With the latest hike, Jerome Powell and his team at the Federal Reserve raised the benchmark borrowing cost to 5.25%-5.50%, thereby ratcheting it up from nearly 0% in 16 months.

While a 2.6% rise in inflation, down from a 4.1% rise in Q1 and well below the estimate for an increase of 3.2%, and an annualized increase of 2.4% in the gross domestic product in the second quarter, topping the 2% estimate, had raised hopes that the elusive “soft landing” could be within reach, recent developments have been less than encouraging.

Despite the falling unemployment rate, the number of jobs created in July came in lower than expected, which could be symptomatic of an economy slowly but surely footing the bill of aggressive interest-rate hikes. Moreover, with a more-than-forecasted increase in wages, there are increasing concerns that interest rates could stay higher for longer.

To compound the miseries further, after placing the country on negative watch amid the debt-ceiling standoff at Capitol Hill back in May, Fitch Ratings recently downgraded U.S. long-term rating to AA+ from AAA, citing the erosion of confidence in fiscal management.

As a result, despite the salvo of interest-rate hikes, the dollar has recently weakened in relation to its peers. The dollar index, a measure of the U.S. currency against six peers, fell 0.185%. The euro edged up 0.31% to $1.0978, and the yen strengthened 0.16% at 142.31 per dollar.

Moreover, with every increase in benchmark interest rates, a selloff of long-duration fixed-income instruments, such as the 10-year treasury notes, gets triggered, which causes a slump in their market value and a consequent increase in their yields.

After benchmark 10-year yields jumped by as much as 15 basis points above the key 4% level, Peter Schiff, CEO and chief economist at Euro Pacific Asset Management, warned of a crash in Treasuries. He has also predicted the benchmark 30-year mortgage rates to soon hit 8%, a level last seen in 2000.

An increase in borrowing costs would not just raise the cost of servicing the $32.7 trillion national debt; significant markdowns prices of legacy bonds and an inability by borrowers to service them due to economic slowdown could crush the loan portfolios of struggling banks and make them go the way of the dodo, such as the Silicon Valley Bank and the First Republic Bank.

Hence, it is unsurprising that Moody’s has cut ratings of 10 U.S. banks and put some big names on downgrade watch, and HSBC Asset Management’s warning that a U.S. recession is coming this year, with Europe to follow in 2024 is gaining credibility with each passing day.

With a material risk that an apparently resilient economy could find itself regressing into a full-blown recession just as Jerome Powell’s colleagues at the Federal Reserve have stopped forecasting it, seasoned investors could be wise to seek refuge in anti-fragile assets which could see upside potential in the event of a turmoil.

Since a devaluation in domestic currency brightens the prospects of exports, one of the ways to navigate the terrain is to bet on U.S. companies generating international sales, which could benefit from an uptick in earnings.

Secondly, since the value of gold has usually been negatively correlated to the global reserve currency, the demand for yellow metal from central banks worldwide totaled 1,136 tons in 2022.

In view of the above, here are a few financial instruments that could be worthy of consideration:

QCOM is engaged in developing and commercializing foundational technologies for the global wireless industry. The company operates through three segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI).

Over the past three years, QCOM’s revenue has grown at a 24.5% CAGR, while its EBITDA has grown at a 34.4% CAGR. During the same time horizon, the company has been able to increase its net income at 46.4% CAGR.

On July 14, QCOM announced its quarterly cash dividend of $0.80 per common share, payable on September 21, 2023, to stockholders of record at the close of business on August 31, 2023.

QCOM pays $3.20 annually as dividends. Its 4-year average dividend yield is 2.32%. The company has been able to increase its dividend payouts for the past 19 years and at a 5.5% CAGR for the past five years.

For the fiscal third quarter that ended June 25, QCOM’s non-GAAP revenues came in at $8.44 billion, with QCT automotive posting an 11th straight quarter of double-digit revenue growth, while its non-GAAP net income amounted to $2.16 billion, or $1.87 per share.

Analysts expect QCOM’s revenue and EPS for the fiscal fourth quarter to exhibit marginal sequential increases to come in at $8.50 billion and $1.90, respectively. It corresponds to the midpoint of the company’s guidance for the quarter. Moreover, QCOM has met or exceeded consensus EPS estimates in three of the trailing four quarters.

