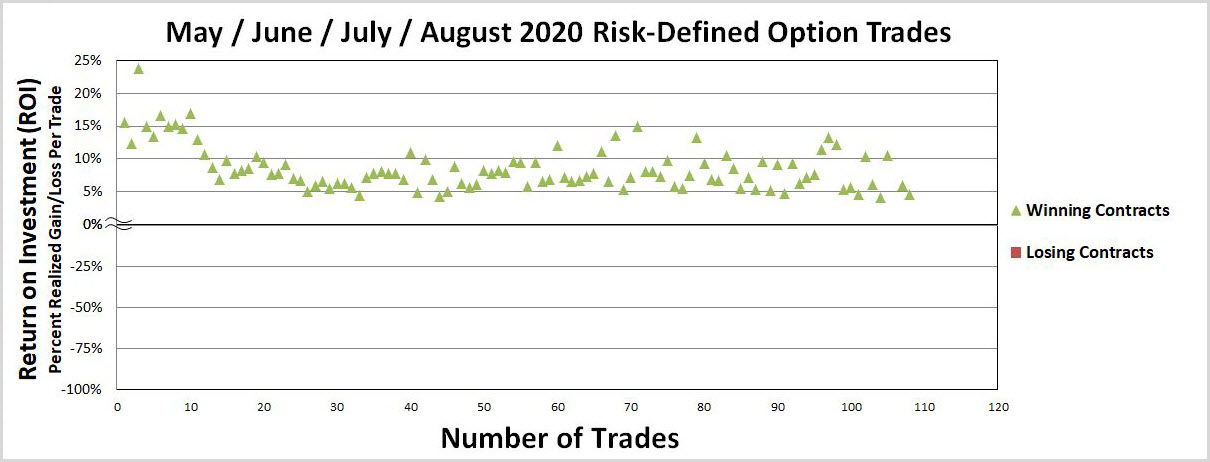

A total of 99 option trades were executed in May, June, July, and August as the markets reached an inflection point and rebounded after the COVID-19 lows. During this timeframe, all 99 trades were winning trades to lock-in a 100% option win rate with an average income per trade of $180 and an average return on investment (ROI) per trade of 7.4%. After the tumultuous market lows of March and into early April, leveraging a minimal amount of capital, mitigating risk, and maximizing returns are essential. An option-based portfolio can offer the optimal balance between risk and reward while providing a margin of downside protection with high probability win rates. As the market continues to rebound, optimal risk management is essential when engaging in options trading as a means to drive portfolio performance.

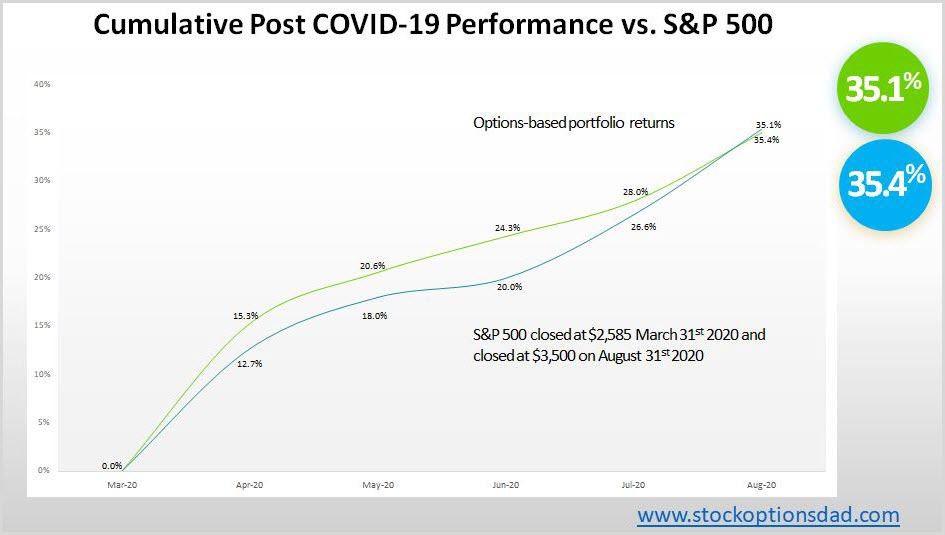

Through the end of August, an option-based portfolio broken out into roughly three parts of ~40% cash, ~30% long equity, and 30% options matched the S&P 500 performance, posting returns of 35.1% and 35.4%, respectively. Risk mitigation needs to be built into each trade via risk-defining trades, staggering options expiration dates, trading across a wide array of uncorrelated tickers, maximizing the number of trades, appropriate position allocation, and selling options to collect the premium income. Maintaining disciple via continuing to risk-define trades, leveraging small amounts of capital while maximizing return on investment, is essential despite the impressive streak of 80 consecutive winning trades.

