Natural gas prices are making a solid comeback after deferring to oil throughout the year. Industry experts speculate that shares of gas production companies may soon outshine those of their oil-focused counterparts.

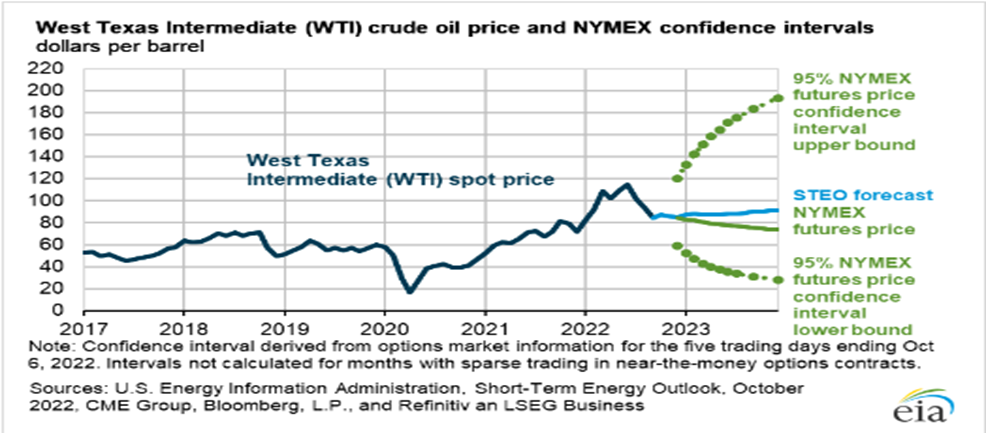

After surging to almost $100/barrel on September 27, global crude prices have suffered a hard fall due to dwindling global demand. Efforts to stimulate price growth through supply cuts are proving ineffective.

The Chinese economy, undergoing a challenging period, weighs on the country's energy consumption. China now relies on record inventory levels accumulated earlier this year as refiners reduce their purchases following the oil price escalation to over $80/barrel.

Europe's economy is also under strain since Russia's invasion of Ukraine disrupted European energy supplies. Meanwhile, U.S. domestic producers have boosted production, anticipated to reach 12.8 million barrels daily this year. Domestic oil demand in the U.S. has decreased due to reduced driving habits, further pushing down oil prices.

Natural gas futures have remained exceptionally volatile due to ongoing worries surrounding supply and demand factors. Prices tipped over $3 following a lower-than-projected inventory build-up.

Let’s see what’s favoring the natural gas price rise…

Favorable Demand

Increased demand during the sweltering summer months resulted in higher usage of air conditioning systems, leading to more electricity production powered by natural gas.

The anticipated colder winter seasons due to the El Niño weather pattern should necessitate additional heating, triggering more demand for natural gas.

Additionally, following the trade deal between Mexico and the U.S., the rising demand for gas from Mexico should further boost the natural gas industry.

Constrained Supply

Despite an initial surplus of natural gas at the beginning of the year, U.S. producers have significantly reduced operations due to declining prices. The number of natural gas rigs in operation has dropped by over 20% since May – a factor likely to provoke increased growth for natural gas futures.

Against this backdrop, let’s understand why industry players Hess Corporation (HES), APA Corporation (APA), California Resources Corporation (CRC), and Obsidian Energy Ltd. (OBE) could be considered.

With a market cap exceeding $47 billion, HES, a prominent natural gas provider to the United States, Guyana, Peninsular Malaysia and Thailand, could experience growth in revenue and profitability amid rising natural gas prices.

The prevailing oil price scenario, highly encouraging and anticipated to persist, is expected to foster an advantageous business climate for HES’ exploration and production activities, particularly in the Gulf of Mexico and offshore Guyana.

HES possesses a notable reserve of premium drilling sites within the Bakken shale play. With a planned four-rig drilling initiative within this area, HES forecasts bringing 110 new wells in 2023, strengthening its production outlook and further accelerating profitability.

Remarkable oil discoveries in the Stabroek Block, situated offshore Guyana, contribute to over 11 billion barrels of oil equivalent (boe) in gross recoverable resources. High natural gas prices could elevate the value and return of these ventures, fostering increased interest in investment and partnership possibilities.

HES anticipates oil production from the country’s impending three production vessels to surpass its estimated capacities. By 2027, the corporation will operate six FPSOs, generating a combined gross output capacity exceeding 1.2 million barrels daily.

The Free Cash Flow (FCF) growth is anticipated to diminish the debt load and execute capital return to shareholders in the coming years. Assuming a crude oil price of $75 per barrel, the company mooted a 25% annual cash flow increase over the next five years.

Moreover, HES plans to allocate 75% of its annual FCF to shareholders through dividend enhancements and share buybacks, demonstrating unwavering commitment to maximize value and capital returns to its shareholders.

Despite the recent downturn in HES’ share price, a more detailed examination of the company's production strategies suggests latent potential for sustained long-term growth.

Wall Street analysts expect the stock to reach $175.25 in the next 12 months, indicating a potential upside of 14.1%. The price target ranges from a low of $150 to a high of $210.

