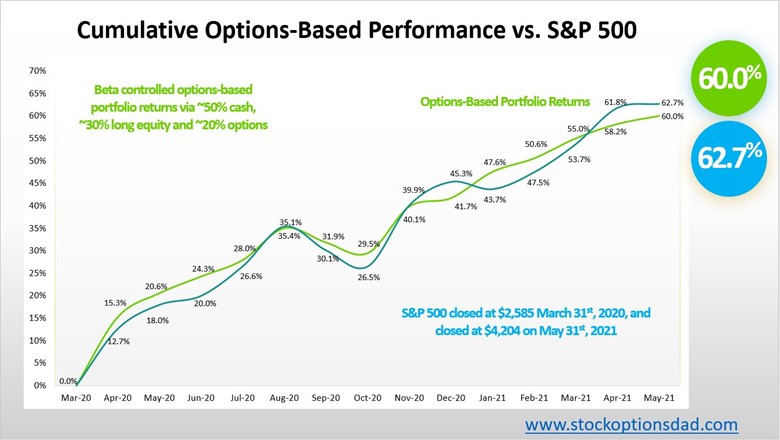

Controlling portfolio beta, which measures the overall systemic risk of a portfolio compared to the market, on the whole, is essential as these markets continue to break record high after record high with violent pullbacks. The month of June was a prime example as the markets pushed to new all-time highs early in the month, then suffered a Federal Reserve induced sold-off to only bounce back into positive territory to close out the month. Controlling beta while generating the same or superior market returns is the goal with an options-based portfolio. A beta-controlled portfolio can be achieved via a blended options-based approach where 50% cash is held in conjunction with long index-based equities and an options component. Options alone cannot be the sole driver of portfolio appreciation; however, they can play a critical component in the overall portfolio construction to control beta.

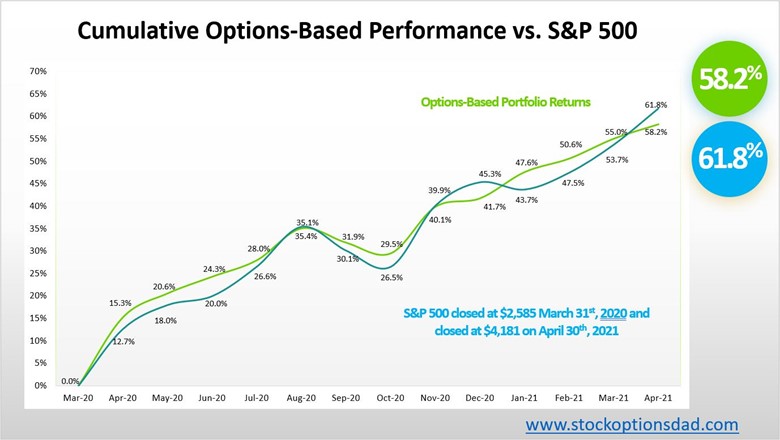

Generating consistent monthly income while defining risk, leveraging a minimal amount of capital, and maximizing return on capital is the core of this options-based/beta-controlled portfolio strategy. They can enable smooth and consistent portfolio appreciation without guessing which way the market will move, and allow one to generate consistent monthly income in a high probability manner in various market scenarios. Over the past 15 months (April 2020 – May 2021), 293 trades were placed and closed. An options win rate of 98% was achieved with an average ROI per winning trade of 7.0% and an overall option premium capture of 84% while moving in lockstep with the S&P 500. The performance of an options-based portfolio demonstrates the durability and resiliency of options trading to drive portfolio results with substantially less risk via a beta-controlled manner. The options-based approach circumvented September 2020, October 2020, January 2021, and May 2021 sell-offs (Figures 1, 2, and 3).

Figure 1 – Overall options-based performance compared to the S&P 500 from April 2020 – May 2021

Continue reading "Navigating Volatility - Beta-Controlled Options"