding is Newmont Corporation (NEM) which has a 12.57% weighting in the fund. It is followed by Barrick Gold Corporation (GOLD) at 10.17%, Franco-Nevada Corporation (FNV) at 8.76%, Agnico Eagle Mines Limited (AEM) at 7.95%, and Wheaton Precious Metals Corp (WPM) at 6%.

The fund has a total of 50 holdings, with 64.44% of its assets concentrated in the top 10 holdings.

Price Action and NAV

GDX has gained 1.3% over the past month and 10% over the past six months to close the last trading session at $29.66, above its 20-day and 60-day moving averages of $28.72 and $26.43, respectively. The fund’s NAV was $29.59 as of January 3, 2023.

GDX has a beta of 0.69, which makes it an attractive investment option during the prevailing market volatility.

Technical Indicators Look Promising

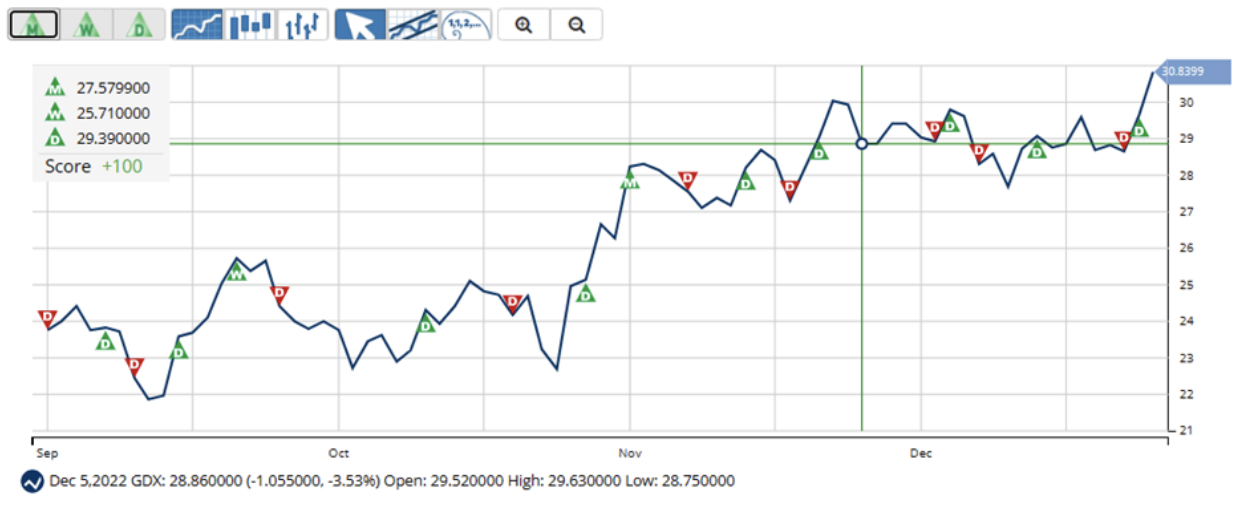

MarketClub’s Trade Triangles show that GDX has been trending UP for each of the three time horizons. The long-term trend has been UP since November 10, 2022, while the intermediate-term and short-term trends have been UP since October 4, 2022, and January 3, 2023, respectively.

The Trade Triangles are our proprietary indicators, comprised of weighted factors that include (but are not necessarily limited to) price change, percentage change, moving averages, and new highs/lows. The Trade Triangles point in the direction of short-term, intermediate, and long-term trends, looking for periods of alignment and, therefore, intense swings in price.

In terms of the Chart Analysis Score, another MarketClub proprietary tool, GDX scored +100 on a scale from -100 (strong downtrend) to +100 (strong uptrend), indicating that the uptrend will likely continue. Traders should protect gains and look for a change in score to suggest a slowdown in momentum.

The Chart Analysis Score measures trend strength and direction based on five different timing thresholds. This tool takes into account intraday price action, new daily, weekly, and monthly highs and lows, and moving averages.

Click here to see the latest Score and Signals for GDX.

What's Next for the VanEck Vectors Gold Miners ETF (GDX)?

Remember, the markets move fast and things may quickly change for this ETF. Our MarketClub members have access to entry and exit signals so they'll know when the trend starts to reverse.

Join MarketClub now to see the latest signals and scores, get alerts, and read member-exclusive analysis for over 350K stocks, futures, ETFs, forex pairs and mutual funds.

Best,

The MarketClub Team

su*****@in*.com