At MarketClub our mission is to help you become a better trader. Our passion is creating superior trading tools to help you achieve your goals -- no matter which way the markets move -- with objective and unbiased recommendations not available from brokers.

The Trader's Toolbox posts are just another free resource from MarketClub.

---

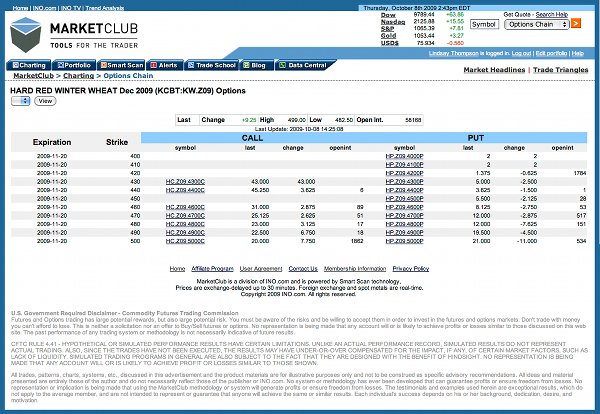

"Spreads sometimes are touted as a no- or low-risk trading option, ideally suited to smaller or more risk-averse traders. Although some do have limited risk in certain circumstances, spreads are by no means risk free, and in fact they contain some unique risks, especially for traders who don’t have a clear understanding of the limitations and possibilities of these transactions.In options markets, the term spreads covers everything from simple time spreads to complex butterflies, boxes and conversions. Although futures spreads are, at least on the surface, more straightforward than many of their options counterparts, understand the basic price relationship between different futures contracts as well as the function off spread trading is integral to a well-informed market perspective.

In the most basic sense, a spread refers to the price difference between two or more trading instruments, whether they are two contact months of the same commodity, two different commodities or the cash and futures price of a particular commodity. (The cash/futures spread is commonly called basis..."

Revisit the Trader's Toolbox Post: "Spread It On" here.

Chances are unless you grew up in the north of England (Newcastle to be exact,) you wouldn't understand the language of the Geordies.

Chances are unless you grew up in the north of England (Newcastle to be exact,) you wouldn't understand the language of the Geordies. Despite a shaky economy recently, there are traders still making money. If you're wondering how,

Despite a shaky economy recently, there are traders still making money. If you're wondering how,