Boasting a market cap of over $11 billion, APA, a leading oil and gas producer in the U.S. and abroad, maintains a diversified portfolio of assets and operations.

APA's considerable production volume is attributed to increased drilling activity, higher completion rates, and enhanced well performance. Moreover, the firm has reaped the advantages of escalated oil and gas market prices, fostering an expectation that elevated natural gas prices could amplify its revenue and cash flow from natural gas production and sales and could strengthen APA’s balance sheet and financial flexibility.

APA forecasts its third-quarter total adjusted production and adjusted oil production to fall on the higher end of its guidance range. It projects adjusted production between 337 Mboe/day and 339 Mboe/d and adjusted oil production between 159 Mboe/day and 161 Mboe/d.

The optimism owes to the high-performing assets in the Permian oil region and the U.K. North Sea, which have consistently proven their value by contributing to the company's total production capacity.

In addition to output, APA's fiscal stability is dictated by pricing strategy. Within the U.S., the company predicts third-quarter realized prices of $82 per barrel for oil, $21.50 per barrel for natural gas liquids, and $2.00 per Mcf for natural gas. This reflects APA’s judicious market analysis and pricing aptness.

Internationally, the firm anticipates realized prices to stand at $88 per barrel for oil, $50 per barrel for NGL, and $4.25 per Mcf for natural gas - indicative of APA’s proficiency in adjusting to disparate market climates.

The company aims to return at least 60% of FCF to shareholders through a competitive base dividend and share repurchases. It pays an annual dividend of $1.00 per share, translating to a 2.57% yield on the current share price. Its four-year average dividend yield is 2.54%. The company’s dividend payouts have grown at a CAGR of 22.1% over the past three years.

California Resources Corporation (CRC)

California, one of the world’s top oil and natural gas hubs and the United States’ seventh most prolific oil producer in 2022, may seem an odd location for investing in an oil and gas company, considering the state's stringent emissions regulations.

Yet, CRC, an oil and natural gas firm in Long Beach, counters this perspective. CRC operates 50 fields in the Sacramento Basin, consisting of dry gas production, which provides a significant portion of the natural gas supply to the San Francisco Bay Area.

Over the past six months, CRC’s stock price increased over 38% and is currently trading at a premium to the sector based on earnings. Wall Street analysts expect the stock to reach $65.40 in the next 12 months, indicating a potential upside of 21.2%. The price target ranges from a low of $60 to a high of $70.

Its forward non-GAAP P/E of 10.60x is 2.1% higher than the industry average of 10.39x. However, its forward EV/Sales multiple of 1.62 is 25.2% lower than the industry average of 2.17.

In line with the environmental responsibility, CRC has embarked on a collaborative joint effort to promote carbon capture and storage projects. This bears testament to the company's commitment to cleaner and greener energy alternatives. The distinguishing feature of CRC remains its substantial investments in renewables alongside a beneficial exposure to its oil and gas asset base, resulting in consistent FCF growth over the long term.

The impact of oil and gas price surges is predicted to be reflected in CRC’s third quarterly report, augmenting its earnings and FCF. Analysts expect its revenue and EPS in the fiscal third quarter of 2023 to come at $498.76 million and $0.97, respectively. CRC topped consensus revenue estimates in each of the trailing four quarters.

Furthermore, CRC attempts to share its success with its shareholders, paying an annual dividend of $1.13 per share, which translates to a 2.10% yield on the current share price. Its four-year average dividend yield is 0.94%. CRC has also been buying back shares at a good rate for the last few years.

Calgary-based Canadian oil and natural gas company OBE, which specializes in exploring, developing, and producing petroleum resources primarily in the Western Canada Sedimentary Basin, has recently revealed a progressive three-year plan.

The plan forecasts a significant production upsurge that should reach 50,000 barrels of oil equivalent per day by mid-2026. The rise in production is expected to be predominantly driven by the enhancement of OBE’s Peace River properties, with a projected increase from 6,600 boe/d to 24,000 boe/d.

Assuming successful implementation of the plan, an estimated $291 million of cumulative FCF could be generated over this period, based on a $75/bbl WTI oil price and a forecasted 2026 funds from operations (FFO) of $8.19 per share.

Capital expenditures for 2024, 2025, and 2026 have been outlined at $380 million, $445 million, and $420 million, respectively, expected to generate an FCF of $53 million, $36 million, and $213 million yearly. The surplus FCF could create further shareholder value, encompassing return on capital, additional growth, and embarking on potential acquisition opportunities.

OBE is in a favorable position as most of its revenues are in U.S. dollars. This allows the company to benefit from the favorable exchange rate between the Canadian and U.S. dollar.

In terms of production, OBE projects an output between 31,500 boe/day and 32,500 boe/day for the fiscal year of 2023. Street expects OBE’s revenue to reach $656.43 million for the same period and an FFO of $3.55.

Considering OBE’s multifarious performance, robust development strategy, and diversified asset portfolio, it has strong potential to be watched.