The Walt Disney Company (DIS) expects its Disney+ streaming platform will have up to 260 million subscribers by 2040. The company continues to exceed all expectations in the streaming space accelerated by the stay-at-home COVID-19 environment. The company has been posting phenomenal streaming numbers that have thus far negated the COVID-19 impact on its other business segments, specifically its theme parks. Disney has had to shutter all its worldwide Parks and Resorts, and ESPN has been hit with the cancellation of virtually all sports worldwide. There have been ebbs and flows with reopening efforts across the globe with mixed results followed by rolling lockdown measures. Despite the COVID-19 headwinds, Disney’s streaming initiatives have been major growth catalysts for the company. Disney+’ growth in its subscriber base has shifted the conversation from COVID-19 impact on its theme parks to a durable and sustainable recurring revenue model. This streaming bright spot, in conjunction with the optimism of its Park and Resorts coming back online, has been a perfect combination as of late, especially with the vaccine rollout picking up steam.

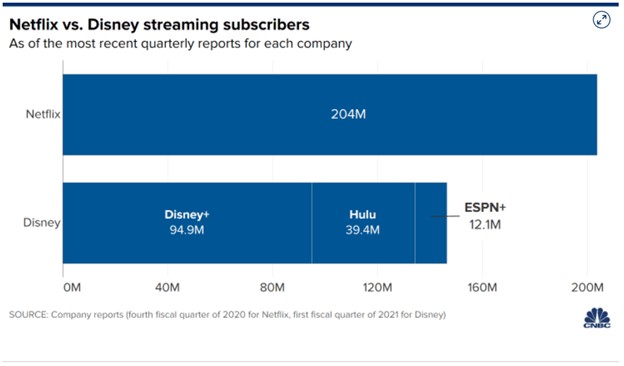

Disney+ has racked up 94.9 million paid subscribers, Hulu has 39.4 million paid subscribers, and ESPN+ has 12.1 million paid subscribers. Collectively, Disney now has over 146 million paid streaming subscribers across its platforms (Figure 1). Disney+ has been wildly successful via unleashing all of its Marvel, Star Wars, Disney, and Pixar libraries in what has become a formidable competitor in the ever-expanding streaming wars domestically and internationally. Hence the tug-of-war on Wall Street between COVID-19 impacts versus the success of its streaming initiatives, with the latter winning out. Thus far, its streaming success has changed the narrative as its stock has broken through all-time highs and nearly breaking through $200 per share. Disney is a compelling buy for long-term investors as its legacy business segments get back on track in the latter part of 2021 in conjunction with these successful streaming initiatives.

Figure 1 – Streaming initiatives across its platforms with over 146 million paid subscribers in total

Post Pandemic

Disney’s business segments will inevitably recover as the pandemic subsides worldwide with widespread vaccinations. Disney’s theme parks will reopen over time, as seen with phased reopening efforts. Inevitably, movie productions will resume, movie theaters and theme parks will reopen to full capacity, and sports will return to pre-pandemic formats. The resumption of these activities will feed into Disney’s legacy businesses in conjunction with its massive streaming successes. Disney continues to dominate the box office year after year with a long pipeline of blockbusters in the queue. Its Parks and Resorts continue to be a growth avenue with tremendous pricing power. Disney is going all-in on the streaming front and acquired full ownership of Hulu, and the company has launched its Disney+ streaming service with tremendous. The company offers a compelling long-term investment opportunity given its growth catalysts that will continue to bear fruit over the coming years despite the current headwinds outside of its streaming initiatives.

Q1 2021 Earnings

The Walt Disney Company (DIS) announced its Q1 2021 earnings, exceeded expectations on revenue and showed a surprise profit. Disney reported a profit per share of $0.01 vs. a loss of $0.45 expected. Revenue came in at $16.25 billion vs. $15.84 billion expected. Total revenue decreased by 22% year-over-year. Disney will continue to forgo its semi-annual dividend to shore up its balance sheet and preserve capital.