Option-Based Portfolio/Long Equity Boost

Anchoring down an option-based portfolio is a key component to taking advantage of black swan events such as COVID-19 via broad-based ETF exposure. During the market lows of March/April, the cash-on-hand component of an option-based portfolio was used to go long equity via Dow Jones (DIA), S&P 500 (SPY), and Nasdaq (QQQ). The cash-on-hand was repurposed to balance out the portfolio into roughly three equal parts of one-third cash, one-third long ETF based equity, and one-third options driven. Through the end of August, an option-based portfolio matched the performance of the S&P 500, posting returns of 35.1% and 35.4%, respectively (Figure 1).

Figure 1 – Overall option-based portfolio returns compared to the S&P 500 returns over the previous four months post COVID-19 lows of 35.1% and 35.4%, respectively

5 Months Post COVID-19 Results

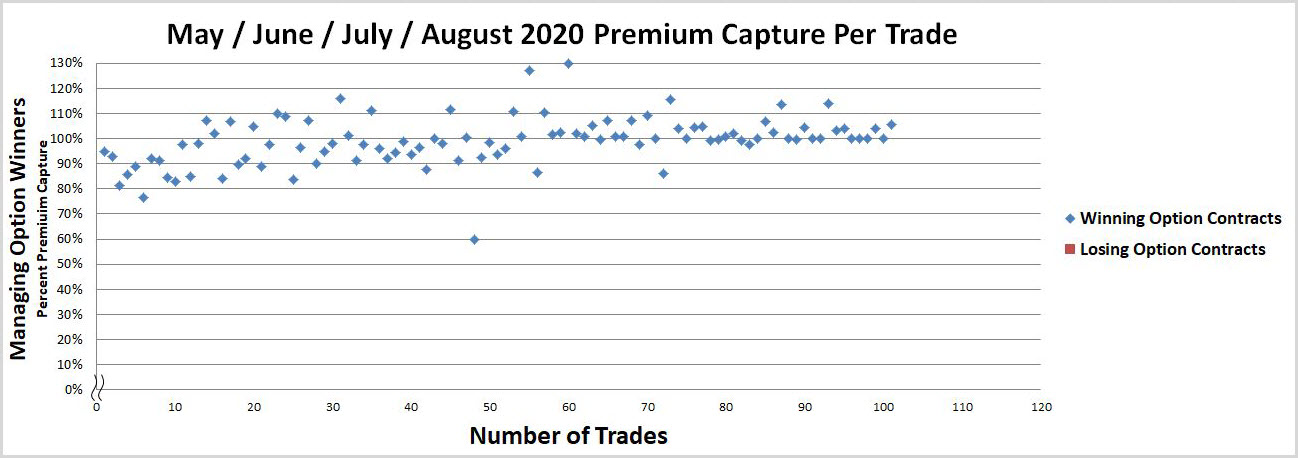

After placing 99 trades throughout May, June, July, and August, a 100% win rate, 99.6% premium capture, and 7.4% ROI per trade was achieved. This was accomplished via leveraging a minimal amount of capital and maximizing return on investment with risk-defined trades. Deploying a combination of put spreads and custom put spreads were used to optimize the risk-reward profile for these 99 trades. Whether you have a small account or a large account, a defined risk (i.e., custom put spreads) strategy enables you to leverage a minimal amount of capital, which opens the door to trading virtually any stock on the market regardless of the share price. Risk-defined options can easily yield double-digit realized gains throughout a typical one month contract (Figures 2, 3, and 4).

Figure 2 – Average income per trade of $180, an average return per trade of 7.4%, and 99.6% premium capture over 99 trades in May, June, July, and August

