Rolling option trades has a negative perception in the options world. The act of rolling an options trade does not deserve the negative connotation it has garnered over the years. Rolling can serve as a valuable tool in a comprehensive options strategy. Inevitably, when trading options, an option’s strike will be challenged, and when this occurs, one may need to act to circumvent a potential loss. These potential losing trades can be managed effectively to avoid losses altogether via rolling. Given the right set of circumstances, trades can be rolled by closing out the pending trade for a debit and subsequently opening a new trade with a later date and further out-of-the-money strikes for an overall credit.

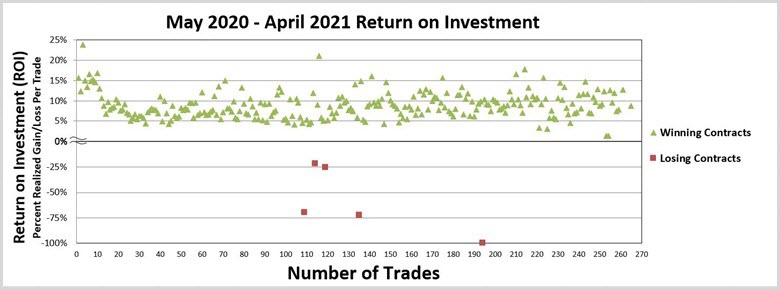

Options provide a statistical edge to the option seller’s advantage. When the option strike is challenged, this statistical edge is negated and must be reset by rolling a trade to reestablish this edge and subsequent advantage. Rolling out to a later date and further out-of-the-money strikes allows more time for the trade to work through the unexpected price excursion. Options trading enables traders to define risk, leverage a minimal amount of capital, and maximize return on investment. Options trading can create smooth and consistent portfolio appreciation without predicting which way the market will move. Options enable one to generate consistent and durable monthly income in a high probability manner in both bear and bull market scenarios, and rolling is part and parcel to this overall options-based approach. Rolling trades seldomly occurs, and over the past 12 months, only 7 trades were rolled while only 3 of those 7 were required (e.g., the strike remained breached at expiration).

Figure 1 – Overall rolled option metrics from May 2020 – April 9th, 2021, including rolled trades

Figure 2 – Overall option metrics from May 2020 – April 9th, 2021

Figure 3 – Overall option metrics from May 2020 – April 9th, 2021

Figure 4 – Overall option metrics from May 2020 – April 9th, 2021

What is Rolling?

Rolling a trade is a mitigation strategy that is deployed when an option’s strike leg is breached. Once the strike is breached, potential losses come into play. Rolling a trade involves closing out the pending trade that is challenged for a debit and then opening a new trade in the same underlying security for a credit. The net credit received will negate the debit required to close out the initial trade while providing a net premium income credit. The new trade will be a later dated expiration with further out-of-the-money strikes. This rolling strategy provides more time and more of a buffer in the stock price movement while circumventing the loss. Essentially, this action extends out the trade duration while avoiding losses.

Why Roll Trades

A statistical edge or probability of success is on your side when selling out-of-the-money options. This statistical edge is jeopardized when the strike price is breached, and the probability of success is no longer in your favor. This statistical edge must be reset by rolling a trade to reestablish this edge to your advantage. Rolling out to a later date and further out-of-the-money strikes will reestablish this statistical edge and allow more time for the trade to work through the unexpected price excursion. Rolling to avoid losses has a mitigating impact on the overall portfolio. The rolling process circumvents losses and avoids any impacts in terms of the overall profit/loss statement on one’s overall portfolio.

Strike Widths

Each initial option trade should be structured to enable the ability to roll the trade in the event the trade is challenged during the option lifecycle. Initial trade structure is imperative, so rolling can easily be a viable option if needed.

Initial strike width selection needs to be narrow. If the strike width is too wide and the trade breaks down well below the protection leg, then the debit required to close the trade will be too great to overcome with a new credit without being over-leveraged in that trade. Rolling a trade is a last resort/lever to pull, allowing the trade to mature as close as possible to its expiration date. This will allow mean reversion to possibly take place and retrace back to out-of-the-money territory so rolling can possibly be avoided altogether.

Dangers of Rolling Trades

When a trade breaches the strike price, one must be careful not to overleverage the amount of capital dedicated to the rolling trade. The underlying security may continue to move against your directional side of the trade; thus, allocation discipline is key. You do not want to dedicate too much capital, nor do you want to continue to allocate capital to a losing trade. Often, absorbing the loss may be the most prudent action if the initial rolling of the trade failed to circumvent losses. Continuing to roll the trade to overcome the debits required to close out the preceding trade(s) will require more leverage in one’s portfolio. This can be a dangerous cycle since strike widths will likely need to be widened and/or the number of contracts will need to be increased. These two elements will require more capital and potential for larger losses than initially set forth.

Conclusion

Although rare and deployed sparingly, rolling can be an effective mitigation strategy when faced with a challenged option strike price. An option’s statistical edge must be reset by rolling a trade to reestablish this edge to your advantage. Rolling out to a later date and further out-of-the-money strikes allows more time for the trade to work through the unexpected price excursion. Often, more patience is required to allow the trade to unfold further into its option lifecycle prior to deciding on rolling a trade.

An options-based approach provides a margin of safety while circumventing the impacts of drastic market moves while containing portfolio volatility. Sticking to the core fundamentals of options trading, one can leverage small amounts of capital, define risk and maximize return on investment. Following the 10 rules in options trading demonstrates the durability and resiliency of an options-based portfolio to outperform during pockets of market turbulence. To this end, cash-on-hand, long exposure to broad-based ETFs and options is an ideal mix to achieve the portfolio agility required to mitigate uncertainty and volatility expansion. Although rarely deployed, rolling trades is part and parcel to a comprehensive options-based strategy.

Thanks for reading,

The INO.com Team

Disclosure: The author holds shares in AAPL, AMZN, DIA, GOOGL, JPM, MSFT, QQQ, SPY and USO. The author has no business relationship with any companies mentioned in this article. This article is not intended to be a recommendation to buy or sell any stock or ETF mentioned.