Federal Reserve, CPI and Prospective Rate Increases

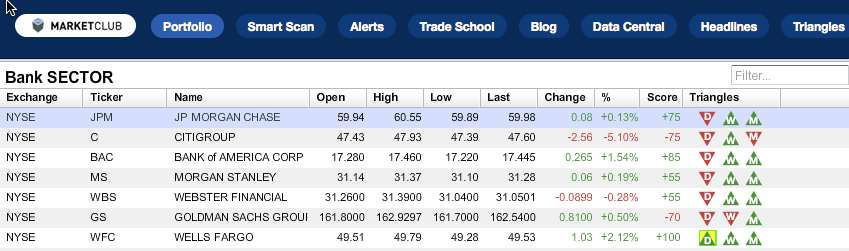

A string of robust Consumer Price Index (CPI) readings spooked the markets as a harbinger for the inevitable rise in interest rates. Furthermore, Federal Reserve commentary also induced volatility in the markets when Jerome Powell spoke in early June. As investors grapple with the prospect of downstream rate increases, pockets of vulnerabilities throughout the market have been exposed. The overall markets have been on a blistering bull run since the November 2020 presidential election cycle. Year-to-date, the S&P is up over 16%, while all valuation metrics are misaligned with any historical comparator with heavily stretched valuations and record risk appetite. As real inflation enters the fray, these frothy markets will come under pressure and possibly derail this raging bull market. Although rising rates may introduce some systemic risk, the financial cohort is poised to go higher. The confluence of rising rates, post-pandemic economic rebound, financially strong balance sheets, a robust housing market, and the easy passage of annual stress tests will be tailwinds for the big banks.

2021 Financial Stress Tests

The recent stress tests were easily passed and indicated that the biggest U.S. banks could easily withstand a severe recession. In addition, all 23 institutions in the 2021 exam remained “well above” minimum required capital levels during a hypothetical economic downturn.

The central bank said that the scenario included a “severe global recession” that hits commercial real estate and corporate debt holders and peaks at 10.8% unemployment and a 55% drop in the stock market. While the industry would post $474 billion in losses, the Fed said that loss-cushioning capital would still be more than double the minimum required levels. Continue reading "Financials - Stress Tests Easily Pass"