Editor’s Note: Our experts here at INO.com cover a lot of investing topics and great stocks every week. To help you make sense of it all, every Wednesday we’re going to pick one of those stocks and use Magnifi Personal to compare it with its peers or competitors. Here we go…

It was an outstanding month for inflows into exchange traded funds (ETFs) in March.

Flows into ETFs almost tripled to $62.1 billion last month—with the bulk of the money heading into safe assets like government debt—as investors sought shelter from the recent banking crisis.

Developed market government bond ETFs soaked up a record $33.2 billion of the money, eclipsing the previous monthly peak of $27.4 billion set in May 2022, according to data from BlackRock.

Todd Rosenbluth, head of research at consultancy VettaFi, told the Financial Times, “In March, while net inflows to ETFs were strong, nearly all of the money U.S. ETFs gathered was in fixed income ETFs, led by Treasury products, as investors sought safety amid the banking crisis and the uncertainty of the Federal Reserve’s next move.”

It was interesting to note how expectations of two interest rate cuts by the Federal Reserve that might come later in 2023 affected the ETF flows. Investors betting on this would gravitate toward longer-term Treasuries versus those (like me) that prefer the safety of shorter-term Treasuries.

The $28.6 billion of net inflows into U.S. Treasury bond ETFs was divided almost equally between those focused on the short end, middle, and long end of the yield curve.

This divergence in views was visible in iShares 7-10 Year Treasury ETF (IEF), which gathered $6.1 billion in March. Meanwhile, at the other end of the maturity scale the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) pulled in $3.8 billion according to VettaFi data. And the iShares US Treasury Bond ETF (GOVT), with an effective duration of 6.3 years, was just behind at $3.7 billion.

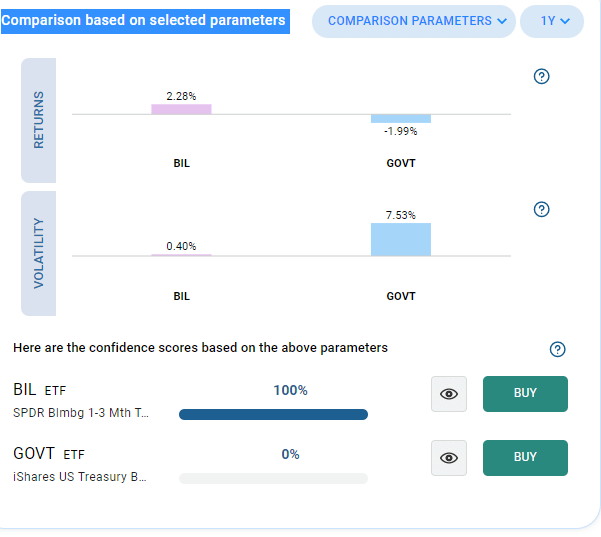

Let's do a comparison of the two ETFs on the two duration ends of the yield curve - BIL and GOVT - over the past very volatile year. The quick and easy way to do this to ask Magnifi Personal to run the comparison for us. It’s as simple as asking this investing AI to “Compare BIL to GOVT.”

Not surprisingly, BIL is vastly superior. Not only is it less volatile, but the return was superior.

This is an example of a response using Magnifi Personal. This image is not a recommendation or individual advice. Please see bottom disclaimer for additional information, including INO.com’s relationship with Magnifi.

This is just a starting point, of course. Magnifi Personal can easily compare several stocks or ETFs on more criteria, such as dividend payments, turnover, volume, and so on.

You can do it, too. Get access to Magnifi Personal completely free-of-charge - just click here.

This ability to have an investing AI pore over reams of data for you in seconds and spit out an easy-to-understand comparison of two or more stocks is an invaluable tool in deciding where to invest next.

We highly recommend you try it out. Click here to see how.

Magnifi Personal makes research like this as simple as typing a question. You can easily do this yourself, or ask Magnifi Personal to add other measures to the comparison, including dividend, valuation metrics such as P/E or P/B ratios, gross margin, and more.

Just click here to see how to set up your Magnifi Personal account.

INO.com, a division of TIFIN Group LLC, is affiliated with Magnifi via common ownership. INO.com will receive cash compensation for referrals of clients who open accounts with Magnifi.

Magnifi LLC does not charge advisory fees or transaction fees for non-managed accounts. Clients who elect to have Magnifi LLC manage all or a portion of their account will be charged an advisory fee. Magnifi LLC receives compensation from product sponsors related to recommendations. Other fees and charges may apply.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

Mutual Funds and Exchange Traded Funds (ETFs) are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.