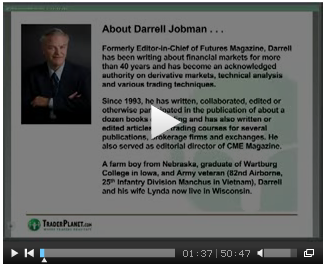

Setting yourself up to catch the next day's market moves can be a daunting task. In this complimentary trading video, Darrell Jobman, published author of more than a dozen trading handbooks and editor of major financial publications, will walk you through his strategy of using predictive highs & lows to develop a plan for next day trading.

Setting yourself up to catch the next day's market moves can be a daunting task. In this complimentary trading video, Darrell Jobman, published author of more than a dozen trading handbooks and editor of major financial publications, will walk you through his strategy of using predictive highs & lows to develop a plan for next day trading.

Could this strategy be what your trading plan is missing for 2011?

You have nothing to risk and everything to gain.

Enjoy,

Trend TV Team