Today's guest is Stock_Analyzer from StockHideout.com, a micro cap community. Certain types of stocks have been hit harder than others lately; risky micro cap stocks have definitely taken a beating. Stock_Analyzer is going to explain the link between the NASDAQ and OTCBB and how he potentially sees some light at the end of the tunnel. Be sure to comment and let us know what you think.

=====================================================================

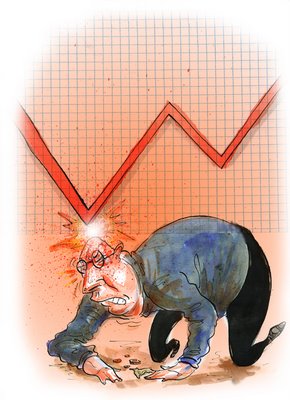

The financial crisis has caused stock markets worldwide to crash, sending them spiraling into a period of high volatility. As a result, a considerable number of banks, mortgage lenders and insurance companies have filed bankruptcy, spurring a loss of investor confidence in the capital markets and decreasing liquidity.

The dollar trading volume of a market is indicative of overall market conditions. It essentially shows how much money is entering or leaving the market. It is well known that the markets are very cyclical in nature and that during the growth stages investors increase their investments, while recessions leave investors looking for exit strategies. Continue reading "NASDAQ gains could indicate a recovery of OTCBB liquidity"