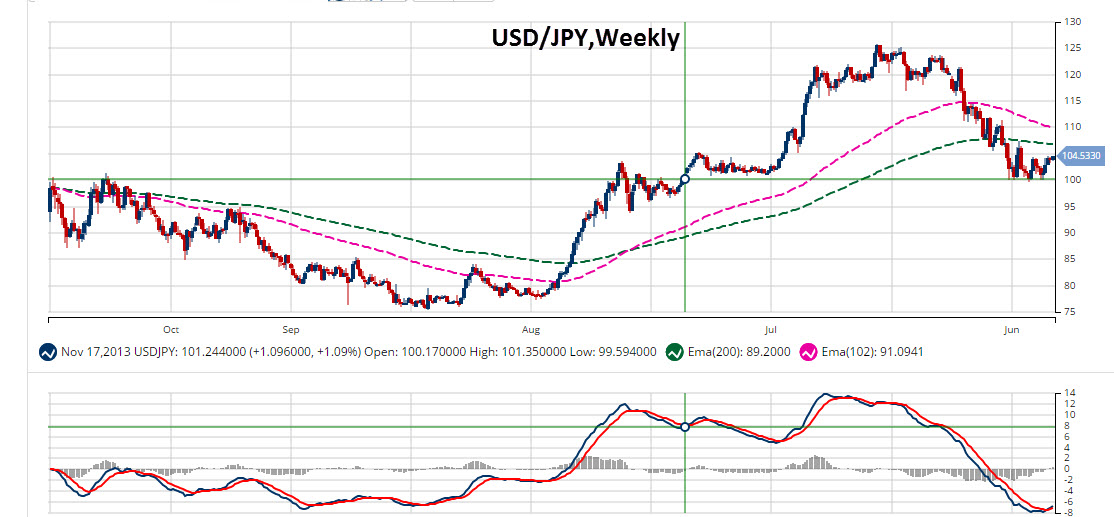

The Japanese Yen is finally ready for another bearish wave, the kind that could drive the Dollar-Yen trade to retest the 2015 highs. At least, that is what the USD/JPY technical analysis suggests. According to the MACD Index, the selling momentum has weakened, and the pair is just resting above the 100 pivot, a key pivot for the pair. But the question is, are fundamentals ripe for another Yen selloff and a USD/JPY rally?

Yen is a Bond Play

As I often reiterate, the Japanese Yen is essentially a bond play. Over the past decade, Japan has been stuck in a long deflationary cycle of falling prices and less than 1% average growth in five years. Moreover, Japanese consumers, as well as Japanese corporations, have had an overwhelming desire to hoard mountains of cash which only exacerbates the stagnation of the Japanese economy. The combination of constant cash hoarding and deflation has created a very robust market for Japanese Government Bonds. The Japanese government has tried to balance the phenomenon by accumulating a jaw-dropping debt of 229% of GDP or roughly $9.5 Trillion, and by trying to spur growth. Instead of balance, however, it has made the Japanese Government Bond market so overwhelmingly large (compared to other sectors), that it essentially dominates the dynamics of the Yen. When demand for Japanese Government Bond rises so does demand for the Yen, and vice versa. Continue reading "Japanese Yen Set for a Winter Sell?"