It’s been a mixed year thus far for the Restaurant industry group, with several quick-service names rallying near all-time highs while casual dining names have struggled to stay in positive territory for the year.

The underperformance of the latter group can be attributed to weaker traffic trends in the casual dining space relative to quick-service.

This is not surprising given that we are seeing a pullback in spending from some consumers and quick-service is a trade-down option relative to casual dining, with consumers able to treat themselves with convenience with pizzas, burgers, and fries without breaking the bank at a casual dining restaurant where average checks are closer to $20.00.

However, while we’ve seen Yum Brands (YUM) and McDonald’s (MCD) continue to make new highs with both up 15% and 25% from their pre-COVID-19 highs, a couple of names remain well below their all-time highs and continue to trade at attractive valuations.

This is despite these two companies having iconic brands similar to McDonald’s, and KFC, Taco Bell, and Pizza Hut (Yum Brands), and despite them having some of the better growth profiles sector-wide.

In this update, we’ll dig into these two companies and highlight why they could be outperformers after a period of underperformance in Dominos Pizza’s (DPZ) case, and years of underperformance in the case of Restaurant Brands International (QSR).

Restaurant Brands International (QSR)

Restaurant Brands International is a $21.2 billion franchisor in the Restaurant industry group with four iconic brands under its umbrella: Burger King, Popeye’s Chicken, Firehouse Subs, and Tim Hortons.

The three latter brands were acquired by Restaurant Brands International over the past decade and they currently make up roughly one-third of its system-wide stores which are spread across over 100 countries.

The largest of its brands is Burger King with ~19,000 restaurants, with Tim Hortons just behind at ~5,600 restaurants, Popeye’s Chicken having ~4,000 restaurants, and Firehouse Subs, the smallest brand, having roughly 1,200 restaurants and operating solely in North America.

Digging into the company’s FY2022 results, Restaurant Brands International reported 12.9% system-wide sales growth to $38.7 billion, which was driven by a 4.4% increase in its consolidated store count and ~8.5% growth in same-store sales.

This translated to annual revenue of $6.51 billion (+14% growth year-over-year) and annual EPS of $3.13, a 12% increase year-over-year. The latter was helped by opportunistic share buybacks, with RBI returning over $1.3 billion in capital to shareholders, or roughly 5% of its total market cap.

However, the major news was that Joshua Kobza has been appointed the new CEO, while Patrick Doyle has replaced Jose Cil as Executive Chairman of Restaurant Brands International, a significant shake-up that is overdue for the company.

For those unfamiliar, Patrick Doyle was transformational for the Domino's Pizza brand, with the stock increasing over 1500% under his tenure and massively outperforming its peer group. And while 3G Capital is an investment firm known for cost-cutting, this was the wrong approach for a Burger King brand that needed investment to revitalize the brand that has been losing market share to McDonald’s.

Therefore, I see this new plan of re-investment (“Reclaim The Flame”) under management with significant experience in the sector and a strong track record as a huge upgrade for Restaurant Brands International, and I would expect better results from Burger King going forward which has unfortunately overshadowed the strong growth we’ve seen at its three smaller brands.

So, why buy a turnaround story like Restaurant Brands International?

Generally, I prefer to buy the leaders in a sector vs. turnaround stories given that turnaround stories are in some cases lower quality and can take a while to get out of the proverbial penalty box and start outperforming.

However, and in the case of Restaurant Brands International, the ingredients are in place for a successful turnaround (new management, reinvestment in its weaker brands, strong unit growth at smaller brands), and the valuation is right, with Restaurant Brands International trading at just ~17.4x FY2025 earnings estimates ($3.96) vs. McDonald’s at ~23.0x FY2025 earnings and ~21.0x, respectively.

I don’t see any reason that Restaurant Brands International should trade at this large of a discount, especially when it has the best dividend in the group and the highest growth rate, making it even more attractive in a market where it’s hard to find growing dividend yields above 3.0% with growth stocks.

In fact, based on what I believe to be a fair multiple of 24.5x earnings, I see a fair value (two-year target price) for Restaurant Brands International of $97.00 per share, pointing to a near 50% total return when including dividends.