As a global technology company, SLB primarily offers oilfield services to national oil companies, integrated oil companies, and independent operators. The company operates through four segments: Digital & Integration, Reservoir Performance, Well Construction, and Production Systems.

SLB has grown its revenue and EBITDA at 1.8% and 7% CAGRs, respectively.

On July 26, SLB and Eni S.p.A. (E), through its subsidiary Enivibes, announced an alliance to deploy e-vpms® (Eni Vibroacoustic Pipeline Monitoring System) technology. The new proprietary pipeline integrity technology, capable of providing real-time analysis, monitoring, and leak detection for pipelines around the world, can be retrofitted to any pipeline, regardless of age.

The system would be capable of providing real-time analysis, monitoring, and leak detection for pipelines around the world.

On July 6. SLB announced that it had been awarded a five-year contract by Petroleo Brasileiro S.A.- Petrobras (PBR) for enterprise-wide deployment of its Delfi™ digital platform. The award represents one of PBR’s largest investments in cloud-based technologies and sets the foundation for it to achieve its decarbonization and net-zero targets.

During the fiscal 2023 second quarter that ended June 30, SLB’s revenue increased by 19.6% year-over-year to $8.10 billion. The company’s adjusted EBITDA increased by 28.2% year-over-year to $1.96 billion during the same period. Consequently, its non-GAAP net income increased by 44% year-over-year to $1.03 billion and $0.72 per share.

Analysts expect SLB’s revenue and EPS for the fiscal third quarter to increase by 11.6% and 23.8% year-over-year to $8.35 billion and $0.78, respectively. The company has also impressed by surpassing consensus EPS estimates in each of the trailing four quarters.

GLD is a world-renowned ETF launched and managed by World Gold Trust Services, LLC. It offers investors exposure to gold, which has of late become an important component of their asset allocation strategy by acting as a hedge against volatility in equity markets, inflation, and dollar depreciation.

With $56.10 billion in AUM, all of GLD’s holdings are in gold bullion, stored in secure vaults. The physically-backed nature of this product insulates this product from the uncertainties introduced through futures-based strategies.

GLD has an expense ratio of 0.40%, lower than the category average of 0.47%. The fund’s net inflow came in at $6.82 billion over the past five years. It has a beta of 0.15.

AFLAC is involved in the marketing and administration of supplemental health and life insurance. The company operates through two subsidiaries: American Family Life Assurance Company of Columbus (Aflac) and Aflac Life Insurance Japan Ltd. (ALIJ), which belong to the Aflac U.S. and Aflac Japan segments, respectively.

Over the past three years, AFL has grown its EBITDA and net income at 6.6% and 16.1% CAGRs, respectively.

On July 25, AFL launched its new product, Aflac Group Life Term to 120, to provide worksite life insurance, flexible living benefits, and affordable rates that won't increase across employees' lifespans. With flexible living benefits designed to make it easy to use whenever needed, the product assures customers of financial protection when needed.

During the fiscal 2023 second quarter that ended June 30, AFL’s total revenues came in at $5.17 billion, while its adjusted earnings excluding current period foreign currency impact increased by 3.6% and 10.2% year-over-year to come in at $979 million, or $1.62 per share, respectively.

Analysts expect AFL’s EPS for the fiscal third quarter to increase by 27% year-over-year to come in at $1.46. Moreover, the company has impressed by surpassing consensus EPS estimates in each of the

In addition to its robust financials, the relative immunity of its demand and margins to potential economic downturns make it an attractive investment option for solid risk-adjusted returns.

