It’s been a mixed year thus far for the Restaurant industry group, with several quick-service names rallying near all-time highs while casual dining names have struggled to stay in positive territory for the year.

The underperformance of the latter group can be attributed to weaker traffic trends in the casual dining space relative to quick-service.

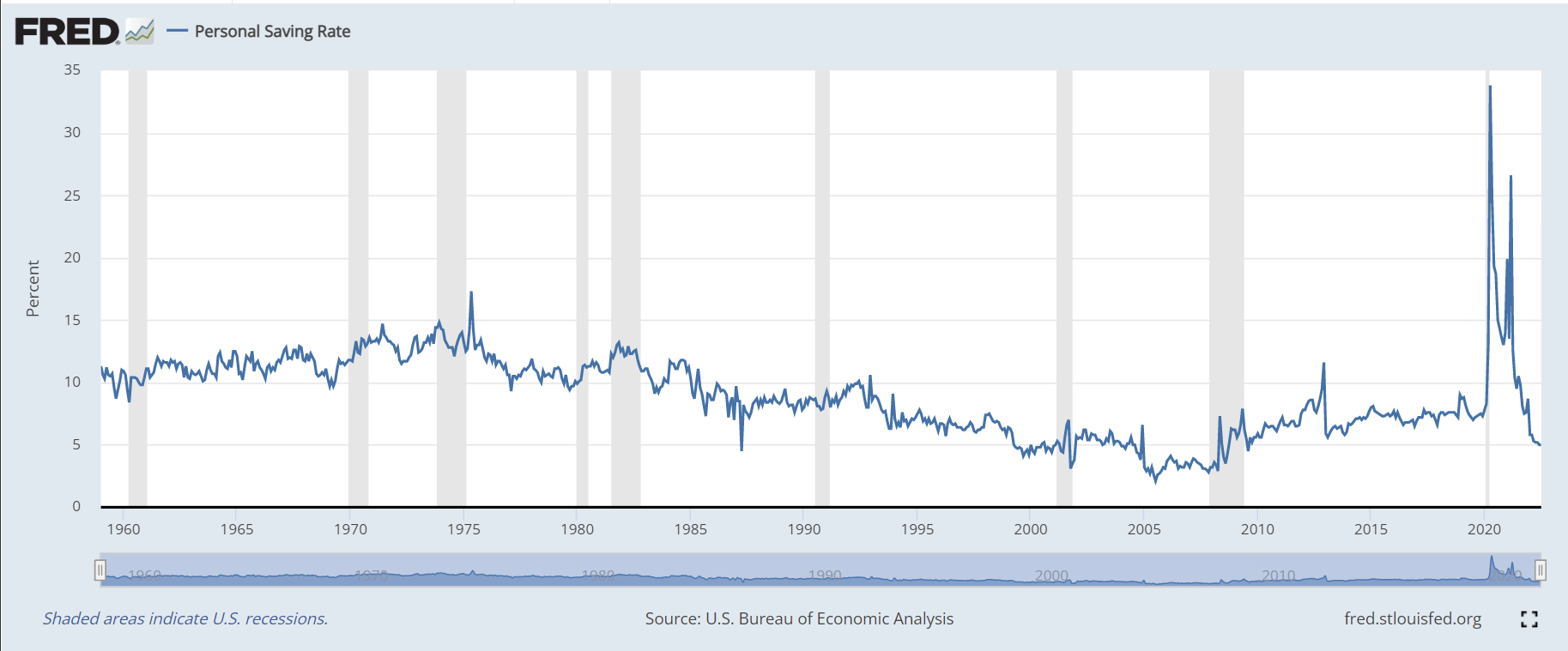

This is not surprising given that we are seeing a pullback in spending from some consumers and quick-service is a trade-down option relative to casual dining, with consumers able to treat themselves with convenience with pizzas, burgers, and fries without breaking the bank at a casual dining restaurant where average checks are closer to $20.00.

However, while we’ve seen Yum Brands (YUM) and McDonald’s (MCD) continue to make new highs with both up 15% and 25% from their pre-COVID-19 highs, a couple of names remain well below their all-time highs and continue to trade at attractive valuations.

This is despite these two companies having iconic brands similar to McDonald’s, and KFC, Taco Bell, and Pizza Hut (Yum Brands), and despite them having some of the better growth profiles sector-wide.

In this update, we’ll dig into these two companies and highlight why they could be outperformers after a period of underperformance in Dominos Pizza’s (DPZ) case, and years of underperformance in the case of Restaurant Brands International (QSR).

Restaurant Brands International (QSR)

Restaurant Brands International is a $21.2 billion franchisor in the Restaurant industry group with four iconic brands under its umbrella: Burger King, Popeye’s Chicken, Firehouse Subs, and Tim Hortons.

The three latter brands were acquired by Restaurant Brands International over the past decade and they currently make up roughly one-third of its system-wide stores which are spread across over 100 countries.

The largest of its brands is Burger King with ~19,000 restaurants, with Tim Hortons just behind at ~5,600 restaurants, Popeye’s Chicken having ~4,000 restaurants, and Firehouse Subs, the smallest brand, having roughly 1,200 restaurants and operating solely in North America. Continue reading "These 2 Restaurant Stocks Could Be Outperformers"