Plus, it’s worth noting that Chairman Patrick Doyle has tens of millions of reasons to execute successfully on this turnaround, with a significant compensation tied to performance if the share price averages at least a 10% compound annualized return over five years.

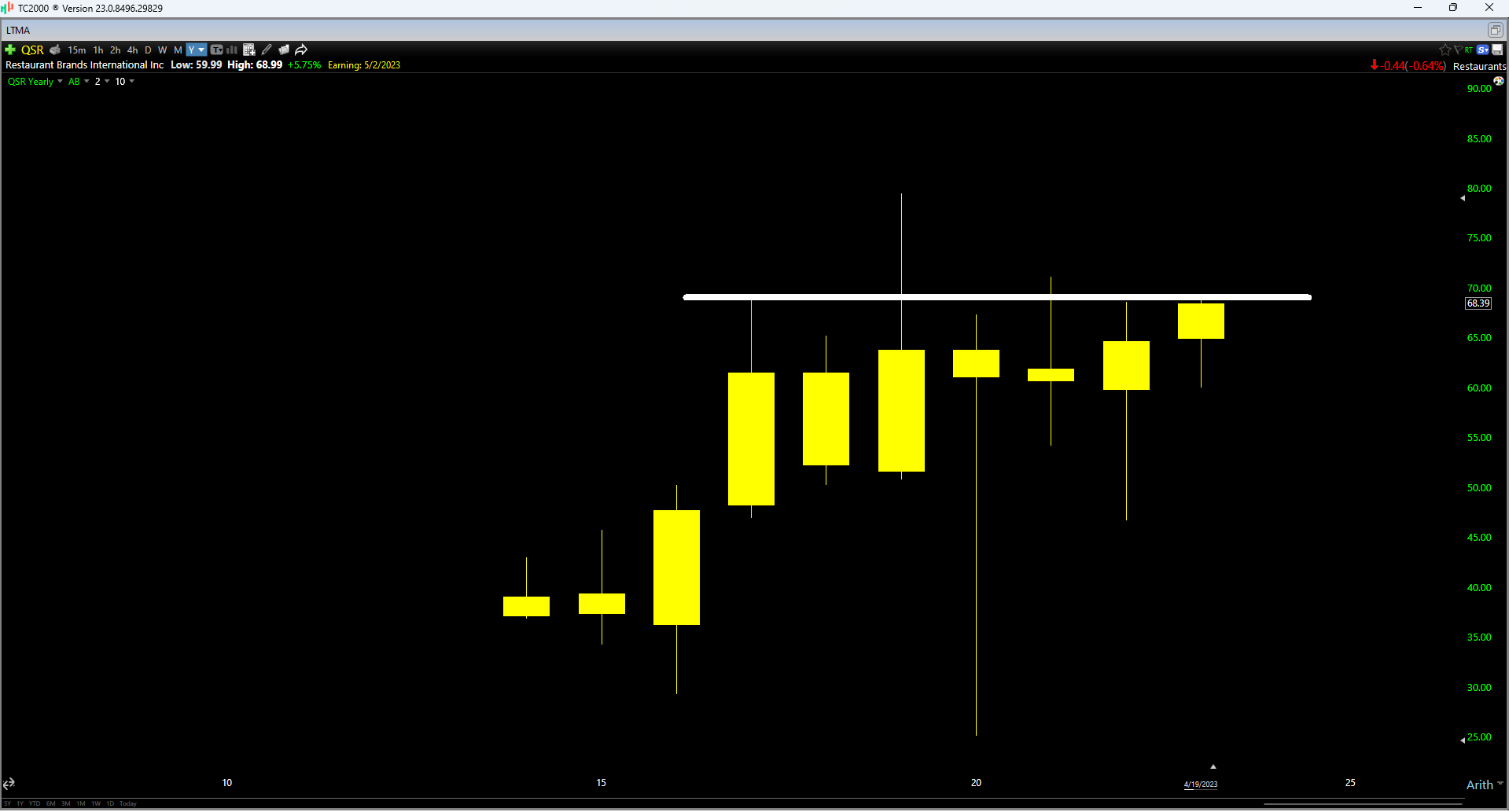

Finally, if we look at the stock from a technical standpoint, QSR is testing key resistance at the $69.00 level which dates all the way back to 2017 despite this being a much larger brand with the addition of Popeye’s Chicken and Firehouse Subs in the period and a stronger management team at the helm.