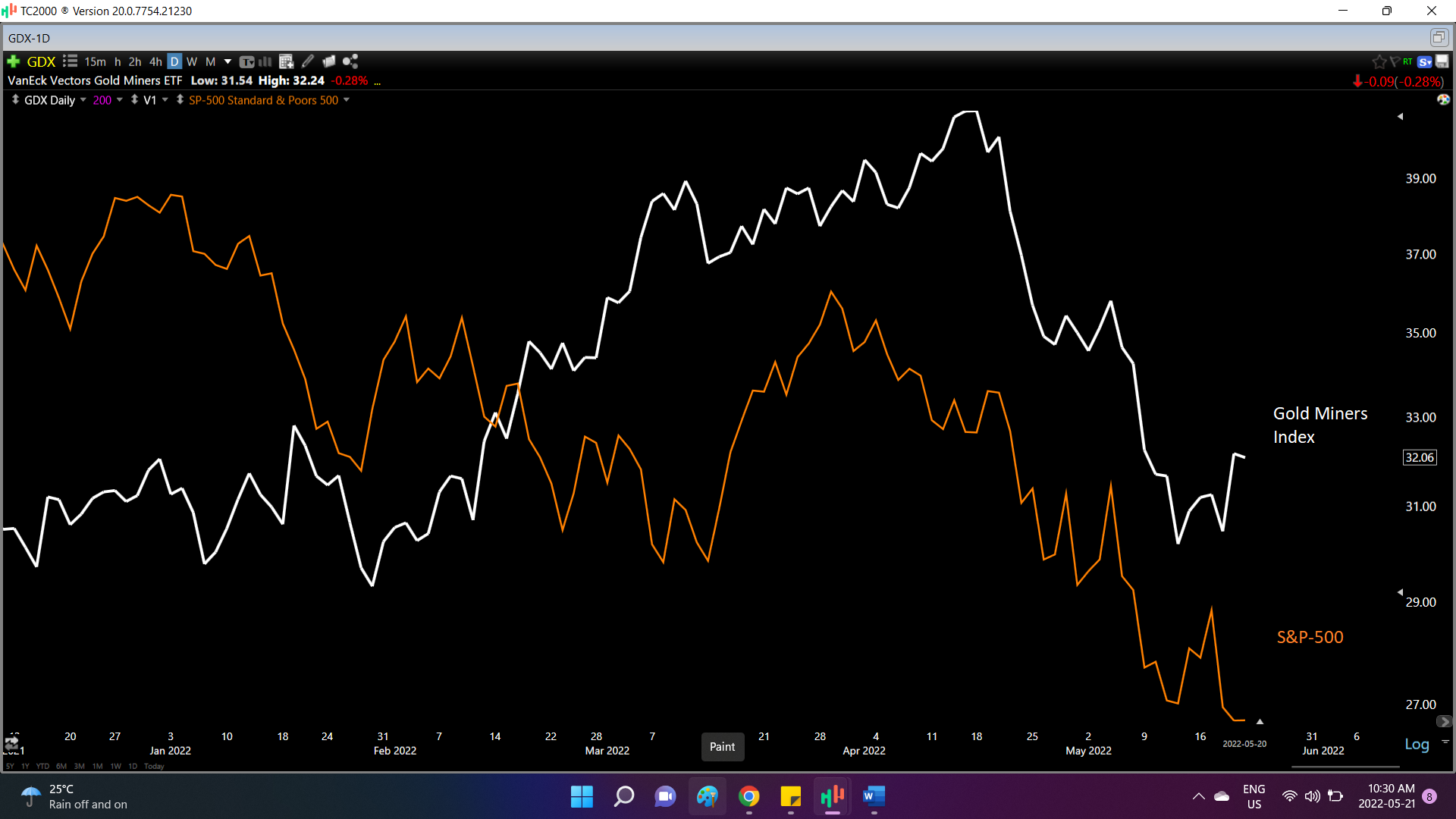

VanEck Vectors Gold Miners ETF (GDX)

GDX is managed by Van Eck Associates Corporation. It offers exposure to some of the largest gold mining companies in the world. Since their stocks strongly correlate to prevailing gold prices, the ETF provides indirect exposure to gold prices.

GDX has an expense ratio of 0.51%. It pays $0.48 annually as dividends, and its payouts have grown at a 22% CAGR over the past five years. It saw a net inflow of $68.53 million over the past month. The ETF has a beta of 0.77.

GDX has about $11.71 billion in assets under management (AUM). The ETF’s top holding is Newmont Corporation (NEM) which has a 10.04% weighting in the fund. It is followed by Barrick Gold Corporation (GOLD) at 9.04% and Franco-Nevada Corporation (FNV) at 8.31%. The fund has 52 holdings, with 61.81% of its assets concentrated in the top 10 holdings.