Controlling portfolio beta, which measures overall systemic risk of a portfolio compared to the market, on the whole, is essential as these markets continue to display bouts of extreme volatility. Containing volatility while generating superior returns relative to the market is the goal with an options-based portfolio. Mitigating risk within a portfolio can be achieved via a blended options-based approach where cash is held in conjunction with stock positions and an options component. Options alone cannot be the sole driver of portfolio appreciation; however, options can play a critical component in the overall portfolio construction to control risk and volatility.

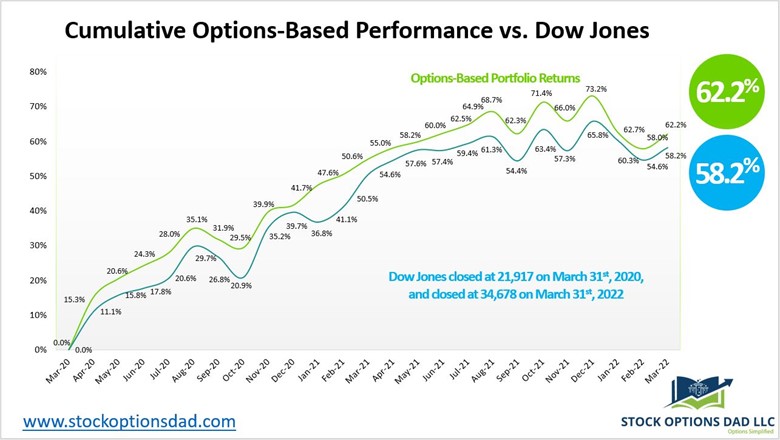

Generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing returns is the core of the options-based portfolio strategy. Options can enable smooth and consistent portfolio appreciation without guessing which way the market will move. Options allow one to generate consistent monthly income in a high probability manner in various market scenarios. Over the past 24 months (April 2020 – March 2022), 419 trades were placed and closed. An options win rate of 97% was achieved with an average ROI per trade of 4.4% and an overall option premium capture of 50% while outperforming the Dow Jones throughout these two years. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk. The options-based approach attempts to circumvent market drawdowns and generated a return of 62.2% relative to the Dow Jones’ 58.2% (Figures 1, 2, and 3).

Figure 1 – Overall option metrics from May 2020 to March 2022 available via a Trade notification service

Continue reading "Navigating Volatility - Risk-Controlled Portfolio"