This significant underperformance suggests that if QSR can breakout we could see it play significant catch up, with a quarterly breakout above $69.00 targeting a move to $92.00 as the first major target.

So, with undervaluation relative to peers, a turnaround story with a lot of promise, and a massive base having been built that is targeting much higher prices on a successful breakout, I see QSR as one of the best buy-the-dip candidates in the market today, and I would view pullbacks below $65.50 as buying opportunities.

Dominos Pizza’s (DPZ)

Dominos Pizza needs little introduction as the world’s largest pizza chain with nearly 7,000 restaurants in the United States alone, ~20,000 restaurants in over 90 markets, and global sales of nearly $18.0 billion.

The company briefly traded at a market cap of ~$20.0 billion at its peak in Q4 2021, but trades at a market cap of just $11.4 billion today based on ~35.4 million shares outstanding.

And while the significant decline in the stock over the past year from a high of $565.00 (~45% correction) has unnerved many investors that didn’t take profits after its incredible run off its COVID-19 lows (~90% gain in 20 months), I don’t see any damage to the long-term picture, and see this correction being more to do with the stock getting ahead of itself at its Q4 2021 highs.

Dominos Pizza released its 2022 results in late February, reporting global retail sales up 4% year-over-year, and 5.2% in Q4 2022. This was below estimates and resulted in a decline in annual EPS when factoring in inflationary pressures, with annual EPS coming in at $12.53 vs. $13.60 in FY2021.

Like Restaurant Brands, Dominos is primarily a franchisor model and although the increase in the cost of its market basket and supply chain headwinds hurt earnings, the impact was minimal given that its company-owned restaurants make up just 2% of its system (402 restaurants).

And while the company reported solid free cash flow generation (~$390 million) and saw 5% unit growth last year, its guidance and earnings performance was a disappointment.

As noted above, the 8% decline in annual EPS took the market by surprise after seven years of consecutive annual EPS growth, and the updated unit growth outlook of 5-7% vs. 6-8% spooked the market a little, as did the updated outlook of 4-8% global retail sales growth (two to three year outlook), which was down from 6-10% previously.

That said, the stock has been punished accordingly, and this outlook for weaker growth over the next few years looks priced into the stock already.

I see this as especially true given that we continue to be in a difficult economic environment and pizza and quick-service are typically the winners from a traffic standpoint when consumers decide to be more judicious with their spending.

So, what’s a fair value for the stock?

Dominos has historically traded at ~32.0x earnings yet has found itself trading at just ~19.1x FY2025 earnings estimates and ~21.7x FY2024 earnings estimates which is a massive discount to its historical multiple.

One could argue that a lower multiple is justified given that annual EPS is expected to decelerate from its previous growth rate of 14-18%.

That said, even if we use a fair multiple of 28.0x earnings and FY2024 earnings estimates of $15.02, I see a fair value for the stock of $420.60. This points to a 30% upside from current levels or closer to 32% on a total return basis which is quite attractive for a more defensive name that has historically outperformed in recessionary periods.

Lastly, if we look at the technical picture, Dominos Pizza is re-testing a multi-year prior resistance level and this is often an area where stocks will find support.

So, not only is the stock trading at a deep discount to its historical multiple and its large-cap peer group but it’s at a pivotal area from a technical standpoint where I would expect buyers to show up.

So, if DPZ were to see further weakness below $314.00, I would view this as a buying opportunity.

There are several names on the sale rack in the restaurant space after the underperformance year-to-date, but not all names are created equal, and some names are cheap for a reason.

However, in the case of QSR and DPZ, I see these as top-5 names in the industry group from a quality and growth standpoint and given their underperformance, they’re also quite attractive from a relative value standpoint.

Hence, I have recently started positions in both names at lower levels, and I would consider adding to my position if we drop below $65.50 on QSR and $314.00 on DPZ.

Disclosure: I am long QSR, DPZ

Taylor Dart

INO.com Contributor

Disclaimer: This article is the opinion of the contributor themselves. Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information in this writing.