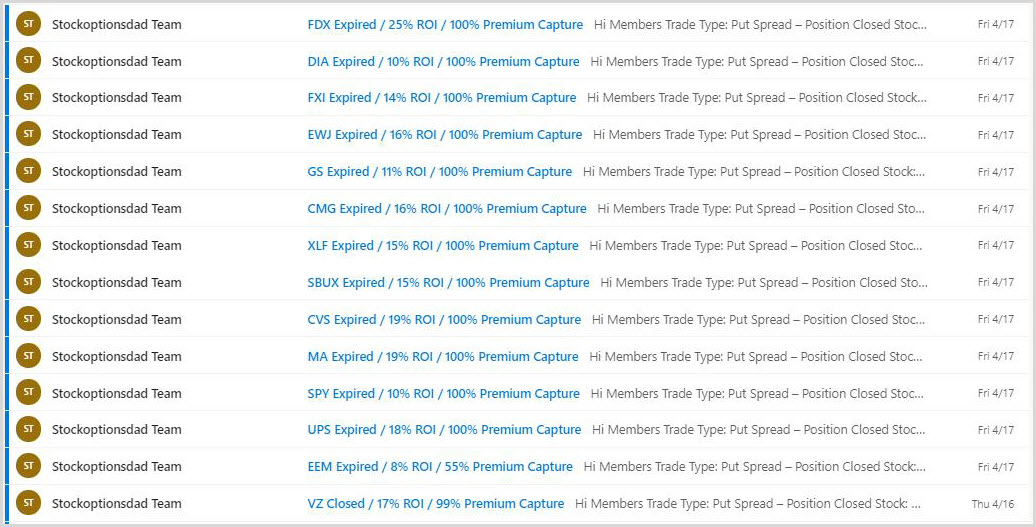

Figure 3 – OWin rate of 100% across 27 unique tickers using put spreads, and custom put spreads with a winning streak of 108 consecutive trades

|

This list ranks the top optionable stocks daily based on trend, volume, price and our proprietary algorithm. FREE Bonus: The Strategy Used To Make 5 Million In 2 Years! |

Figure 4 – Average return on investment (ROI) per trade of 7.4% using a risk defined strategy via leveraging a minimal amount of capital to maximize returns

Figure 5 – Average premium capture per trade of 99.6% with numerous trades with greater than 100% premium capture using a custom put spread strategy

Overall Option-Based Strategy

Options are a leveraged vehicle; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. A combination of put spreads and custom put spreads is used as the foundational strategy as an ideal way to balance risk and reward in options trading. This strategy involves selling a put option and buying a put option while collecting a credit in the process. When selling the put option, a premium is collected and simultaneously using some of that premium income to buy a put option at a lower strike price. The net result will be a credit on the two-leg pair trade with defined risk since the purchase of the put option serves as protection.

By selling the put option, you agree to buy shares at the agreed-upon price by the agreed-upon expiration date. By buying the put option, you have the right to sell shares at the agreed-upon price by the agreed-upon expiration date. Thus risk is defined, and capital requirements are minimal since you can sell shares at a specific price regardless of stock movement. This will cap any losses beyond the price at which you have the right to sell shares.

Additionally, trading across uncorrelated tickers, targeting a delta of 0.15 (translating into ~85% probability of success at expiration), trading very liquid tickers in the options market, maintaining a large portfolio cash position, and managing winning trades are a few of the keys that underpin this strategy.

An Effective Long-Term Options Strategy

A slew of protective measures should be deployed if options are used as a means to drive portfolio results. One of the main pillars when building an options-based portfolio is maintaining a significant portion of cash-on-hand. This cash position provides the ability to rapidly adapt when faced with extreme market conditions such as COVID-19 and Q4 2018 sell-offs. When selling options and running an option-based portfolio, the following guidelines are essential (Figure 6):

-

1. Trade across a wide array of uncorrelated tickers

2. Maximize sector diversity

3. Spread option contracts over various expiration dates

4. Sell options in high implied volatility environments

5. Manage winning trades

6. Use defined-risk trades

7. Maintains a ~50% cash level

8. Maximize the number of trades, so the probabilities play out to the expected outcomes

9. Continue to trade through all market environments

10. Appropriate position sizing/trade allocation

Figure 6 – A composite of ~80 tickers was used as a means to trade uncorrelated tickers across diverse sectors

Conclusion

Options are a leveraged vehicle; thus, minimal amounts of capital can be deployed to generate outsized gains with predictable outcomes. A total of 99 trades were placed in May, June, July, and August after the COVID-19 market lows. During this timeframe, all 99 trades were winning trades to lock-in a 100% option win rate with an average income per trade of $180 and an average return on investment (ROI) per trade of 7.4%.

Over the past 5 months, an option-based portfolio broken out into roughly three equal parts of cash, long equity, and options kept pace with the S&P 500 returns of 35.1% and 35.4%, respectively. A combination of put spreads and custom put spreads underpins this option-based strategy. These types of trades are an ideal way to balance risk and reward in options trading. Generating consistent income for steady portfolio appreciation in a high probability manner despite market conditions is the goal in options trading. This options-based approach provides a margin of safety while mitigating drastic market moves and containing portfolio volatility.

Options trading is a long-term game that requires discipline, patience, and time. The COVID-19 black swan event reinforces why keeping liquidity, spreading out expiration dates, maximizing sector exposure, maximizing ticker diversity, risk defining trades, and continuing to sell options through all market conditions is essential. It’s also necessary to maximize the number of trades, so the probabilities reach their expected outcomes, given enough occurrences.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.

Hi, these are good returns. How does one take advantage of such an opportunity?