While the Gold Miners Index (GDX) started the year sharply in positive territory and raced ahead of the S&P-500 (SPY) despite its rebound to start 2023, the index has retreated all the way into negative territory as of mid-February, giving up considerable gains.

This has led to considerable underperformance vs. the S&P-500 (SPY), and this isn’t overly surprising given that sentiment was becoming overheated short-term in the miners heading into late January.

However, with the index down more than 15% from its highs, it’s time to start building watchlists for potential buying opportunities.

In this update, we’ll look at two small-cap names with world-class deposits aiming to become 250,000 ounce per annum producers post-2025.

Osisko Mining (OBNNF)

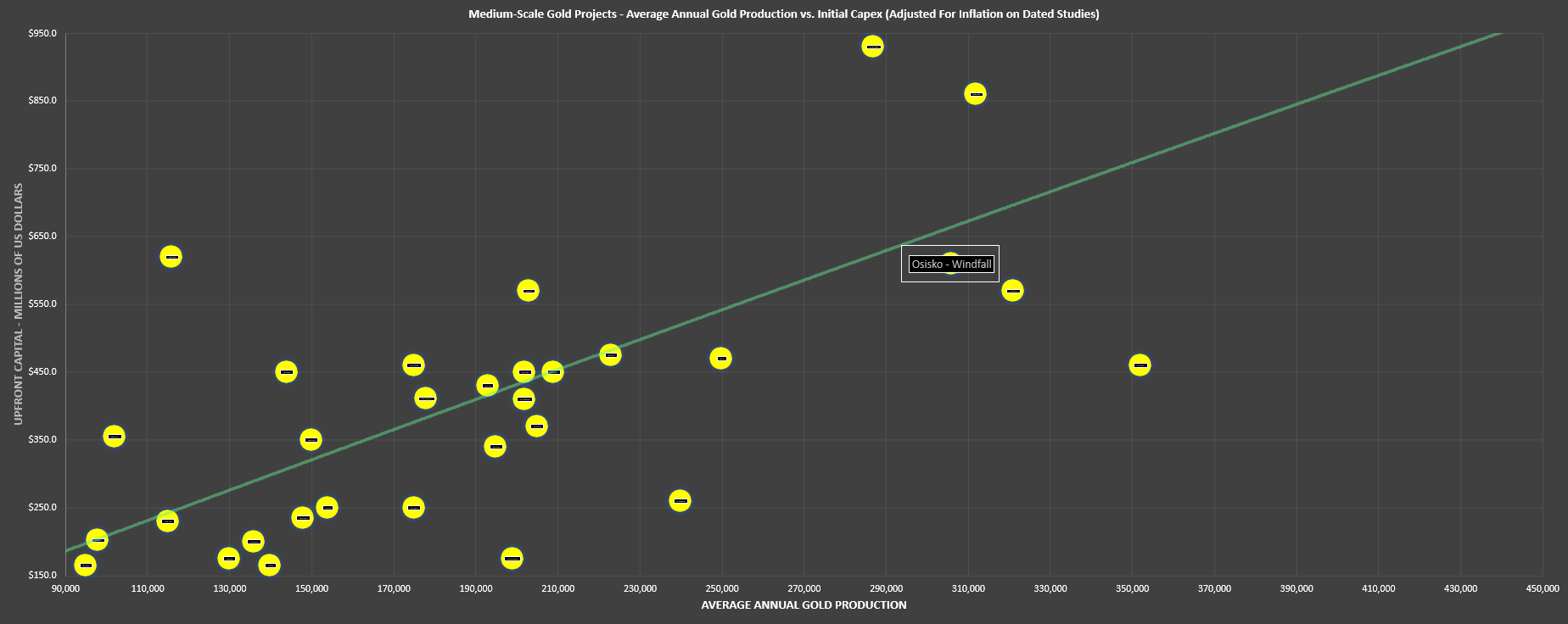

Osisko Mining (OBNNF) is a ~$1.0 billion gold developer based on an estimated ~465 million fully diluted shares, and it’s well known for being the proud owner of one of the highest-grade gold projects globally in Northern Quebec, Canada.

This project, known as Windfall, hosts more than 7.0 million ounces of gold at an average grade of 12.0+ grams per tonne gold, and would be one of North America’s highest-grade mines if it were in production today.

Once in production (2026 estimate), the mine is expected to produce upwards of 270,000 ounces of gold per annum at sub $725/oz all-in-sustaining costs, translating to ~61% margins at an $1,875/oz gold price assumption.