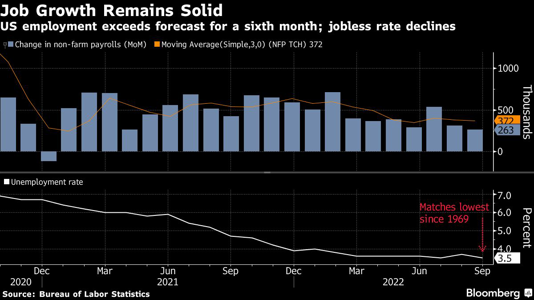

Friday’s jobs report for September showed a decrease in monthly gains, with 263,000 new jobs added last month, a decline from the prior month in which 315,000 new jobs were added.

The deep impact it had on almost every asset class in the financial markets was not because of the tepid numbers but rather hopes by the Federal Reserve that these numbers would be even lower.

The Federal Reserve had hoped that Friday’s report would reveal even slower growth because that would indicate progress by the Federal Reserve in reducing inflation.

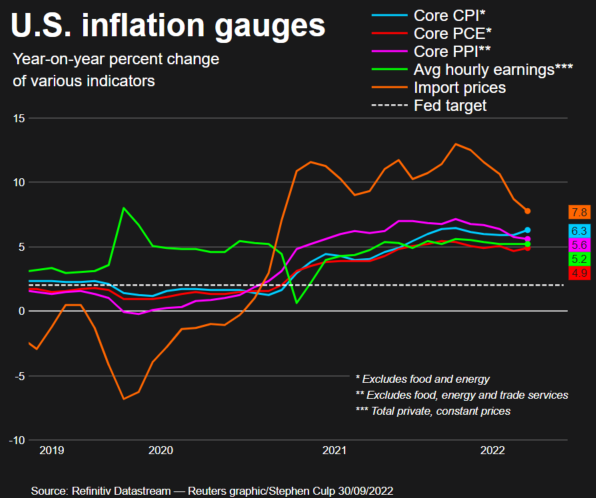

Inflation is still greatly elevated at a 40-year high even after the Federal Reserve has raised interest rates at every FOMC meeting since March. The Fed raised rates by 25 basis points in March, 50 basis points in May, and 75 basis points in June, July, and September. The Fed took their benchmark Fed funds rate from between 0 and 25 basis points in February to between 300 and 325 basis points in September.

Although Friday’s report indicated slowing job growth it is believed that this contraction is not enough for the Federal Reserve to slow down its current pace of interest-rate hikes. Continue reading "How to Interpret the Jobs Report"