Hello traders everywhere. The move lower started early Friday in Europe when IHS Markit said that manufacturing activity in Germany dropped to its lowest level in more than six years in March. In France, manufacturing and services slowed down to their lowest levels in three months and two months, respectively. For the eurozone as a whole, manufacturing fell to its lowest level since April 2013. This data sent the German 10-year bund yield to their lowest level since 2016, briefly dipping into negative territory.

Once trading opened in the U.S. we got news that the spread between the 3-month Treasury bill yield and the 10-year note rate turned negative for the first time since 2007 - thus inverting the so-called yield curve - according to Refinitiv Tradeweb data. An inverted yield curve happens when short-term rates surpass their longer-term counterparts. This is considered a trustworthy indicator of a recession coming in the near future.

These moves come after U.S. central bank surprised investors by adopting a sharp dovish stance on Wednesday, projecting no further interest rate hikes this year and ending its balance sheet roll-offs. Market sentiment was boosted by the Fed's updated outlook on interest rates, but the reasons behind it caused some concern.

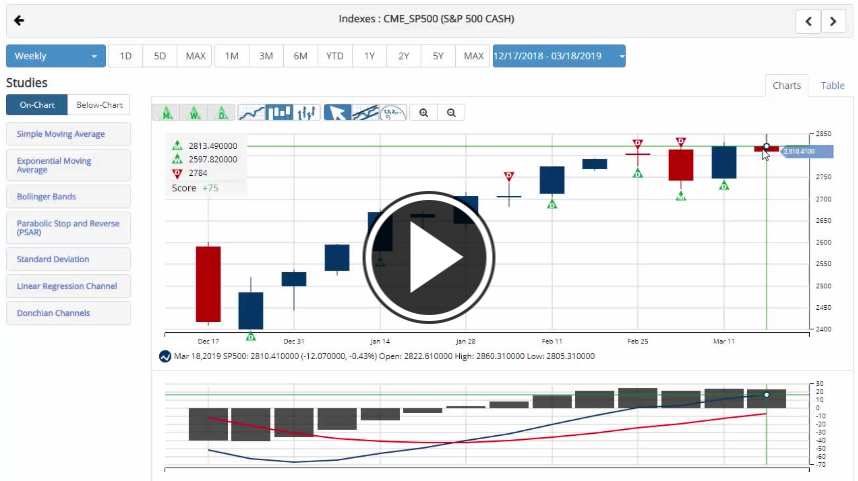

Key Levels To Watch Next Week:

- S&P 500 (CME:SP500): 2,722.27

- Dow (INDEX:DJI): 26,155.98

- NASDAQ (NASDAQ:COMP): 7,332.92

- U.S. Dollar (ICE:DX): 97.63

- Gold (NYMEX:GC.J19): 1,306.50

- Crude Oil (NYMEX:CL.K19): 60.19

- Bitcoin (BITCOIN:BITSTAMPUSD): 3,670.00

Every Success,

Jeremy Lutz

INO.com and MarketClub.com