Revenue from its Parks, Experiences, and Products segment declined by a whopping 53%. Media and Entertainment revenue came in at $12.66 billion, down 5% year-over-year. Disney has been unable to release a new film in theaters since mid-March 2020, which has taken a toll on its studio business.

“We believe the strategic actions we’re taking to transform our Company will fuel our growth and enhance shareholder value, as demonstrated by the incredible strides we’ve made in our DTC business, reaching more than 146 million total paid subscriptions across our streaming services at the end of the quarter,”. “We’re confident that, with our robust pipeline of exceptional, high-quality content and the upcoming launch of our new Star-branded international general entertainment offering, we are well-positioned to achieve even greater success going forward.”

Bob Chapek, Chief Executive Officer, The Walt Disney Company

The pandemic is still negatively impacting Disney’s business segments in many ways, specifically at Parks, Experiences, and Products. Closures of theme parks, retail stores, suspension of cruise ship sailings, and guided tours while experiencing supply chain disruptions in Q1. Disney has delayed theatrical releases and suspended stage play performances at its Studio Entertainment. Disney has also experienced disruptions in the production and availability of content, including the cancellation or deferral of certain sports events and suspension of production of most film and television content. Many of these businesses have been forced to be closed consistent with government mandates.

Wildly Successful Disney+’ Launch

Disney+ has been an absolute juggernaut with a 94.9 million subscriber base that’s far ahead of estimates on Wall Street and by internal projections. Disney had provided guidance of 230 million-260 million global subscribers by the end of fiscal 2024. Disney has launched plans to continue expanding Disney+ throughout Western Europe, as well as across Latin America and Japan, per Kevin Mayer, chairman of Walt Disney Direct-to-Consumer & International. Disney+’ content lineup includes more than 500 films and 350 television series from its collective brands of Disney, Pixar, Marvel, and Star Wars. There are also dozens of originals, such as the Star Wars live-action series “The Mandalorian.” There’s plenty of runway ahead for the streaming service, years into the future.

Conclusion

The Walt Disney Company (DIS) has successfully shifted its business model to a subscription-based service that produces a durable, sustainable, and predictable revenue stream via its streaming initiatives. As a result, the company has shifted the narrative from pandemic challenges to a focus on becoming a streaming juggernaut with over 146 million paid subscribers across its various platforms. In this backdrop, its legacy business segments are ready to regain their footing as the pandemic subsides via vaccine and therapeutic options. All the initiatives that Disney has taken over the previous few years to remediate its business and restore growth appear to be coming to fruition via its Fox acquisition and its streaming initiatives. Disney+ blew out expectations with 94.9 million paid subscribers thus far into 2021 and on pace to deliver projections years ahead of schedule. Disney continues to invest heavily in its streaming services (Hulu, ESPN Plus, and Disney+) to propel its growth and dominance in the streaming space. The company is evolving to meet the new age of media consumption demands via streaming and on-demand content. Disney’s streaming initiatives will continue to be major growth catalysts moving forward. Disney is a compelling buy as its legacy business segments get back on track in conjunction with its streaming initiatives.

Noah Kiedrowski

INO.com Contributor

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. He may engage in options trading in any of the underlying securities. The author has no business relationship with any companies mentioned in this article. He is not a professional financial advisor or tax professional. This article reflects his own opinions. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned. Kiedrowski is an individual investor who analyzes investment strategies and disseminates analyses. Kiedrowski encourages all investors to conduct their own research and due diligence prior to investing. Please feel free to comment and provide feedback, the author values all responses. The author is the founder of www.stockoptionsdad.com where options are a bet on where stocks won’t go, not where they will. Where high probability options trading for consistent income and risk mitigation thrives in both bull and bear markets. For more engaging, short duration options based content, visit stockoptionsdad’s YouTube channel.